Travel Tax in the Philippines & Terminal Fees: Cost, Exemptions, Refunds

Traveling is not cheap. Although we Filipinos, sometimes budget our way when going out of the country, there are certain expenses that we need to pay. One of those things we can’t seem to escape during our vacation is the Travel Tax and Terminal Fees in the Philippines.

According to Presidential Decree 1183, the Travel tax is imposed on individuals leaving the Philippines. But not all have to pay; certain people are exempted from the Travel Tax or have reduced payment. The proceeds are for TIEZA (Tourism Infrastructure and Enterprise Zone Authority), CHED’s tourism-related programs (Commission on Higher Education), and NCCA (National Commission for Culture and Arts).

This article will discuss Philippine Travel tax; how much is the payment, who needs to pay, and who is exempted, how to get a refund or exemption. This will also discuss the Terminal fees of the Philippine Airports.

- How to Schedule a DFA Online Appointment to Get a Philippines Passport

- One year Visa-free Balikbayan Stay in the Philippines for the Foreign Spouse/ Children of Filipino Citizens

- OFW Guide – List of Work Abroad Websites To Help You Find Jobs Overseas

- Philippines Tourist Visa – How to Get a Tourist Visa to Visit the Philippines

- How to Teach English Abroad – Get 60% OFF Your TEFL Certification Online

Table of Contents

Travel Tax in the Philippines

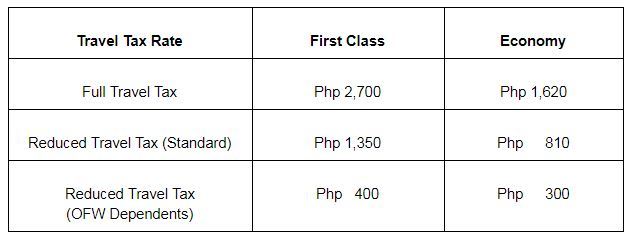

How much is the travel tax in the Philippines?

Who needs to pay a travel tax?

- Filipino Citizens

- Foreign Nationals who are Permanent Residents of the Philippines

- Non-Resident Foreign Nationals who stayed for more than 1 year in the Philippines

What are the Requirements Needed for paying the Travel Tax?

- Passport

- Airline Ticket

- Travel Tax Payment (maybe in Cash or Credit)

How to Pay Travel Tax?

- Included when booking an airline ticket

- At Travel Tax Centers or Counters

- Online: https://tieza.gov.ph/online-travel-tax-payment-system/

If you are in a hurry, I recommend paying ahead to avoid the long queues at the counters. However, refunds may take time but it is still possible.

Philippine Travel Tax Exemption

Who are exempted from payment of Travel Tax in the Philippines? What are the Requirements Needed?

Main Requirement: Passport

Overseas Filipino Workers

- If hired through POEA: Original Overseas Employment Certificate

- If directly hired: Certificate of Employment issued by the Philippine Embassy or Consulate in the country where you are working or a copy of Employment Contract authenticated by the PH Embassy or Consulate

Filipino Permanent Residents Abroad whose stay in the Philippines is less than a year

- Bio page of passport and stamp of the last arrival in the Philippines

- Permanent Residency Card or any proof that you reside permanently in a foreign country

- Certification of Residence issued by Philippine Embassy or Consulate in case the country you are staying doesn’t grant permanent residency

Balikbayan whose stay in the Philippines is less than a year

- Bio page of passport and stamp of the last arrival in the Philippines

- Airline Ticket used to travel to the Philippines

Balikbayan who is a former Filipino Citizens and naturalized to another citizenship whose stay in the Philippines is less than a year (including spouse and children)

- Philippine and Foreign Passport

- For Children: certified true copy or authenticated copy of birth certificate or adoption papers

- For Spouse: certified true copy or authenticated copy of marriage certificate

Infants who are two years old and below (if two years old and one day, then standard reduced travel tax is paid)

- If no passport, PSA copy of birth certificate

Foreign Diplomatic, consular officials, and staff accredited in the Philippines. Immediate members of the family and household staff are included as long as there is an authorization from the Philippine Government.

- Certification from their respective Embassy or Consulate, from the Department of Foreign Affairs or Office of Protocol

United Nations organization and its agencies’ Officials, Consulates, Experts, and employees and those exempt under Laws, Treaties or International Agreements

- UN Passport or Certificate of Employment from UN office or agencies with international agreements with the Philippines

US military personnel and their dependents. US nationals with fares paid by the US government or on US government-owned transports. Filipinos in US military service and their dependents. Filipino employees of US government or US State department visitors traveling to the US for government business.

- Government Transport Request for airline tickets or certification from the US Embassy that the US government paid for the fare

Airline crew of international routes

- Certification from Civil Aeronautics Board that the crew member is on his aircraft must have:

- Crew’s Name

- Position

- Location of aircraft

Philippine Foreign Service personnel assigned abroad and their dependents

- Certification from the Department of Foreign Affairs

Officials and employees of Philippine Government on official business (except GOCCs)

- Certified True Copy of Travel Authority or Travel Order from Department Secretary

Grantees of foreign government-funded trip

- Proof that the foreign government funds travel

A student with an approved scholarship from a Philippine Government Agency

- Certification from the government agency

Personnel and their dependents of a multinational company with regional headquarters but not engaged in business in the Philippines

- Certificate of Board of Investments

Authorized by the President of the Philippines for national interest

- Written authorization stating that the passenger is exempt from travel tax

How to get Tax Exemption?

- Present passport and documents to the Travel Tax officer

- Get Travel Tax Exemption Certificate

Reduced Travel Tax

Certain people don’t need to pay the full amount of travel tax. There are two types; standard and privilege reduce travel tax. Here are the qualifications.

Who can avail Standard Reduced Travel Tax in the Philippines? What are the requirements?

Main Requirement: Passport

Minors – 2 years and one day – twelve years old (it must be exact, if twelve years old and one day, no more exemption)

- If no passport, PSA copy of birth certificate

- Airline Ticket, if already issued

Accredited Filipino Journalist (writers, editors, reporters, announcers) in pursuit of assignment

- Certification from an editor or station manager that passenger is an accredited journalist

- Certification from the Office of the Press Secretary

Authorized by the President of the Philippines for national interest

- Written authorization from Office of the Presidents stating the passenger is entitled to Reduced Travel Tax

- Airline Ticket, if already issued

Who can avail of Privilege Reduced Travel Tax in the Philippines? What needs to be submitted?

If you are a dependent of an OFW traveling to the country where your spouse or parent is at, then you can avail of this.

Main Requirements: Passport and any of the following:

- Original Overseas Employment certificate

- Certified true copy of Balik-Manggagwa Form or OFW’s Travel Exit Permit

- Certification of Accreditation or Registration

- OFW’s Work Visa or Work Permit

- Valid Employment Contract or Company ID of the OFW

- Recent payslip of OFW

Legitimate spouse of an OFW

- PSA Marriage Certificate

- Airline Ticket, if already issued

- Certificate from the agency that the dependent is joining the seaman’s vessel

Unmarried children of an OFW who are 21 years old and below (legitimate or illegitimate)

- PSA Birth Certificate

- Airline Ticket, if already issued

- Certificate from the agency that the dependent is joining the seaman’s vessel

Child of an OFW who is a Persons With Disability (any age)

- PWD ID Card issued by an office of National Council of Disability Affairs

- PSA Birth Certificate

- Airline Ticket, if already issued

- Certificate from the agency that the dependent is joining the seaman’s vessel

How to get Reduced Travel Tax?

- Present passport and documents to the Travel Tax officer.

- Pay the fee.

- Get the Reduced Travel Tax Certificate (RTTC).

Philippine Travel Tax Refund

In case you have paid tax refund or are qualified for such but have paid. You can get a tax refund. You can claim if within two years from your date of payment.

Who can get a tax refund? What are the requirements?

Main Requirements: Passport and Airline Ticket with travel tax payment or If travel tax was paid at TIEZA, official receipt (passenger copy and airline copy)

Owners of an Unused ticket

- Fare refund voucher or certification from airline signatory that ticket is unused, non-rebookable and has no fare refund value

Owners of a Downgraded Ticket

- Certification from the airline that the ticket was downgraded or the airline flight manifest

Non-immigrant foreign nationals who have not stayed in the Philippines for more than a year

- If passport can’t be presented; a certification from the Bureau of Immigration indication passenger’s identity, status, and applicable date of arrival

Those Qualified for Travel Tax Exemption

- Supporting Documents (see list above)

Qualified for Reduced Travel Tax

- Supporting Documents (see list above)

Double Payment (paid travel tax for the same ticket)

Undue Travel Tax

How to get Travel Tax Refund?

- Fill-up TIEZA Refund application form.

- Present passport and documents to the Travel Tax officer and a SPA if the claimant is not a passenger.

- Get a check of the refund.

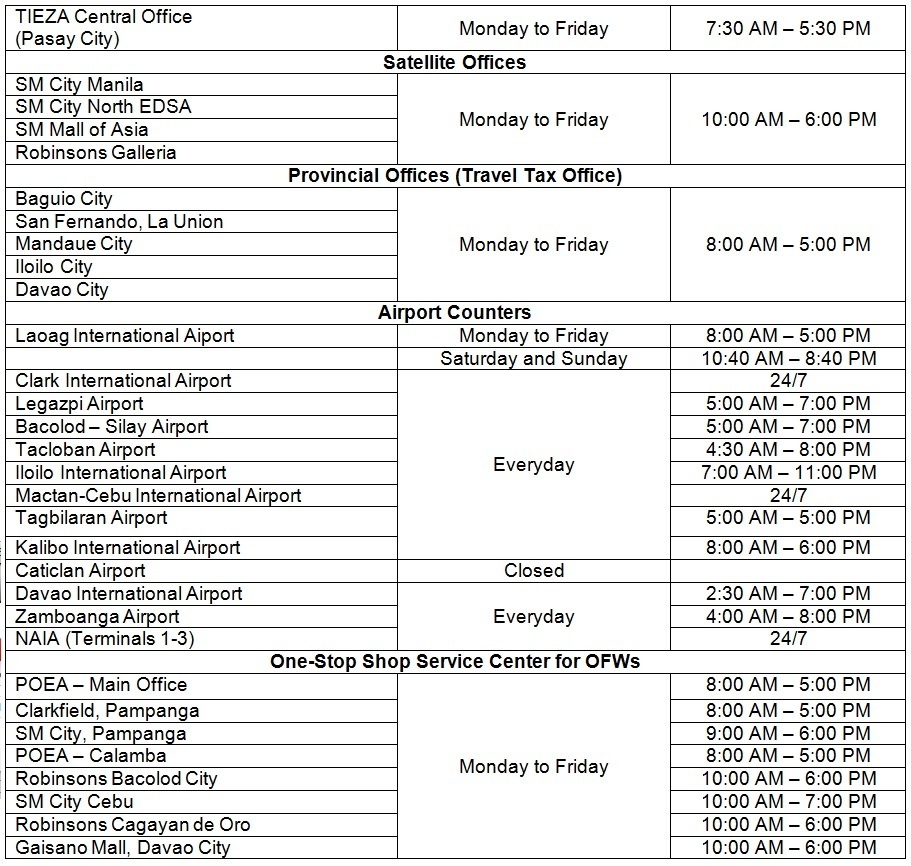

Travel Tax Centers and Schedules

Here are the places you can process or pay your travel tax, tax exemption, reduced tax, or travel tax refund. It’s better to process before your flight as it might take longer at the airport if there are long queues.

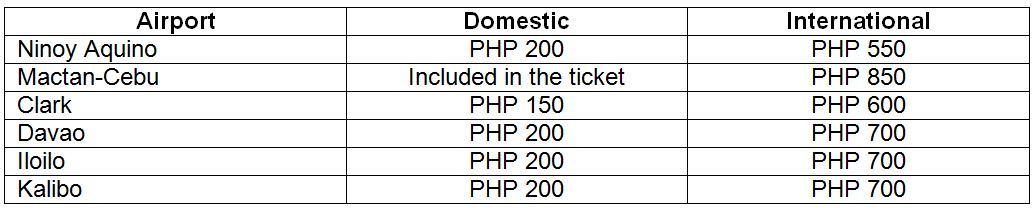

Terminal Fees

Terminal Fees are paid at the airport counters or it is included in the airline ticket. Sometimes, it is named as Passenger Service Charge. However, this is the list of terminal fees:

Who are exempted to pay terminal fees:

Note that most domestic flights cost Php 20 – 200; they are usually included in the ticket, For International flights Php 500 – 850

- Children below two years old

- Overseas Contract Workers

- Denied Passengers

- Deportees

- Airline Crew

- Diplomats

- Athletes – must be endorsed from Philippine Sports Commission

- Muslim Passengers for Mecca or Hajj

- Passengers specified by law

Where to pay terminal fees?

- There are counters at the airport, you may pay there, or it is included in the airline ticket as Passenger Service Charge

I hope this guide has helped you in getting information on the Travel Tax in the Philippines or the terminal fees. So, it’s better to bring cash or pay ahead as you might get unlucky and the ATMs malfunctions. Don’t worry though; it can be refunded! Happy Travels!

Are you on Pinterest? Pin these!

How can i take my travel tax refund when im missed to passed by a counter for that?i travelled internationally and domestically.And i am an ofw.

Hello good morning.

I would like to know if I am eligible to get a travel tax refund as I was denied by the BOI in Manila to board my flight to KL Malaysia last March 1 2022.

I am a Filipino citizen who wanted to travel in Malaysia as a tourist.

And can I get the refund if I’m eligible in Iloilo travel tax centers in my own province which is in Iloilo?

Thank you.

im an ofw, where can i get my PAL and CEB terminal fee refunds?

You can have your terminal fee refunded at the terminal fee payment counters in Mactan Cebu Airport. Just make sure you have your OEC with you, and your boarding pass stamped by the airline for refund, when you approach the counter.

hello i need a government of my country to fetch me, this is lee dong rou i am a tourist licence but i have left my U.N passport because of foreign degree because i am a cabin crew different airline

Hi I’m a filipino citizen who live abroad I want to ask if I have to pay tax because my flight is only rescue flight because my son he’s a Austrian national and I have visa card from Austria thanks I hope u answer plead

If you have a permanent residency abroad then you can be exempted.