All You Need To Know About the BIR Memo for Online Sellers and Freelancers

I remember way back 2011, my classmates and I had a thesis about Taxation on Online Shops as it was emerging back then. Because of the pandemic and stay or work from home policies, many online businesses are increasing – selling of food, goods, or services. The BIR has noticed and finally gave a memo about it. Here’s All You Need To Know about the BIR Memo for Online Sellers and Freelancers.

Taxation means “the power or means of the sovereign, through its law-making body, raises income to defray the necessary expenses of the government.” Dahil marami na tayong expenses due to the pandemic at dag-dag na utang sa World Bank, the BIR has looked for means to collect more internal revenue. Since hindi sila pwede mag-increase ng taxes, nakita nila yung mga Online Sellers and Freelancers na patok ngayon. Honestly, I can’t really blame them as the country needs money and taxes; hopefully, this will not be pocketed by crocodiles and crooks but used for projects like improvement of Health System or for Education.

- How Filipino Digital Nomads or Online Sellers Can Register to BIR and Pay Taxes

- How to Get NBI Clearance Online [Guide to Online Application Registration for NBI]

- Valid Philippines ID Guide – How to Apply for a Philippine Postal ID

- 40+ Websites to Find Digital Nomad Jobs – Work Wherever You Want

- Step by Step Guide on How to Pay Your BIR Taxes Online in the Philippines

Table of Contents

Who is the BIR Memo for?

The revenue memorandum circular no. 60-2020 is for the persons doing business and earning income in any manner or form. Specifically, those who are in digital transactions like mga Online Sellers or Resellers, Freelancers (like Online Teachers, Virtual Assistants, etc.), even payment gateways like GCash or DragonPay should pay taxes.

It has been in the law that anything you earn be it compensation and/or business is taxable. However, since wala naman stores or offices ang mga online sellers and freelancers, di yan makikita during tax mapping. Tax mapping, by the way, is yung pupunta mga taga-BIR sa lugar nyo at mag.inspect if nagcomply ba kayo, registered in BIR, updated ang books, atbp. Pag-alam ng tao pupunta ang BIR, marami ding nag-sisira na tindahan kasi malaki yung penalties if di-magcomply like PHP 10K or 20K.

BIR can’t really track down saan storage or bahay nyo unless isa-isahin nila yung pages sa Facebook at shops sa Shopee or Lazada. This is like a call to please register your business and pay taxes.

What do you need to do?

- Register your business

- Issue Sales Invoice or Official Receipts to clients or customers

- Have Books of Accounts and records of your business transaction

- Withhold taxes

- File Tax Returns (Usually, yung binabayaran is the percentage and income tax which is filed every quarter and annually)

- Pay Taxes on Time

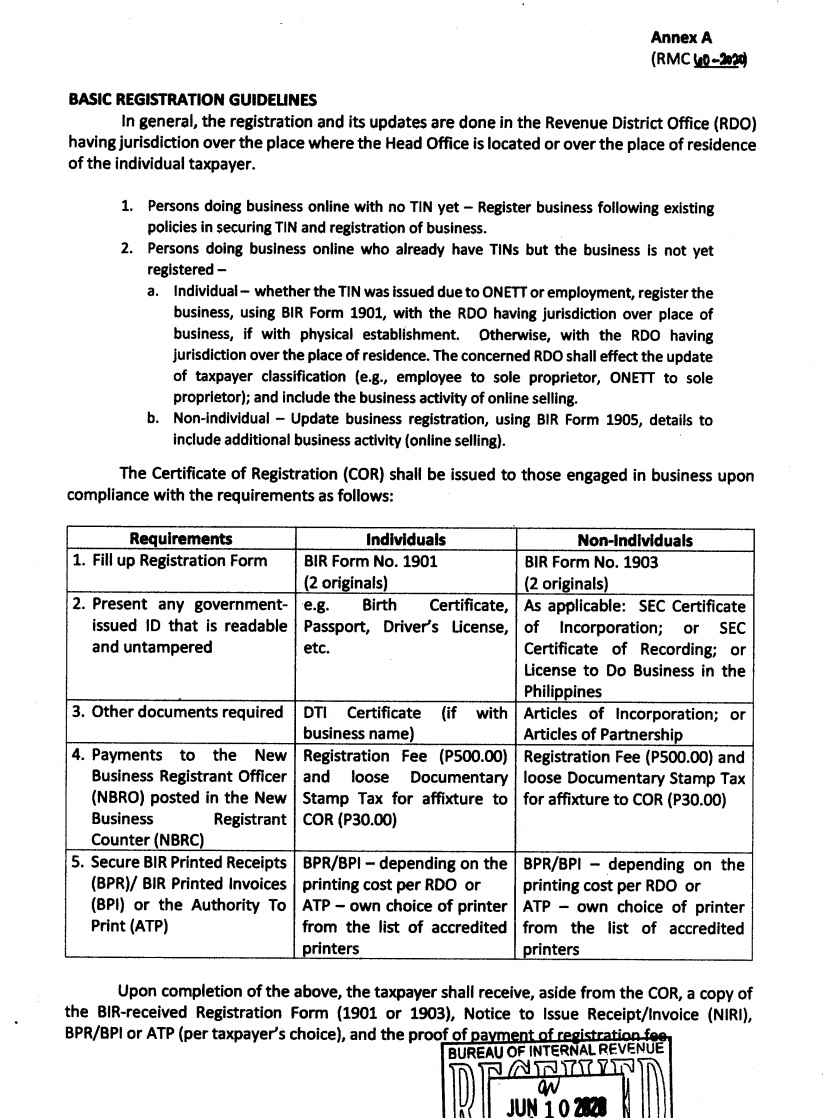

BIR Registration Guidelines

- First, you’ll need to have a TIN (Tax Identification Number)

- If you already have one, you can register your business at the RDO (Regional District Office) kung saan yung physical shop nyo if wala kang physical shop, then yung saan ka nakatira or residence

Check this guide on how to Register in BIR and File Taxes in BIR.

Deadline

The deadline for registration and filing of taxes is July 31, 2020. If beyond that, you may face penalties … please note that the penalties for late filing is at least PHP 1,000 plus may interest or surcharge pa.

Additional Information

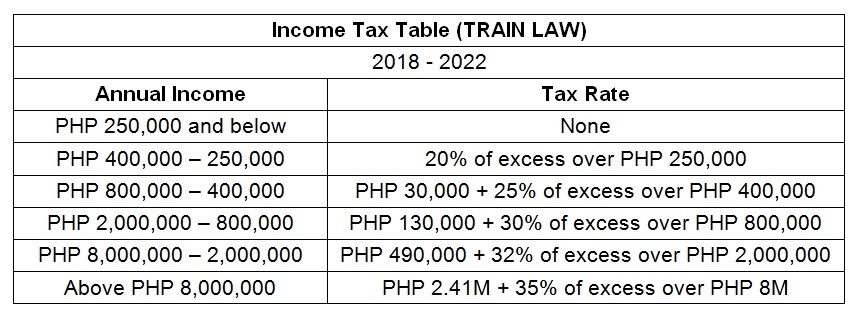

- For Purely Self-Employed Individuals and/or Professionals with earnings that is less than PHP 3M – you can choose between Graduate Income Tax Rate or 8% IT Rate

- Graduated income tax – uses the tax table. However, you will also pay 3% percentage tax on your gross receipts or sales quarterly

- For the 8% Flat Rate, you won’t need to file 3% percentage tax just the income tax, if you are a purely professional or business income earner (no compensation or sweldo), tax due is 8% of the excess of 250,000

- (We’ll soon write an article on which is better Graduate or 8% Income Tax)

- If you have net income below Php 250,000 per year (or PHP 20,8333 per month) – income tax payable is zero, so don’t be afraid to register

- Filing and paying taxes is beneficial if you want to apply for visa applications as you will pass Proof of Income and Income Tax Returns

- Kung young business mo is hingi pang.matagalan (yung a few months lang dahil sa quarantine), it’s better not to register especially if you don’t reach PHP 250K. Ang hirap ng business closure – fill-up ka sa form, submit you mo yung COR, book of accounts for 3 years, used and unused official receipts, etc. Nakaka-loka yan kaysa opening ng business. Plus if di mo i.close, you need to file tax returns until you do. Kahit zero, file ka.

That’s what you need to know about the BIR Memo for Online Sellers and Freelancers. If you want to know how to register, you can read this article. You could also pay online and avoid queuing at banks through (read this.) If you have questions, feel free to ask me, I’ll try my best to answer your questions!

Are you on Pinterest? Pin these!

About the Writer

Hey, I’m Lyza! I once was a person who just imagined going to places “one day” but decided to pursue my dreams. My first travel abroad was in Japan, solo, last 2018, and fell in love with the journey since. I’m aiming to visit 10 countries before turning 30 and 2 new places in the Philippines every year. Besides traveling, I love organizing trips, photography, reading, and making new friends. Follow my adventures through my Instagram.

Hi Ms. Lyza,

Question ko lang po, bale employed po ako and nag open po ako ng shopee shop last month at konti lang naman po yung products.

Bale question ko po ay need ko po ba i file yung kinikita ng shop kahit maliit lang around 2k – 3k?

yung 250k po ba na limit ng tax sa None tax rate po ay Compensation income (work) + business income ?

kasi po yung Compensation income (work) ko ay more than 250k na po.

Hi Ms. Lyza,

Asked ko lang may lazada/shopee po ako and nagkapagregister and nagbayad sa dti noong 2020 pero di po ako nakapag register sa bir.

okay lang po ba magregister ako ng bagong dti business name, if mag register ako sa bir this 2022?

Thank you

pwede lang po ..

Hi Ms. Lyza,

ask ko lng I started selling thru shopee this yr, and since I can see that I can upscale my business. I plan to register my business early next yr 2022. Do I need to file the date when I started to do business in shopee this yr? is there any charge for that just incase? or I can file a date where I will be register like for ex. I would like to register Feb 2022. Ngayon lng kasi ako nakapagdecide na magparegister for good since I just test the water if I have a market and can build a cash flow from this business.

I hope mapansin. Salamat po!

You can do it next year along with your DTI and business permit

Can I ask if you have any idea about the online seller taxation practices?

Question..

If I will buy online items in e-commerce stores, then sell it to the customers in my physical store (grocery). Some lazada online sellers doesn’t issue invoices or OR.

Now, Can i still sell my ordered items to my customers?

Good day po.

Nagbebenta po ako thrifted clothes. Every month po ako naglalabas ng collection. 3k po max na puhunan. Halos 1k naman po kita ko. Kaka start ko pa lang po nung august.May fb page po ako at gumamit rin ako business name.

Ask ko lang po. Need ko po ba magregister? Balak ko po sana DTI kasi sabi sa balita ineencourage daw mag register sa dti. Kaso di po ako nakapg register agad kasi sabi naman daw e need daw sa bir kaso di po ako makalabas dahil may toddler ako. Ano po ba dapat kong gawin. Pasado na po deadline, di po ako nakapagregister dun sa dalawa. Worried po ako na may nalalabag na ko batas. Salamat po!

Good day po 🙂

Nagtitinda po ako ng thrifted clothes. Naglalabas lang ako collection every month, tapos maximum 3k po puhunan ko.

Halos 1k lang po kita ko per month.

May fb page po ako at gumamit ako ng business name.

Question po. Kailangan pa rin po ba magregister?Balak ko po kasi sana noon mag dti pero hirap magpunta sa bir kasi may toddler ako at hirap ko siya iwan. Pasado na po deadline, di po ako registered sa dti at bir at worried po ako na baka labag sa batas na pala itong ginagawa ko. Thanks po

Hi Lyza,

I have registered in DTI na cause I was thinking malapit na deadline for BIR registration. Then I read na if hindi naman super big ang income like hobby lang or temporary ang selling, no need na to register. If iccancel ko ba yung DTI Registration ko, I won’t have to register na in BIR within a month? Or do I have to push through with the BIR Registration?

And If later on, if ever this business gets big (cause it’s a big what if din) if I register same name I cancelled in DTI and BIR, mag-iincur ba ng penalties?

Thank you

Hello, you can cancel your DTI Registration and not go through your BIR. May date yung DTI Certificates usually and doon magbabase ang BIR kasi wala silang same na system. Usually what my mom’s clients do is they’ll just change it, for example, JJ Online Store to J and J Online Shop (something like that).

thank you so much really appreciate this 🙂

Hi,

I recently resigned from my company (july 2020) and planning to put up a store on lazada, at the same time be a part-time virtual assistant. What do I need to do to register? Should I update my status from employment to sole proprietor? do you use the same form for online selling and freelancer?

Update your information through 1905 and pass your requirements to the nearest RDO.

Hi,

I am an online seller with lazada and shopee and also sell wholesale to local stores. I have the required registrations and sales invoices…My question is according to 60-2020 we are required to send a sales invoice to every buyer…but I dont actually collect from the buyer as Lazada and shopee collect and then submit the payments to me….In the past I always just issued a cash invoice when I received the money from shopee or Lazada which comes every week.. Does the bir require us to send a cash sales invoice to each buyer? I am confused on how to proceed.

if im selling my preloved items, you dont consider it as an income? do i still need to register? im just trying to declutter and expect return from it rather than throwing it away.

If that’s only for the meantime, pwede di mo i-register po.

Hello po mam. Ibig sabihin po okay lang kahit sa DTI po muna magparegister? Part time reseller lang din po kasi ako. Kahit hindi na po ba muna magparegister sa BIR? Kasi maliit lang din naman po onhand products ko. 10k lang paikot ikot lang din yung puhunan..

if di ka mag push through sa BIR, wag nalang din sa DTI. DTI is for name ng business only, you’ll have a penalty from BIR if you don’t register a month after your DTI registration.

how much po kaya penalty if lumagpas ng 1 month after ng dti registration?

about PHP 1,000 – 5,000

sa no. of days po ba na na-late naka-based ang computation non? natatagalan po kasi yung pagtransfer ng RDO kaya aabutan na ko ng 30 days since i registered sa dti 🙁 thank you po for answering 🙂

Opo. Mas better nga po if magtransfer ka first or tawagan mo ng pa-ulit ulit yung office ng BIR.

I’m planning to sell online, (resell Lang) since I’m currently unemployed. I’m not sure if I should register since I’m also not sure for how long I’ll do the business. Can I not yet register (I haven’t started anything yet), and register nalang after a few months, like when there’s already cashflow?

you can do so, it’s better to register when you are sure since the closing of business is more tricky than opening.

Hello Ma’am, I’d like to ask. Nakapag register na po ako sa DTI for Business Name yet noe, I have no plans on registering sa BIR. Magkakapenalty pa rin po ba ako because I registered at DTI and did not proceed to BIR? Once po ba nagkapagregister sa DTI required na talaga ipagpatuloy sa BIR? Part-time online seller lang po bc my husband has no permanent job due to pandemic.

Hindi naman, yung sa DTI kasi sa business name lang po yan and requirement ng sya ng BIR and Mayor’s Permit. You can stop there po, pero if gusto nyong i register sa BIR make sure within one-month from registration para wala kayong penalty.

Hello maam lyza, read your article.

My concern po ay should i still file and or register to a BIR.?? Even if my online bussiness is just part time because im employed in a manufacturing.

I dont have physical store just herw in our house. My items is just limited and wont even reach to 6k above

??

Do i need to file BIR???

Btw, i have already file DTi permit for business name.

Hello mam, if it’s part-time and you won’t be doing it for long, no need to register po as it doesn’t exceed per year 250K din.

No need din po yung DTI because it’s for trade name purposes and a pre-requisite sa mayors permit at BIR.

Plus if you register with an expired DTI permit mag-kaka-penalty ka nyan.

need po ba ipacancel ung registration sa dti pag hindi na plan magregister s bir?

pwede mo nalang i.leave yon at wag mong gamitin, pero if gusto mo gamitin yung name you can cancel it.

wala naman po kaya maging issue pag hindi po yun ipina-cancel?

as per experience, wala po