One crucial requirement for visa applications is financial proof. That’s why it’s better to have a bank account. If you don’t have one, you can apply at UnionBank. Know how you can open a UnionBank Account Online with no Initial Deposit.

Many people don’t open a bank account because there’s an initial deposit required. Sometimes it PHP 5,000 or it’s PHP 10,000, and many find that hard. There’s also a need to have a minimum amount to be maintained, so you are not charged. However, with UnionBank Personal Savings Account, you don’t have to worry about that! Read how on this article.

[box]Other articles you can read:

- How To Get a Bank Certificate and Bank Statement for your Visa Applications

- No Bank Account – How To Apply for Tourist Visa Without Bank Statements

- Banks in the Philippines: Complete List of Philippine Bank Codes and SWIFT Codes

- Tips on How to Have the Right “Show Money” for Your Visa Application

- Bank Transfer Tips: What to Know When You Transfer Money from One Bank to Another

[/box]

UnionBank’sPersonal Savings Account Features

- Zero Initial Deposit

- No Minimum ADB Requirement

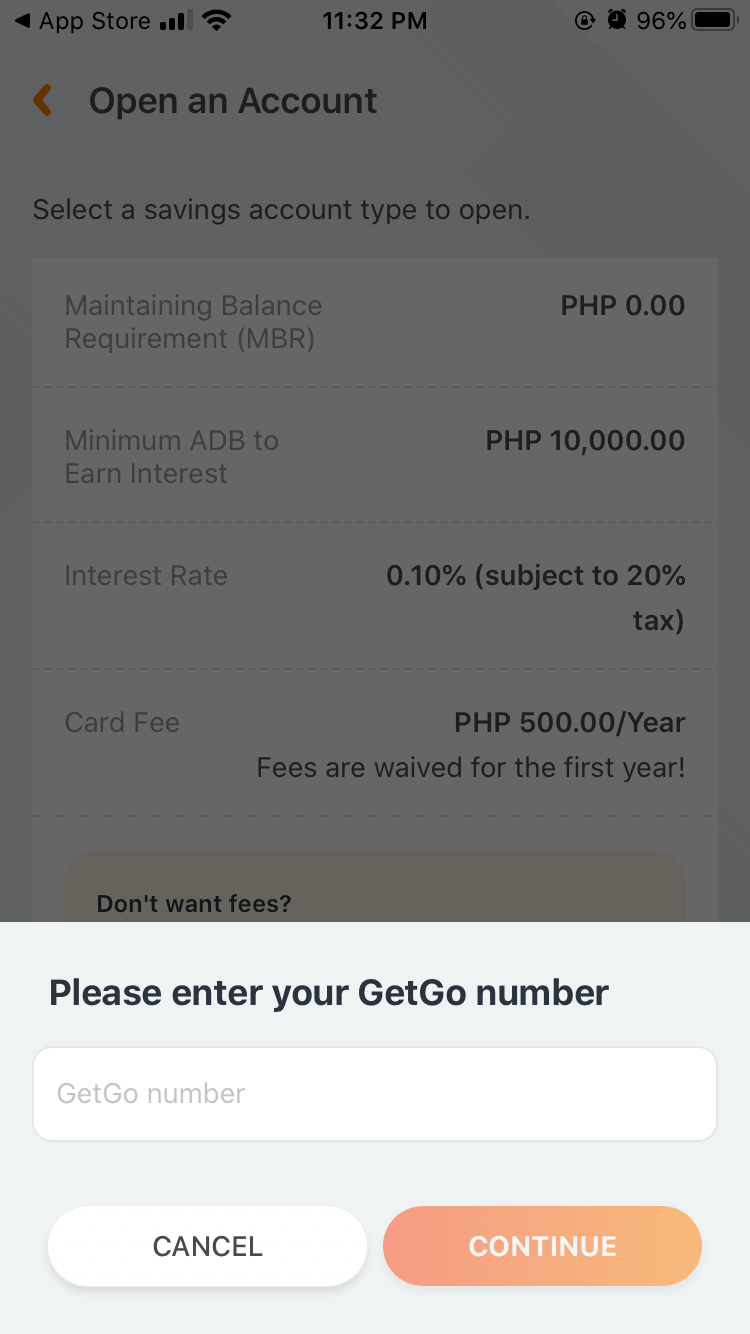

- ADB to earn interest is PHP 10,000 with 0.10% interest

- With Bancnet ATM Card

- The card is a Visa EMV Debit Card, which can be used for online purchases

- Money can be accessed 24/7 online

- PDIC up to PHP 500,000 per depositor

- The application can be made online

- Annual Fees are waived for the first year

- Annual Fees can also be waived if you maintain at least PHP 10,000 on your daily balance

Types of UnionBank Debit Card

EWallet

- EMV Visa Debit Card

- With PHP 350 annual fee

GetGo Debit

- Earn 1 GetGo Point for Every PHP 100 spent

- Exclusive Access to GetGo and Cebu Pacific Seat Sales

- With PHP 500 annual fee

UnionBankLazada Debit Card

- Earn Lazada Wallet Credits

- 2X Cashback for Every PHP 200 spent in Lazada

- 1X Cashback for Every PHP 200 spent for other stores

- With PHP 500 annual fee

PlayEveryday

- With PHP 500 annual fee

- You earn 1 Play point for every PHP 20 Visa spend

Things you will need to open a UnionBank Account Online

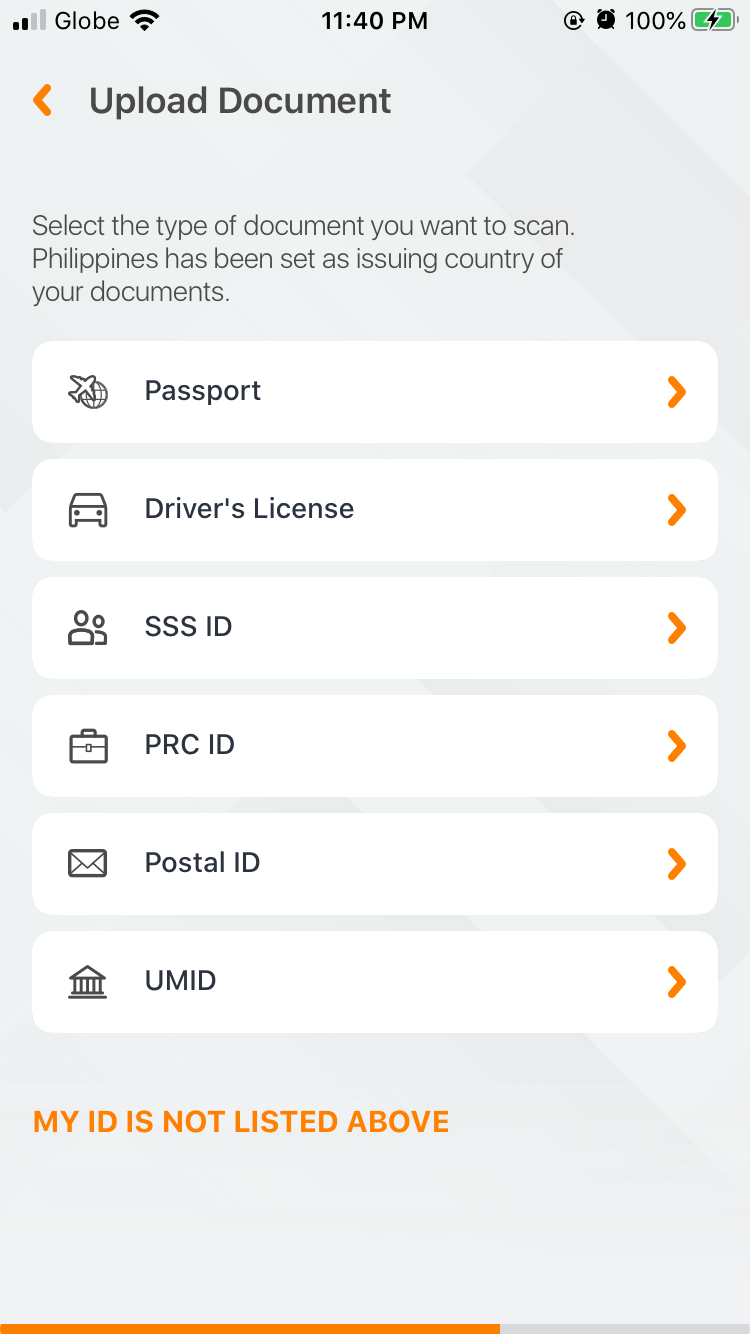

Valid ID

If your ID is not listed below, you will need to continue your application at a UnionBank Branch:

Cellphone with Camera

You will need to be able to capture your valid ID and have a selfie.

Internet

How to Apply for UnionBank Account Online

Because it’s the pandemic, going out is a bit of a hassle. You don’t need many documents nor go out to the branch online.

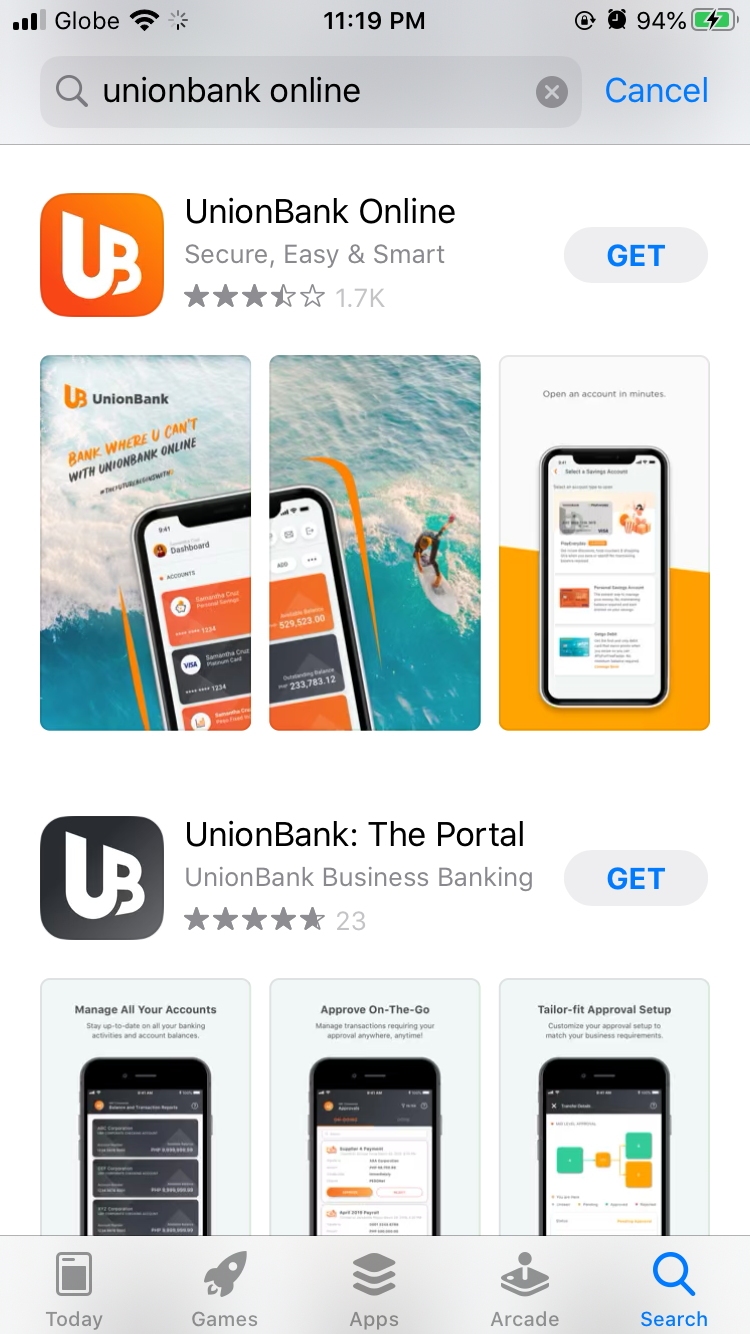

STEP 1: Download the UnionBank application – Google Play or Apple iOS

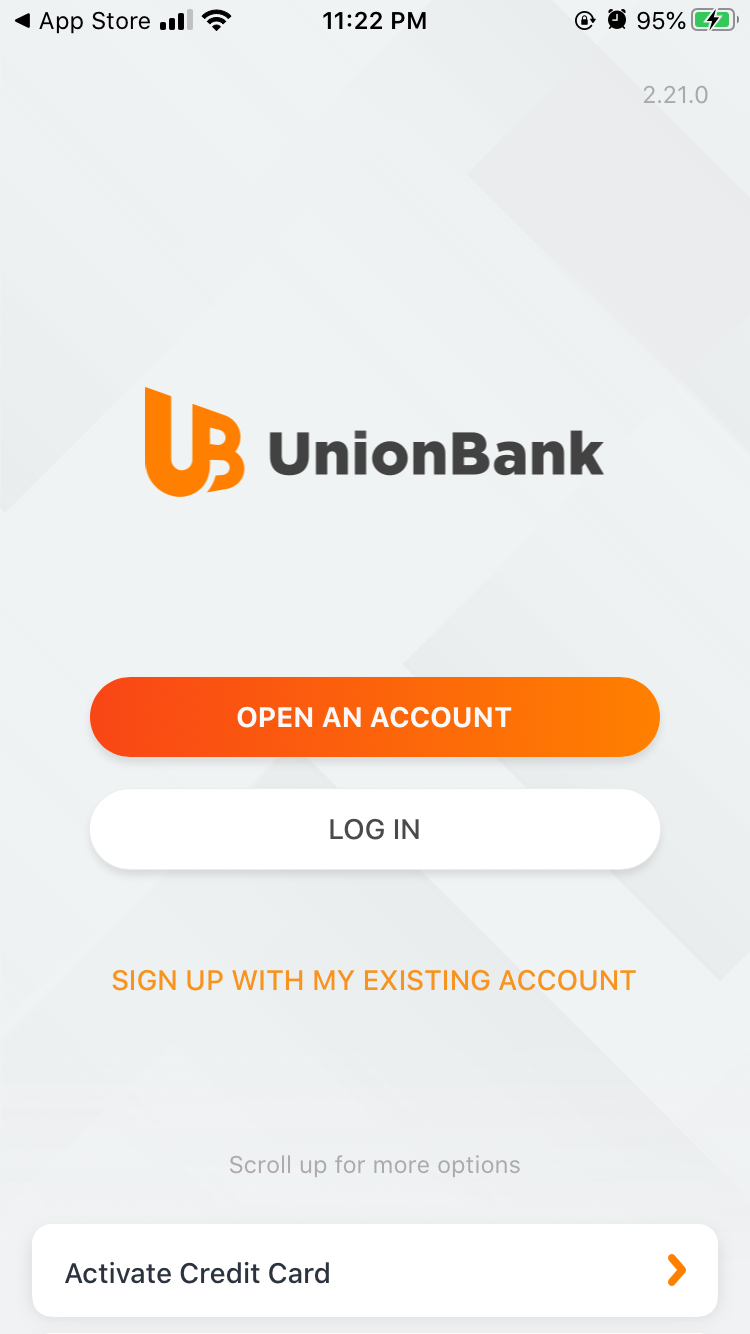

STEP 2: Tap Open An Account.

STEP 3: Choose an account you will open – Savings Account with Debit Card is the right choice.

STEP 4: Choose which type of card you will open. The E-Wallet has the least amount of annual fee, which is PHP 350. But if you are an online shopper, the Lazada Debit Card is a great deal. However, for travelers, the GetGo Debit is recommended for the promos and the points (GetGo Number may be asked). Tap Select.

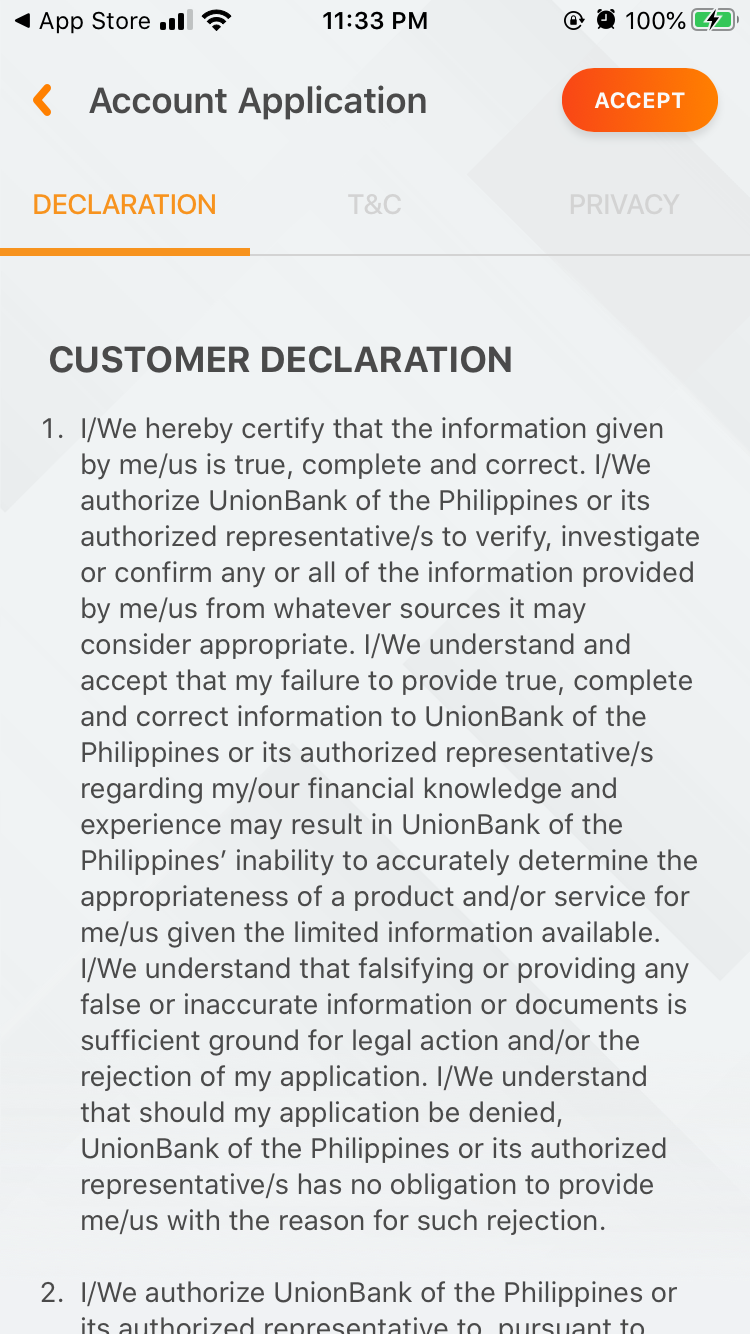

STEP 5: Accept the Customer Declaration, Terms and Condition, and the Privacy Policy.

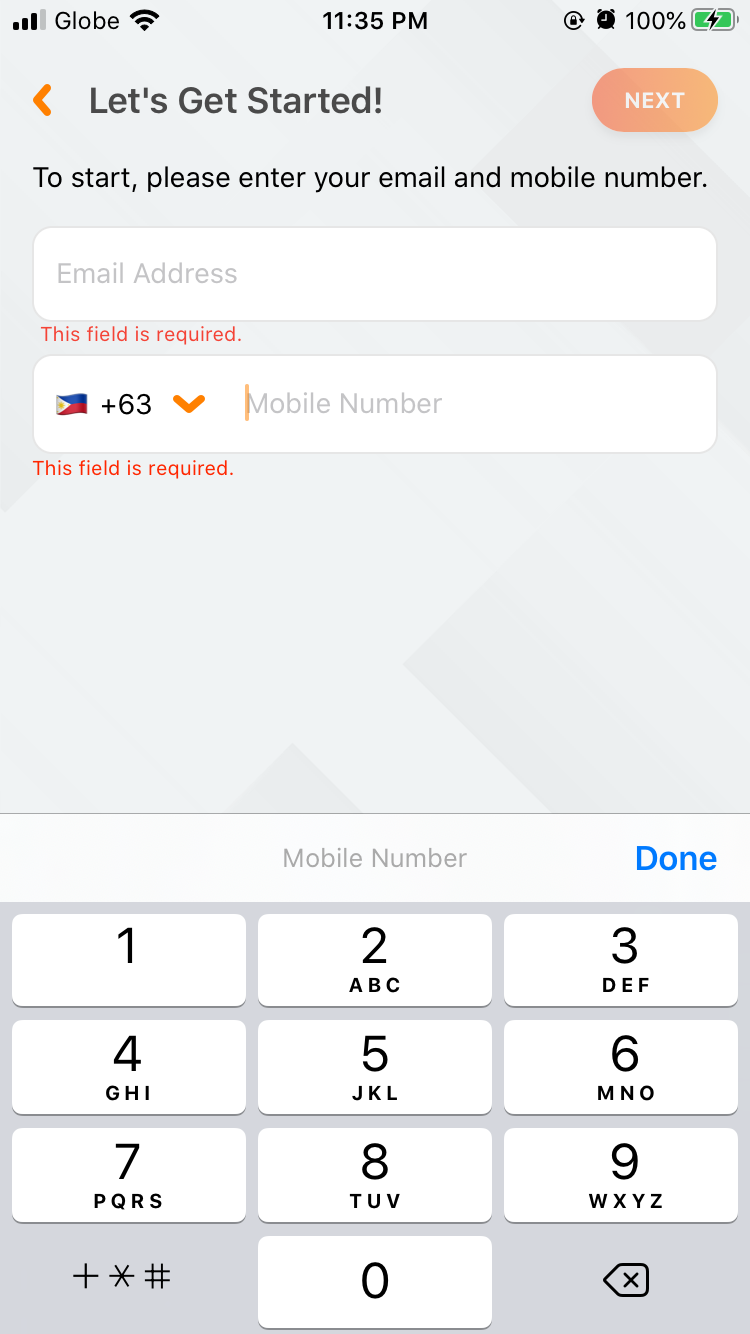

STEP 6: Enter your e-mail address and mobile number.

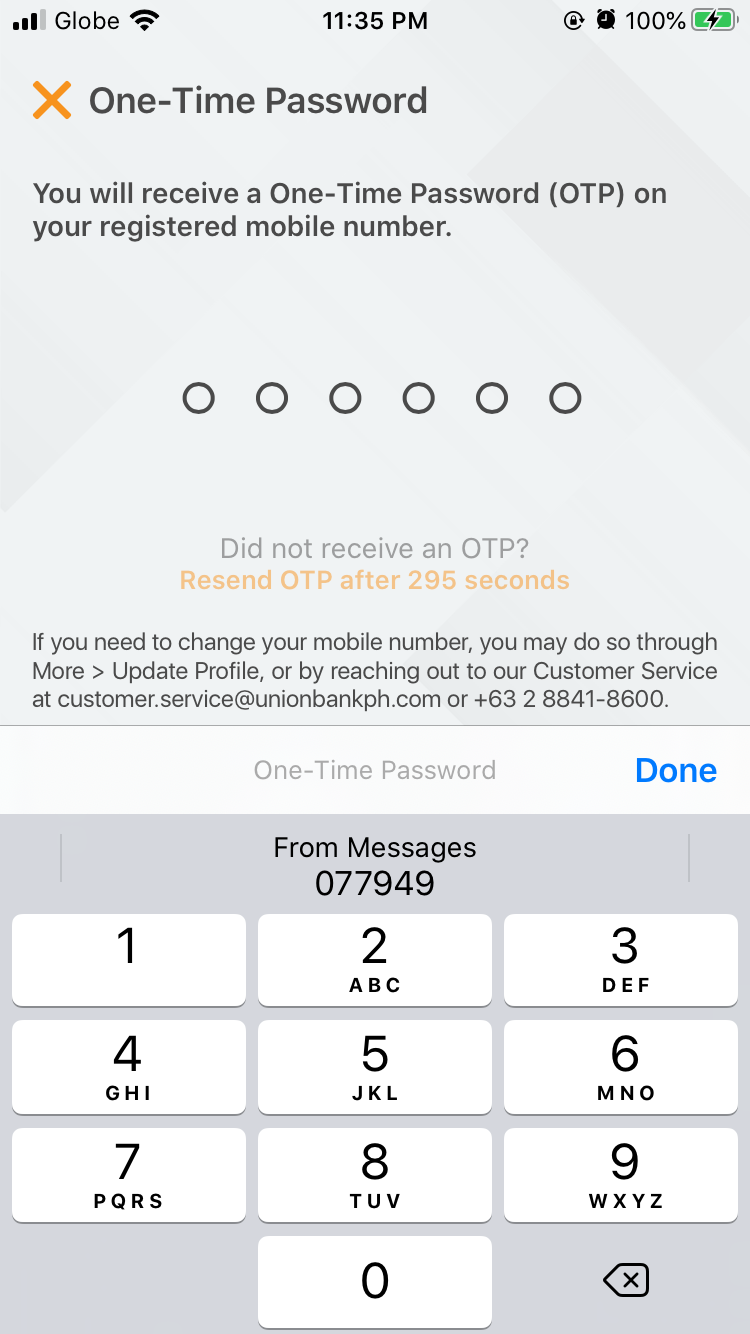

STEP 7: Enter the OTP sent to your number.

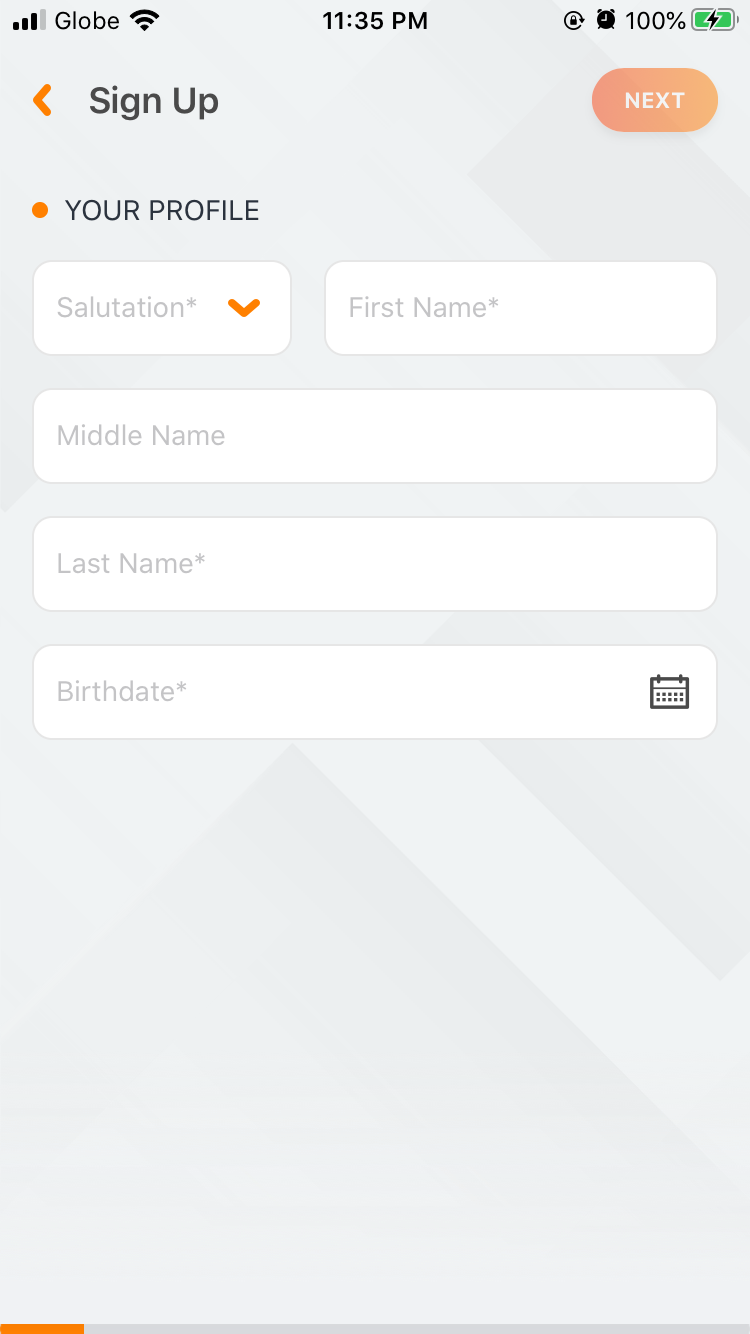

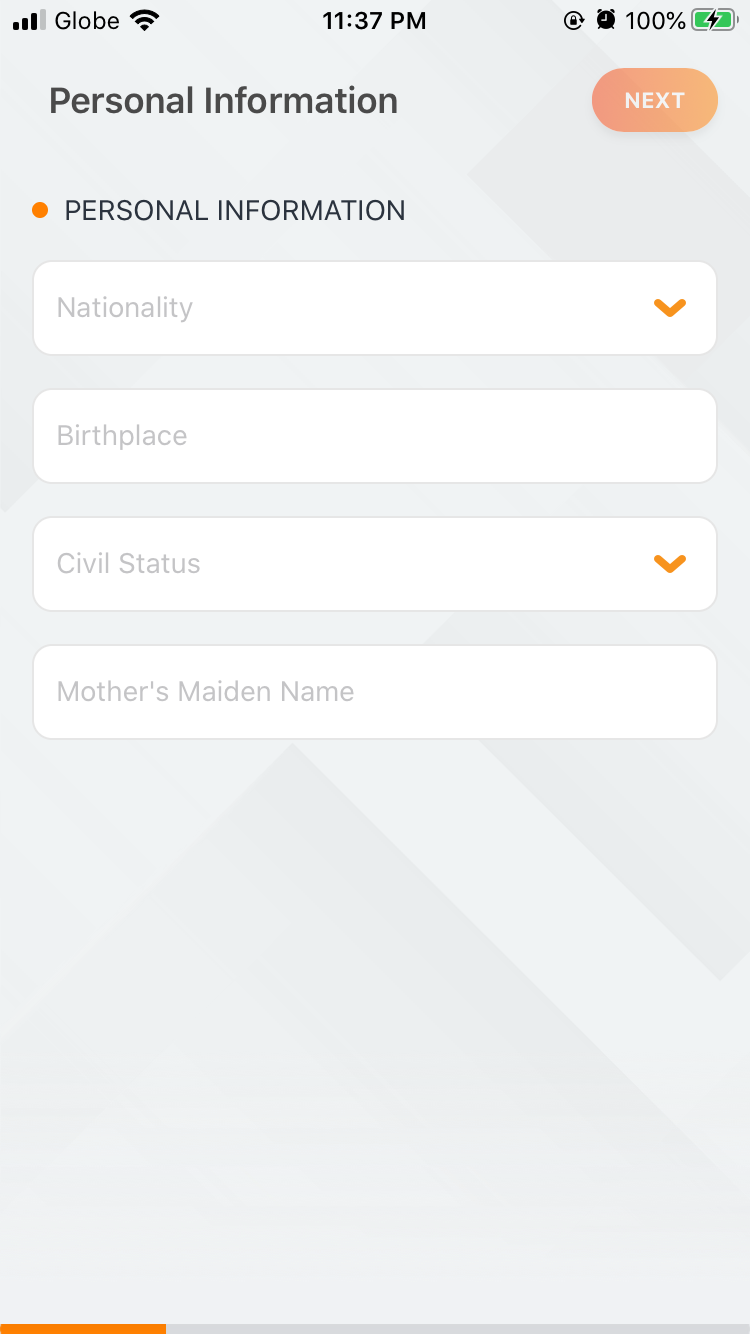

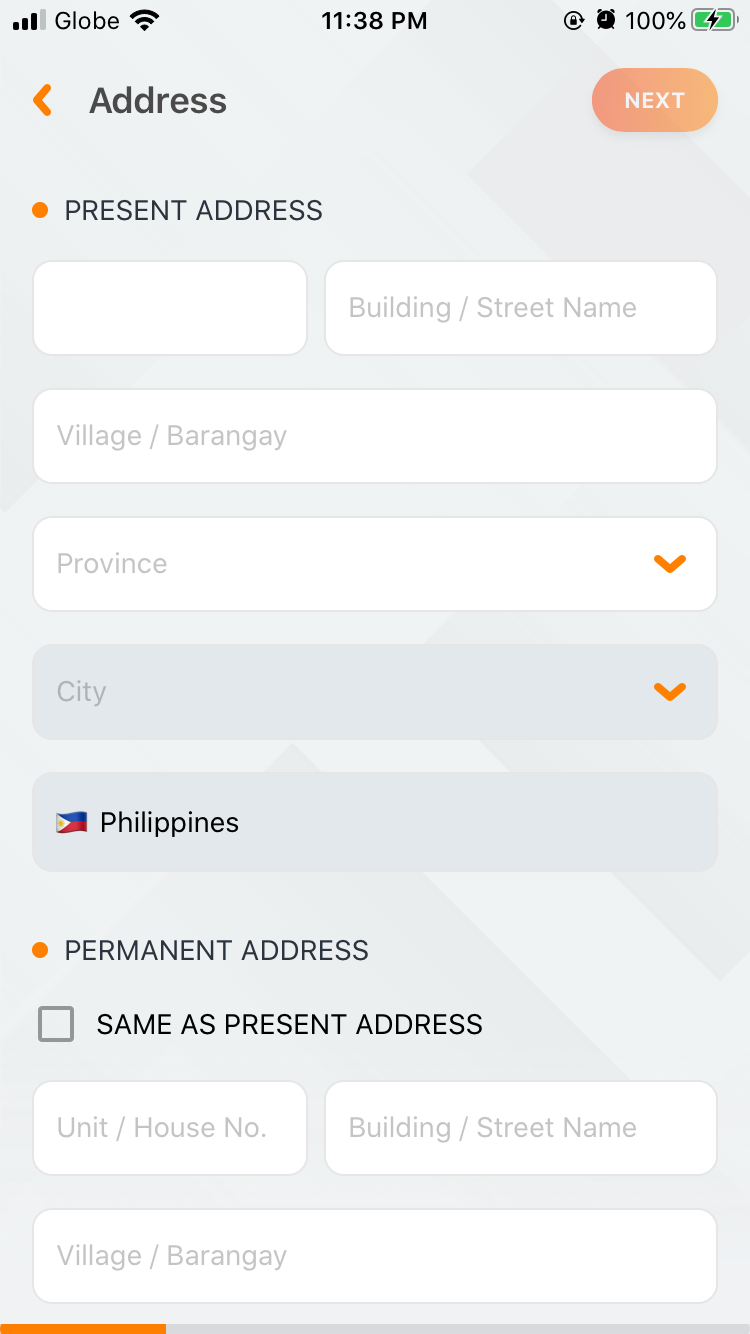

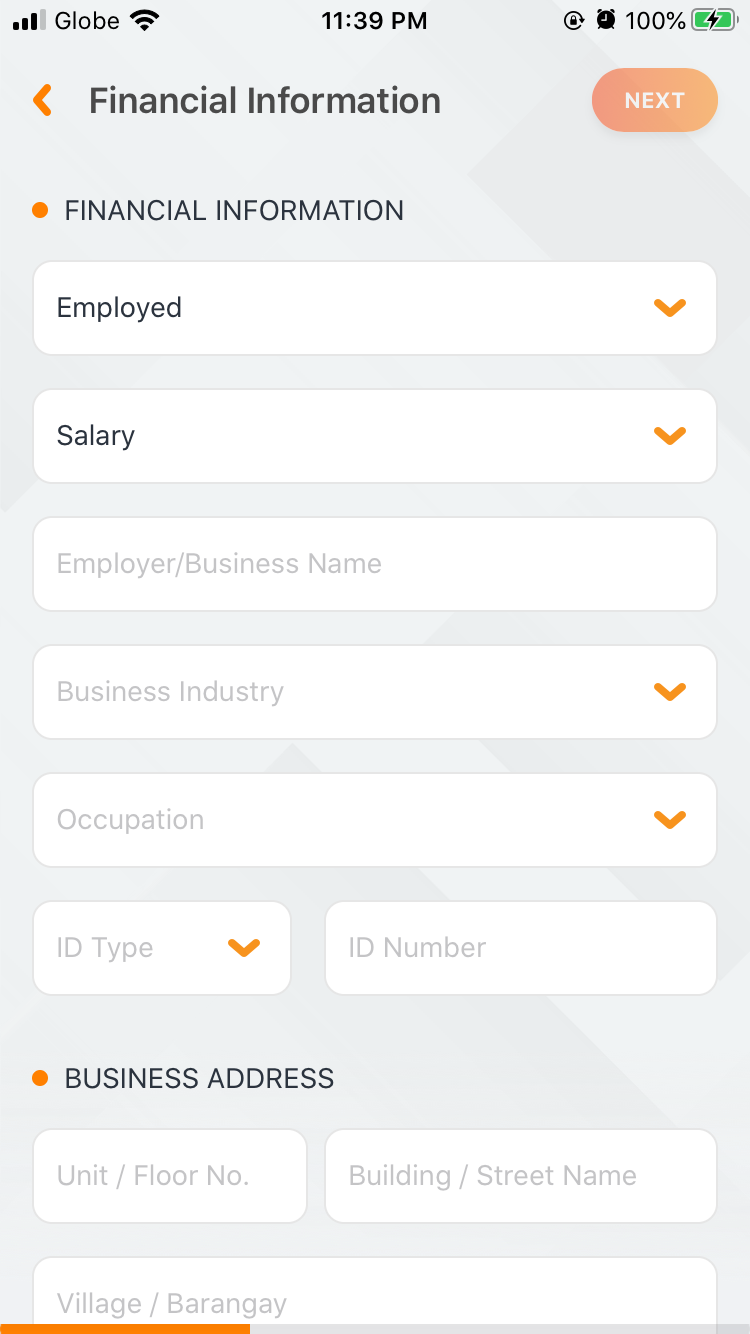

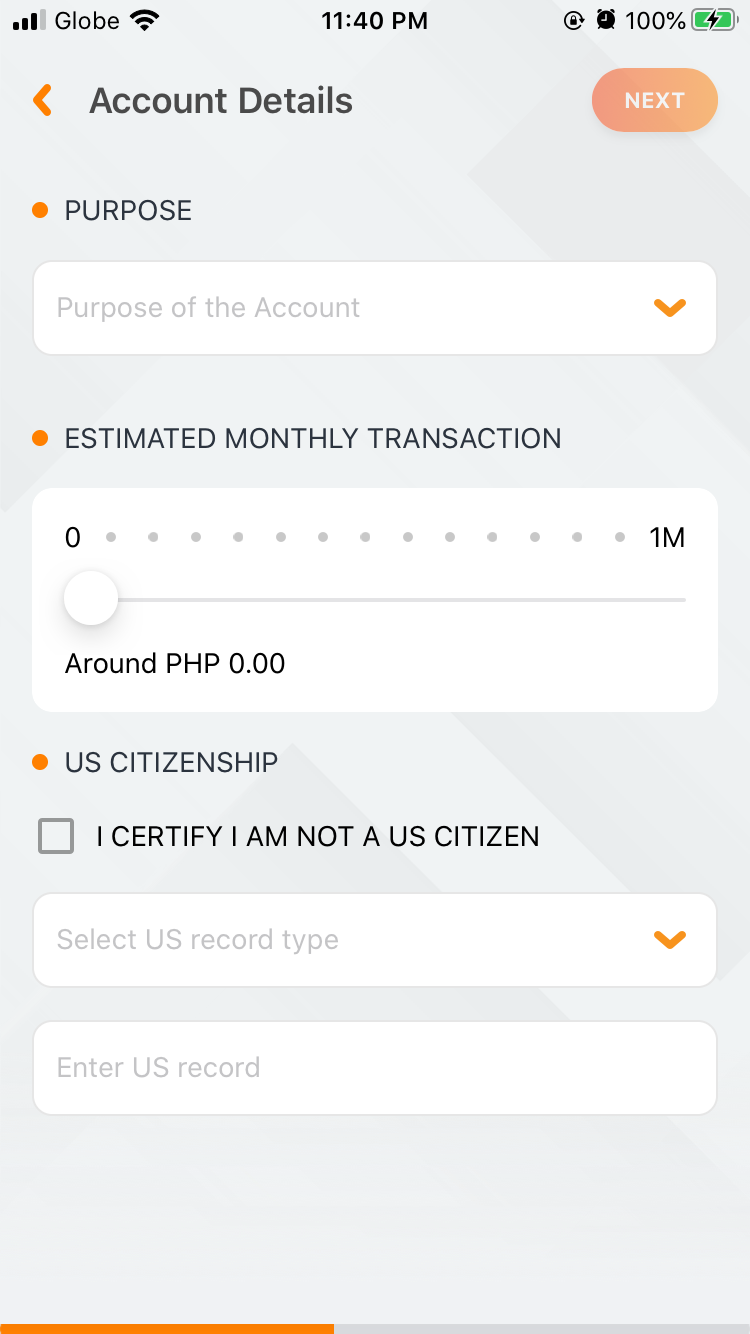

STEP 8: Type the details for your profile.

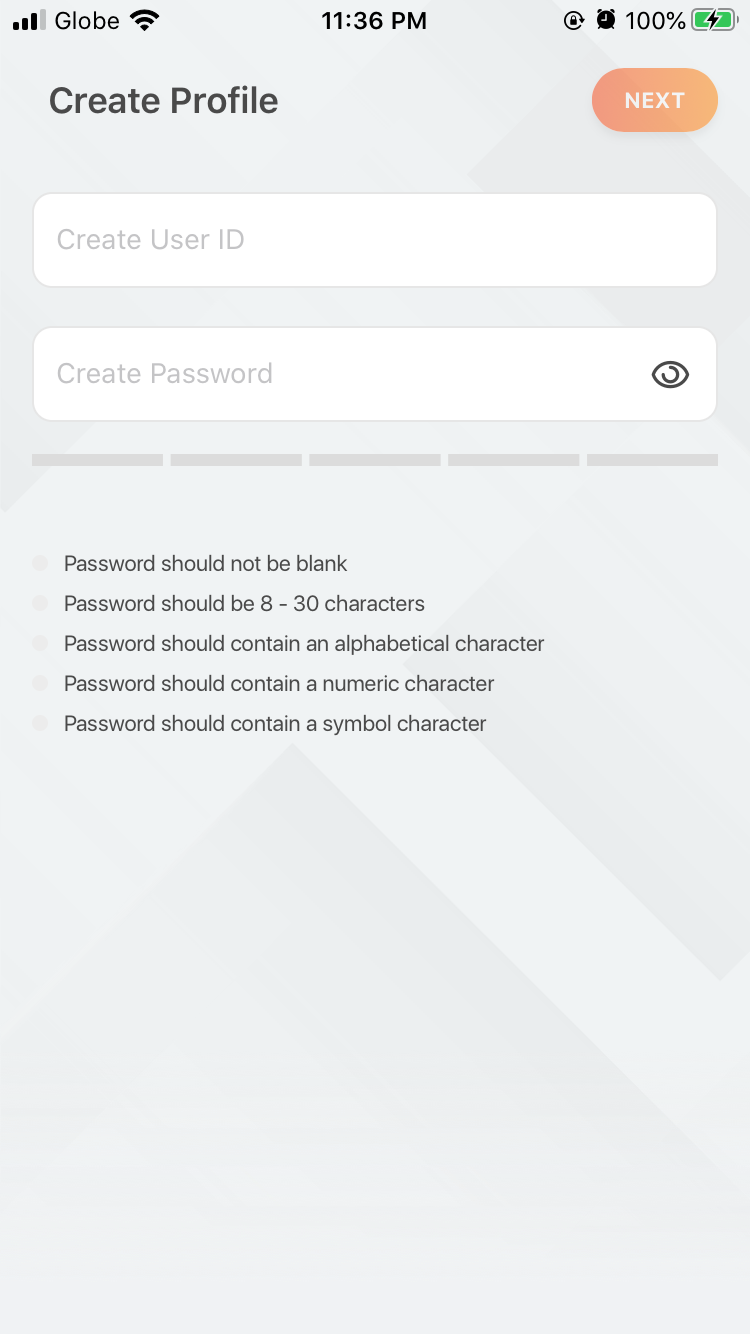

STEP 9: Create a User ID and Password for your online account.

STEP 10: Answer everything asked.

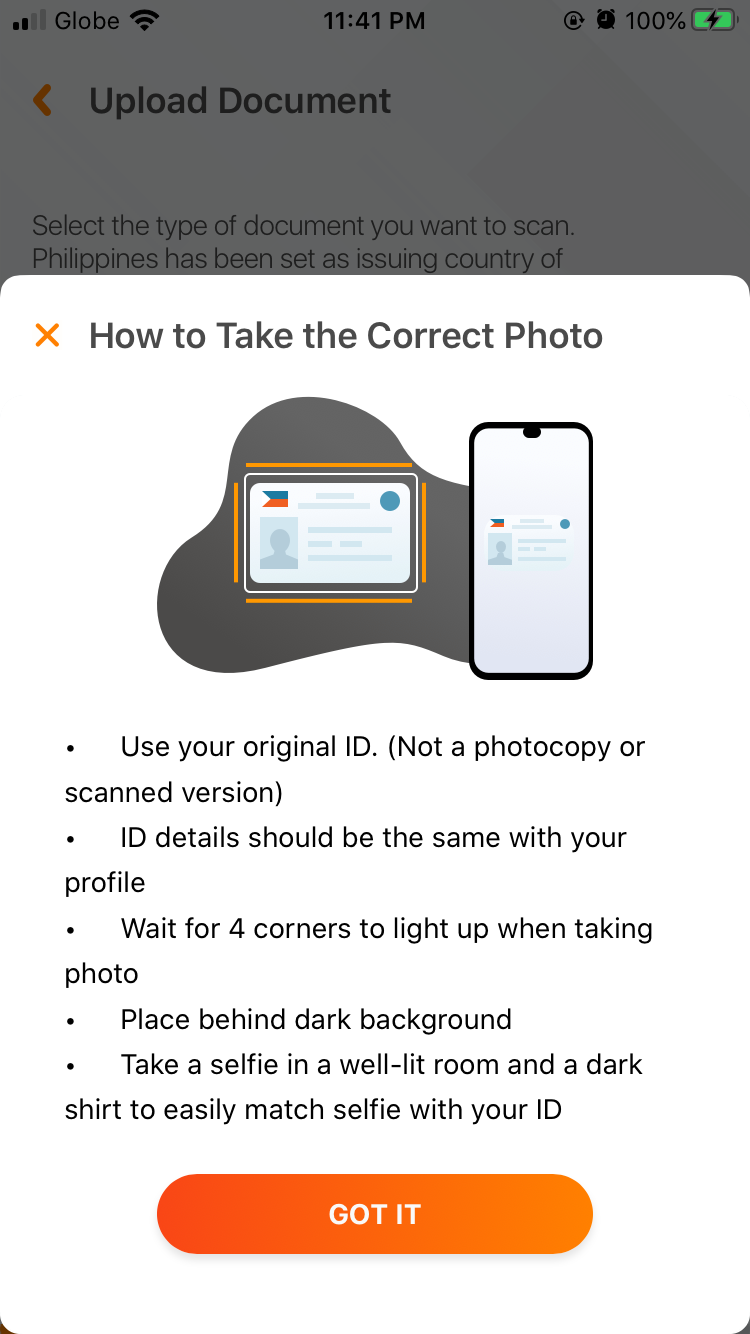

STEP 11: Upload or Take a picture of your ID.

STEP 12: Take a Selfie. This is to confirm that you are really the person applying.

STEP 13: Review the details you have entered. Confirm your application.

STEP 14: Wait for your account to be activated. It might take about 24 hours.

STEP 15: Start saving with UnionBank!

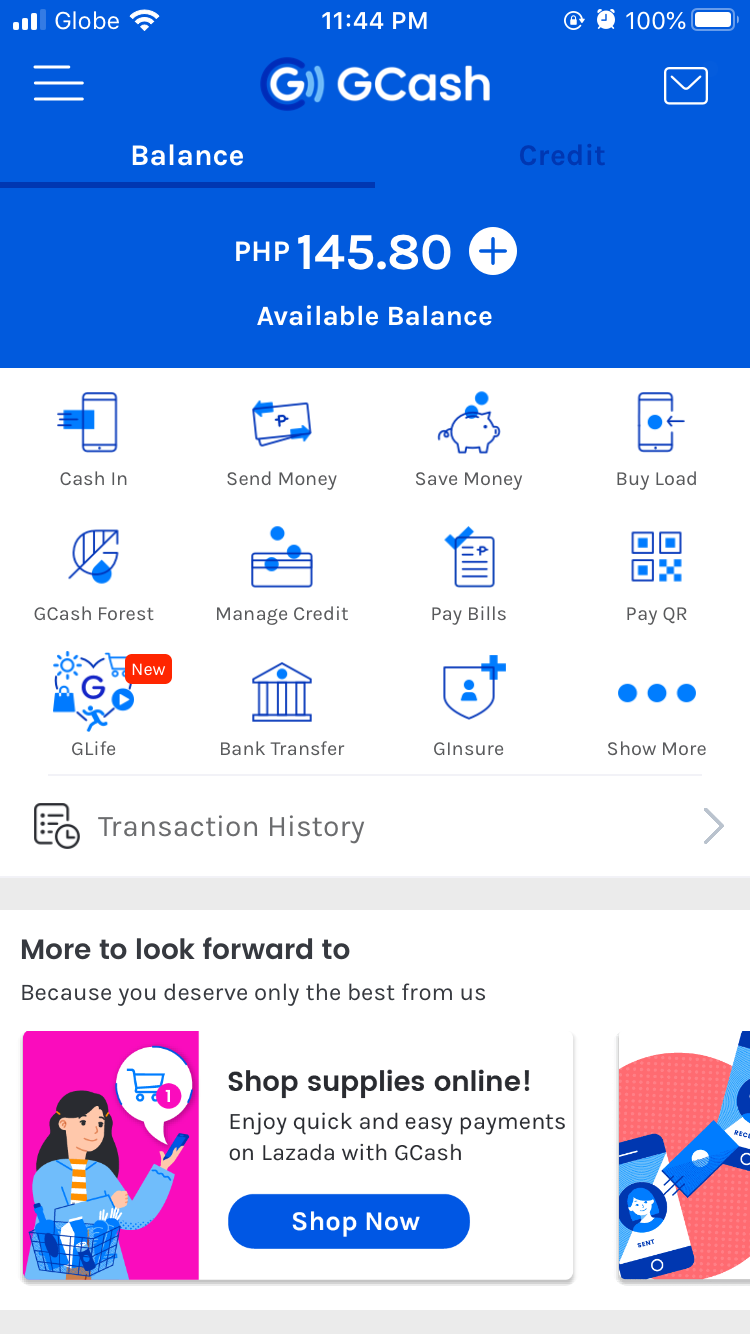

How to Add Funds to your UnionBank Account from GCash

STEP 1: Open the GCash App. Make sure you already have an account there. Read our guide: How to Use and Send Money using GCash in the Philippines

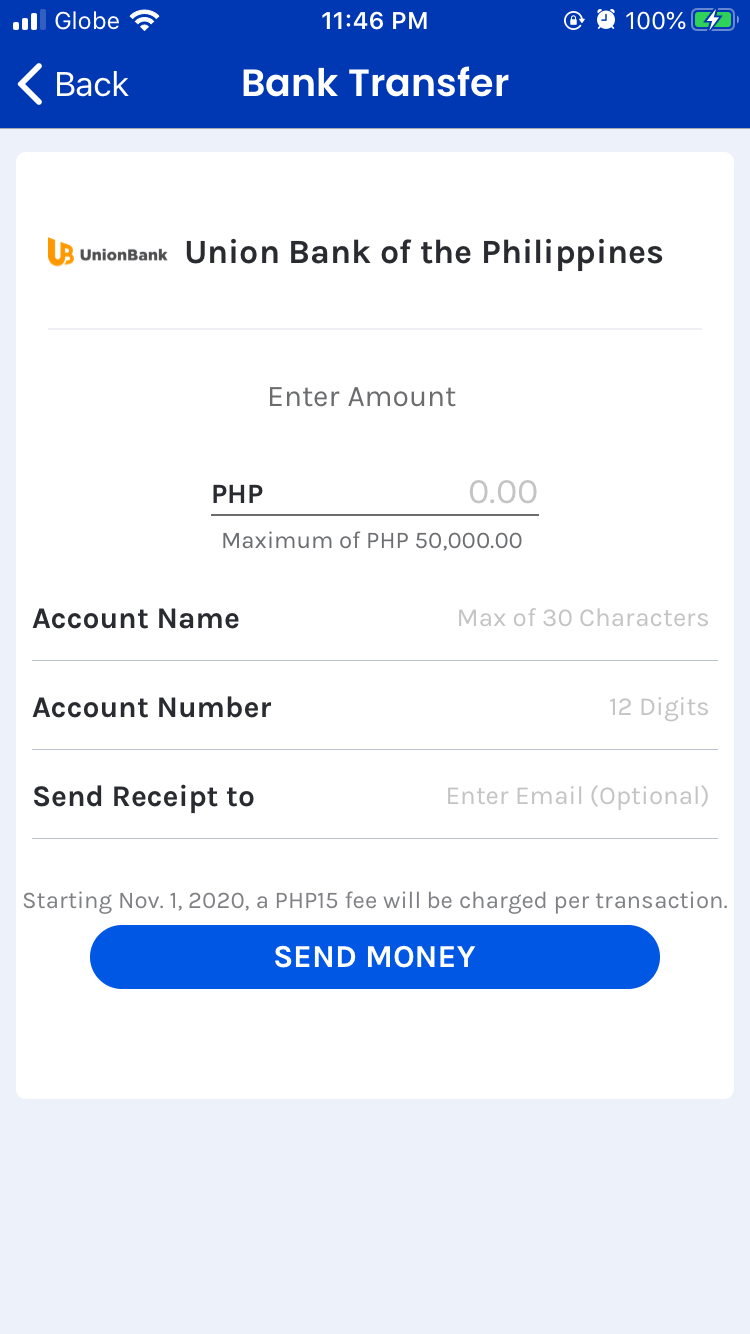

STEP 2: Go to Bank Transfer and look for UnionBank.

STEP 3: You can enter your UnionBank Account Name and Number and deposit your money there.

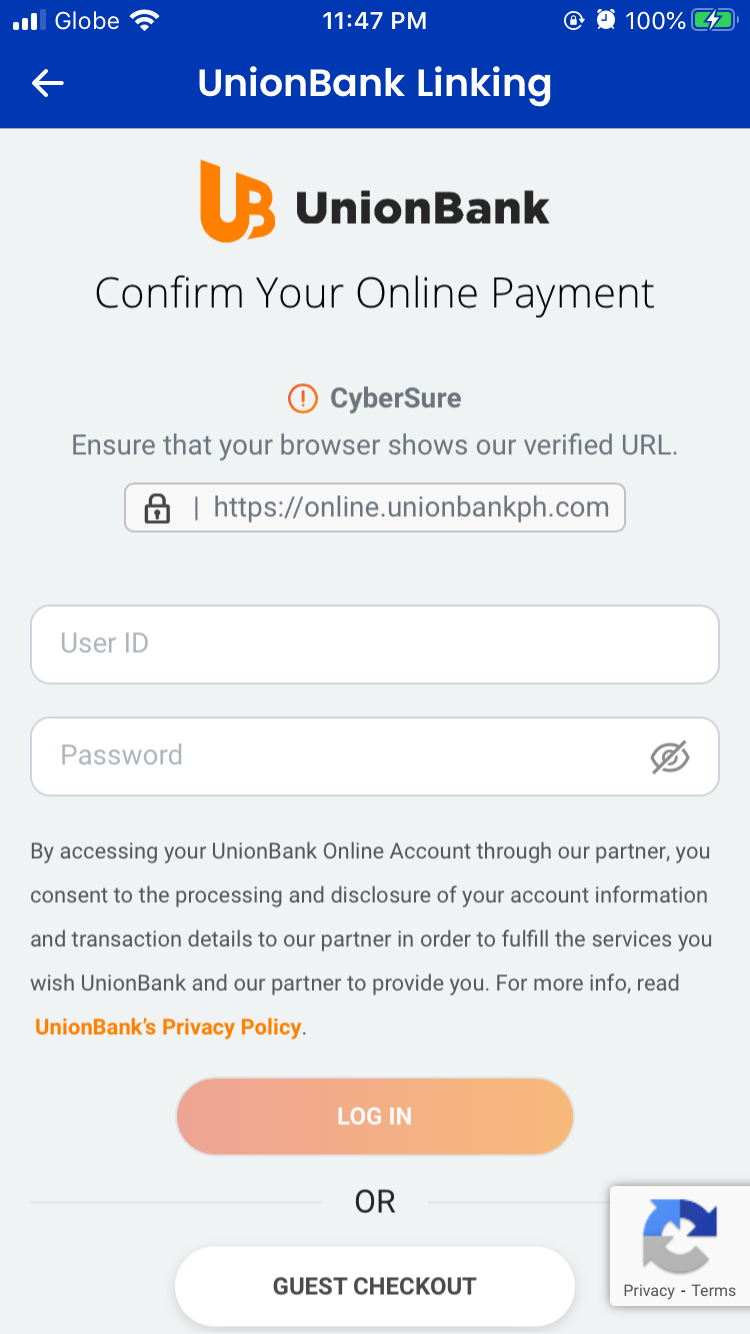

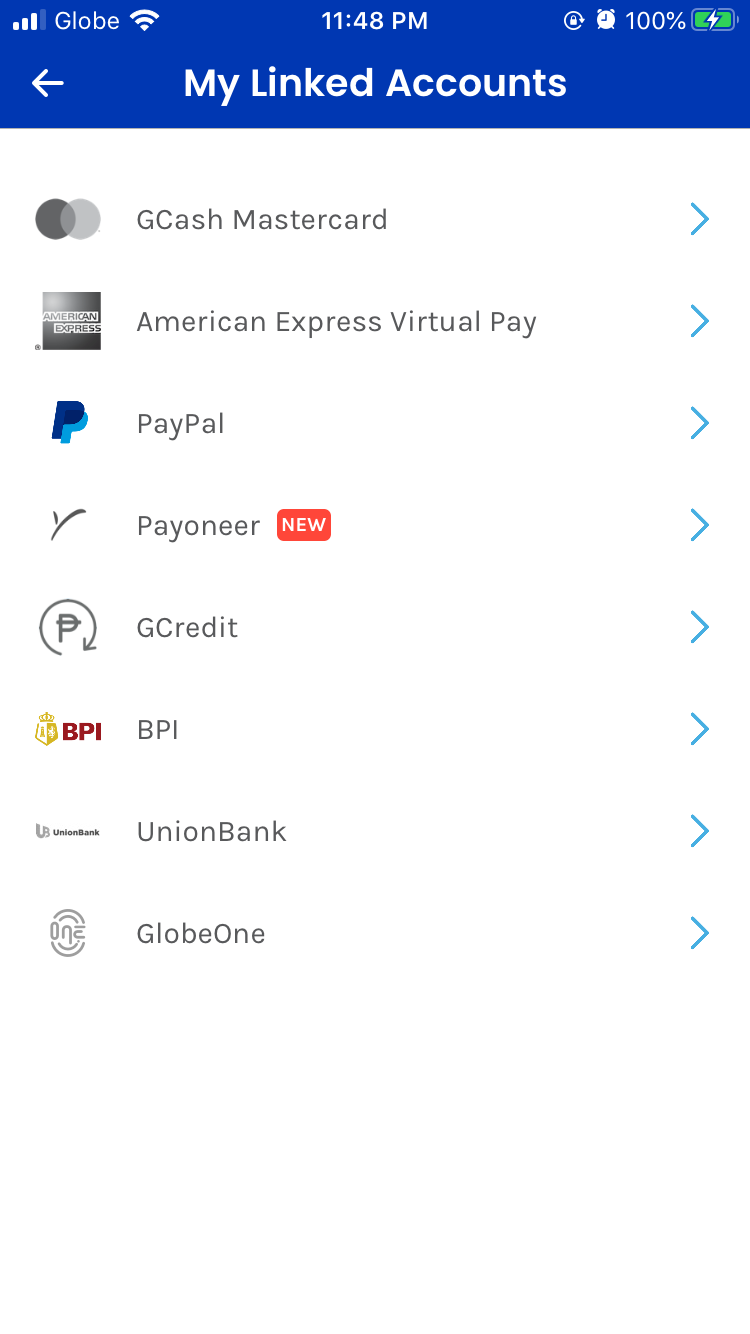

You could link your UnionBank Account and GCash for faster transactions. Just go to your profile – My Linked Accounts and tap UnionBank. Log-in to your UnionBank Online Account.

Congratulations, you have now opened a UnionBank Account. This can be used for your future visa applications. Get your bank statement or bank certificate at any UnionBankbranch nationwide. I hope this helps with your future travels!

[line]

About the Writer

Hey, I’m Lyza! I once was a person who just imagined going to places “one day” but decided to pursue my dreams. My first travel abroad was in Japan, solo, last 2018, and fell in love with the journey since. I aim to visit 10 countries before turning 30 and 2 new places in the Philippines every year. Besides traveling, I love organizing trips, photography, reading, and making new friends. Follow my adventures through my Instagram.

[line]

Are you on Pinterest? Pin these!