If you’re getting ready to move to Germany, opening a bank account is one of the first things you need to do. Although most people think they can take care of everything online and manage their finances even before arriving in Germany, that’s not always the case.

Nevertheless, this is necessary since you’ll need the account to apply for a flat, pay the rent, receive your salary, and much more. Today’s blog will help you get familiar with the types of bank accounts in Germany, the documents you need to open an account, factors to consider, and the best banks.

[box]

Other Related Articles:

- 10 Best Things To Do in Berlin, Germany [with Suggested Tours]

- Bank Transfer Tips: What to Know When You Transfer Money from One Bank to Another

- How To Apply For Schengen Germany Visa For Filipinos [Germany Schengen Visa Guide For Filipinos]

- Banks in the Philippines: Complete List of Philippine Bank Codes and SWIFT Codes

- Berlin Backpacking Guide – List of the Best Backpacker Hostels in Berlin, Germany

[/box]

Types Of Bank Accounts You Can Open In Germany

Here are the most common types of accounts you should know about before you decide to open one:

1. Current Account (Girokonto)

This is a basic type of account you need to receive your salary, pay bills, etc. You can opt for a general Girokonto or a specialized one if you’re a young adult or a student.

2. Savings Account (Sparkonto)

Sparkonto accounts are meant for your savings and are available for residents and non-residents. The first type of savings account is Festgeldkonto, and you’ll need to decide how long your money has to stay in the account. The Tagesgeldkonto offers you instant access to your savings.

3. Offshore Account

An offshore account is a good alternative if you’re often on the go and need to transfer money to different countries. These accounts will help you save on taxes, and you’ll have various advantages when traveling to different countries. Commerzbank and Deutsche Bank are the two banks to consider if you’re interested in an offshore account.

4. Non-Resident Account

If you don’t have an address in Germany, some banks might not offer standard current accounts. In that case, your best bet is a non-resident account. You can open this account even before arriving in Germany.

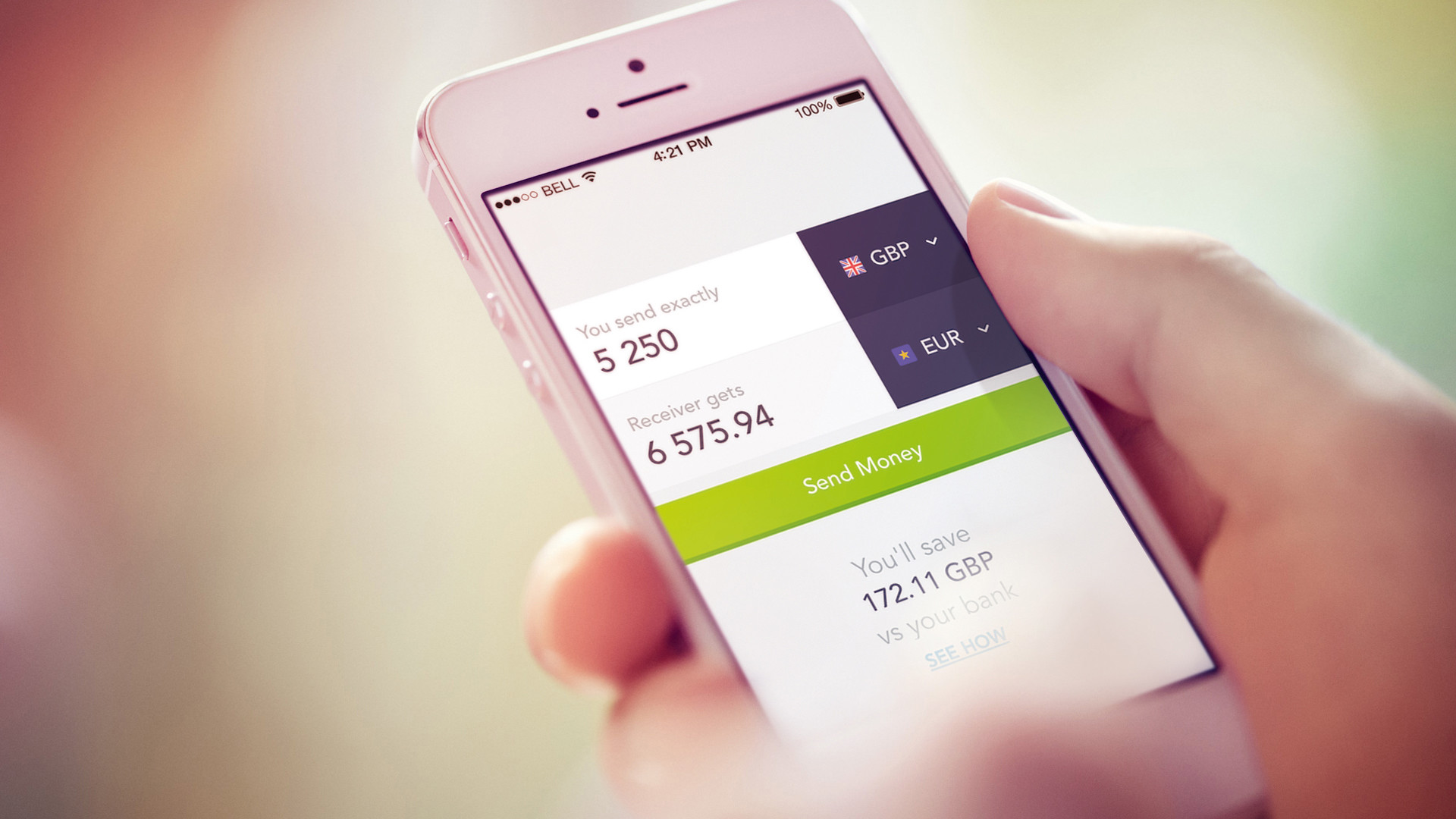

5. Digital Accounts

Mobile and digital accounts work through special apps that you download. One of the best things about Germany is that they have numerous mobile and online-only banks that will help you sort your finances via your mobile phone or laptop.

How To Open A Bank Account In Germany

Now that you’re familiar with the various types of accounts, you should also know the documents you need to open a bank account. Some banks are very open to working with non-residents, while others can be more hesitant and require more paperwork or tell you that they don’t work with non-residents. Although the procedure depends on the bank you’ll choose, here are the most common documents you have to provide:

- A valid passport or a German residence permit.

- Registration and proof of current address.

- Application form with the first name, last name, address, phone number, age, income, etc.

- Proof of employment and income. If you’re a student, banks require you to bring proof.

- Deposit for opening the account. The amount will depend on the bank you’ll choose.

- A recommendation letter from your employer, and all the other documents you can provide to prove that you have a steady income and are eligible for a bank account.

- SCHUFA credit rating

When opening an online account, most banks require you to create a profile; then they’ll need to confirm your identity. In other words, they’ll probably ask you to turn on your camera, send codes you should enter, send documents to the bank, etc.

Reliable Banks In Germany You Should Know About

Here are some of the oldest and most reliable banks in Germany you should add to your list when searching for the best option:

- Sparkasse

- Deutsche Bank

- HypoVereinsbank

- KfW Bankengruppe

- Commerzbank

- Barclays Bank

- DKB

- N26

- Volksbank

![10 Best Things To Do in Berlin, Germany [with Suggested Tours]](https://twomonkeystravelgroup.com/wp-content/uploads/2021/03/10-Best-Things-To-Do-in-Berlin-Germany-with-Suggested-Tours11.jpg)

Factors To Influence Your Decision When Choosing A Bank

With so many different banks in Germany, how can you ensure that you choose the best one for your needs? Here are a few factors that should influence your decision:

- Fees – learn all the details when asking about the fees, and ensure you compare them from different banks. Withdrawal and maintenance fees can be costly, so do your research before choosing.

- Customer services – the best way to find out whether a bank’s customer service is reliable is to give them a call. You can also research online or ask friends, co-workers, and people you know if they’re happy with their bank.

- Banking services – different banks offer different services and fees for those services. First, put together a list of the services you’ll need, especially if you travel often. Then, give the bank a call, and ask how much these services will cost you, whether they have partnering banks in the country you’ll be traveling to, the cost of international transfers, etc.

- Languages – if you’re still learning German, your best bet is to find a bank whose staff is proficient in English to make the communication more effortless.

- Online and mobile banking – this feature will save you time and money. Online transactions are cheaper and faster in most cases, so ask all banks on your list to let you know about their online services and fees.

- Access and ATM network – the more widespread a bank’s ATM network is, the easier it will be for you.

[box]

Other Related Articles:

- 15 Best Things To Do in Dortmund, Germany

- How to Open a UnionBank Account: Online Bank Account with No Initial Deposit

- Top 7 Things to Do in Berlin, Germany for Couples

- 7 Awesome Things To Do in Mannheim, Germany

- 15 Best Things To Do in Dusseldorf, Germany

[/box]

Conclusion

Opening a bank account in a new country can be stressful; therefore, you must do your research. The most common types of bank accounts you can open in Germany are current, savings, offshore, non-resident, and digital.

Before getting familiar with the documents you need, you have to list potential banks and ask about the services they offer, fees, whether they provide online and mobile banking, if they have English-speaking representatives, their ATM network, etc. Once you have all the information, you should ask for a detailed list of documents you need to bring and start your application process.