Airport Tax Refund: Guide on How to Get a Philippines Travel Tax Refund

Was your trip canceled but you already paid a Philippine travel tax? Are you exempt from travel tax? Well, don’t worry, you could get a refund for the tax you have paid even if your ticket is not refundable. Here’s how to get a Philippine Travel Tax Refund on your flight tickets.

As per PD 1183, the travel tax is paid by people leaving the country. To those who are in a hurry or doesn’t want the hassle during on the day of your flight, you can buy pay your travel tax in advance through your ticket or online through the TIEZA site. Read our guide to get your money back, especially on a canceled trip.

As per PD 1183, the travel tax is paid by people leaving the country. To those who are in a hurry or doesn’t want the hassle during on the day of your flight, you can buy pay your travel tax in advance through your ticket or online through the TIEZA site. Read our guide to get your money back, especially on a canceled trip.

- Travel Tax in the Philippines & Terminal Fees: Cost, Exemptions, Refunds

- Step by Step Guide on How to Pay Your BIR Taxes Online in the Philippines

- How Filipino Digital Nomads or Online Sellers Can Register to BIR and Pay Taxes

- How to Use and Send Money using GCash in the Philippines

- 9 Ways To Make Money While Traveling – How To Sustain a Travel Lifestyle

Table of Contents

Travel Tax

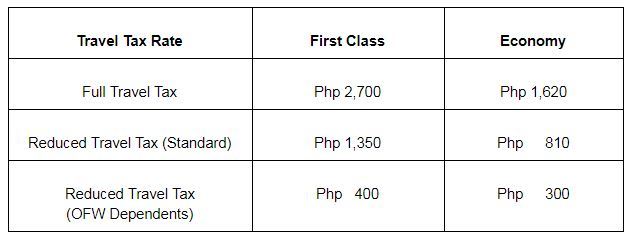

How much would you pay for a travel tax in the Philippines?

Here’s an article that discusses more travel tax and terminal fees.

Persons who can get a Travel Tax Refund

If you have paid for travel tax or are exempt or got downgraded, you can get a refund. Refunds can be claimed within two years from your payment date. Included are the requirements for getting a refund.

Those with unused tickets

- Passport

- Airline Ticket with travel tax payment or Official Receipt of Travel Tax (Passenger and Airline copy)

- Fare Refund Voucher or Certification from Airline (stating that ticket is not used, non-rebookable or has no refund value)

Downgraded

The First Class and Economy class have different costs; if you are downgraded, you can get a refund of the difference.

- Passport

- Airline Ticket with travel tax payment or Official Receipt of Travel Tax (Passenger copy)

- Certification from the airline that your ticket was downgraded or the flight manifest

Non-immigrant foreign nationals staying in less than a year

If you are a foreigner that has stayed in the Philippines for less than a year (e.g., a tourist), then you can skip paying the travel tax. However, if you have an international flight, you may get automatically charged. Get a travel tax refund!

- Passport or a certification from the Bureau of Immigration indicating the passenger’s identity, status, and date of arrival

- Airline Ticket with travel tax payment or Official Receipt of Travel Tax (Passenger Copy)

Qualified for Travel Tax Exemption

Check here if you are exempted for travel tax (OFWs, Diplomats, etc.)

- Passport

- Airline Ticket with travel tax payment or Official Receipt of Travel Tax (Passenger Copy)

- Supporting Documents

Qualified for Reduced Travel Tax

Check here if you are qualified for reduced travel tax (Minors, Spouse or Children of OFWs, etc.)

- Passport

- Airline Ticket with travel tax payment or Official Receipt of Travel Tax (Passenger Copy)

- Supporting Documents

Double Payment

If you have paid travel tax twice for the same ticket, then you can get a travel tax refund.

- Passport

- Airline Ticket with travel tax payment or Official Receipt of Travel Tax (Passenger Copy)

Undue Travel Tax

- Passport

- Airline Ticket with travel tax payment or Official Receipt of Travel Tax (Passenger Copy)

Step by Step Guide in Getting a Travel Tax Refund

STEP 1: Gather all your documents before going to Travel Tax Center. If you are not the payee, you’ll need a Special Power of Attorney. If you are a parent of a minor payee, bring your child’s birth certificate.

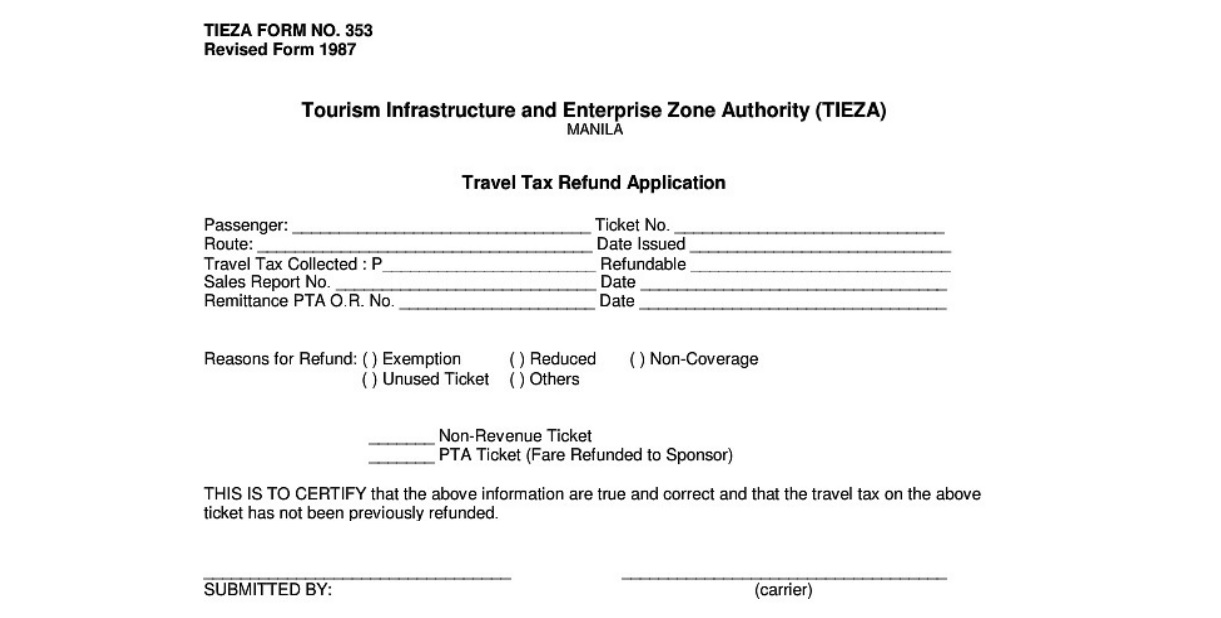

STEP 2: Fill-up a TIEZA Refund Application Form. You can print this form ahead, too.

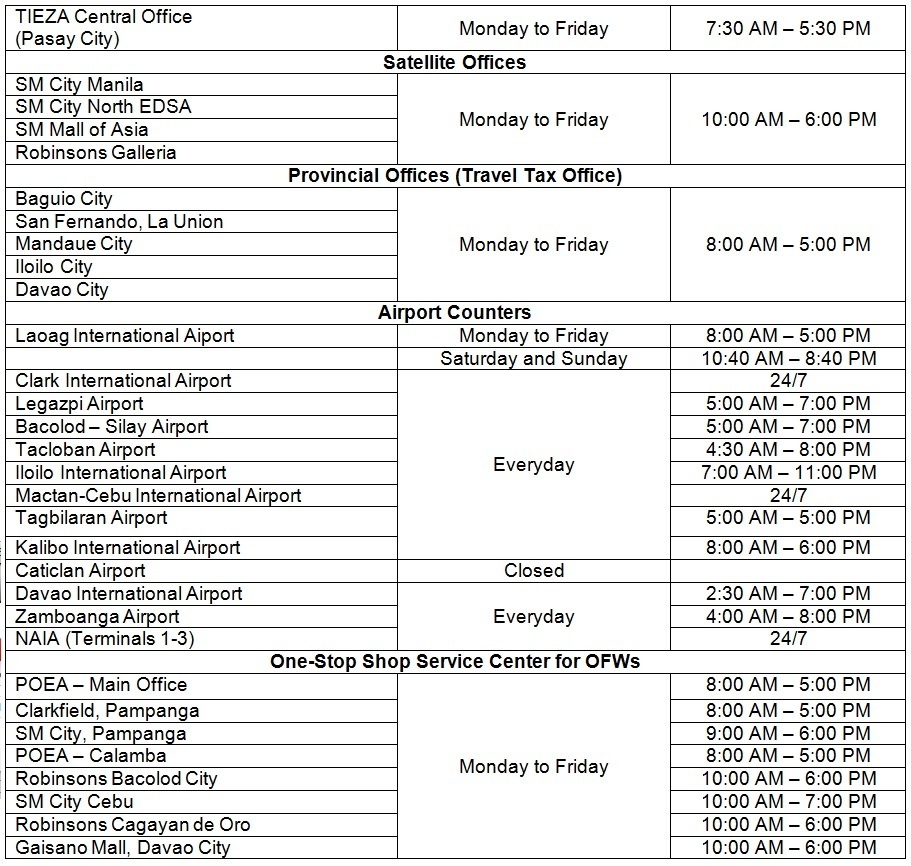

STEP 3: Present the documents to the TIEZA Centers.

STEP 4: Wait when your check is available. It’s usually within three working days buy you can avail the one Same-day refund. See below who can avail.

STEP 5: Get your check refund.

Travel Tax Centers and Schedules

Frequently Asked Questions

When can I get a refund?

You can get it within 2 years from the payment date.

What if I’m out if the country?

You can do it when you return to the Philippines within 2 years from the date of payment or execute a Special Power of Attorney for a representative to process for you.

What if the payee is a minor?

The parents shall present the minor’s original birth certificate unless the parent has signed the passport on the minor’s behalf. If the claimant is not the parent, you’ll need to present a Special Power of Attorney executed by the parent and the original birth certificate of the minor, as well.

Can I get a refund from my airline?

Yes, if the travel tax has not yet been remitted.

Whose name is in the check?

The travel tax refund check is for deposit to the payee’s account. However, you can ask an uncrossed check, too.

I don’t have my passport, what else can I use to claim the refund?

- GSIS / SSS ID

- Original Postal ID

- Driver’s License

- PRC ID

Who can get a same-day refund?

Submit your SDR form and the documents if you the reason for the refund is:

- Offloaded Passengers or Cancelled Flights

- Entitled to exemption or reduced tax

- Tax paid twice

- Undue Tax

Where can I get a same-day refund?

Mostly at the airport counters.

I hope this guide will help you in getting a Philippine Travel Tax Refund. Though our flight is canceled, at least we get our money back, right? Also, this is very useful, especially if you are an OFW or a tourist since you won’t have to pay. Good luck!

Are you on Pinterest? Pin these!