As per the Universal Health Care law, a circular was published by PhilHealth last April 2020 with regards to the contributions of Overseas Filipino Members. The contribution is mandatory, as per its policy but as per the President’s request, it may be voluntary. If you want to know more about PhilHealth Circular 2020-0014, read this article.

We will discuss who is subject to contribute as well as the payment. Every year, the premium rate will increase by mostly 0.5%. You can also check the sample computation to know how many members will pay.

[box]Other articles you can read:

- How to Get NBI Clearance Online [Guide to Online Application Registration for NBI]

- Step by Step Guide on How to Pay Your BIR Taxes Online in the Philippines

- How You Can Get a DFA Appointment for Philippine Passport Renewal

- How to Apply and Get a Police Clearance Online in the Philippines

- Apostille Certificate: How To Authenticate Documents In DFA Philippines

[/box]

Who are considered as Overseas Filipinos?

- Land-Based OFWs

- Seafarers and other sea-based workers

- Filipinos with dual citizenship (RA 9225)

- Filipinos living abroad

- Overseas Filipinos in distress

- Other overseas Filipinos not previously classified elsewhere

Proof of income

Present any of the following as proof of income subject to Validation

Land-Based OFWs

- Employment Contract

- Overseas Employment Certificate

- Overseas Employment Letter

- Certificate of Employment with Income

- Current Payslip

- Other Documents

Seafarers and other sea-based workers

- Certification from the Manning Agency

Filipinos with Dual Citizenship and other Filipinos living abroad

- Income Tax Return

- Duly-Notarized Affidavit of Income Declaration

- Other Acceptable Proof of Income

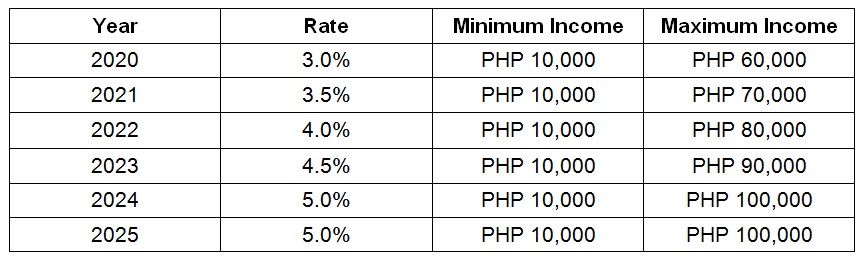

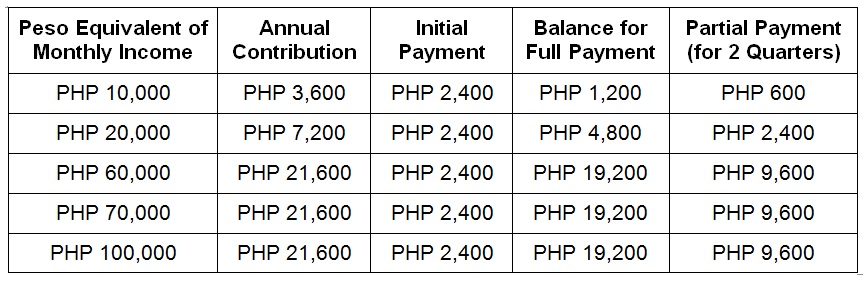

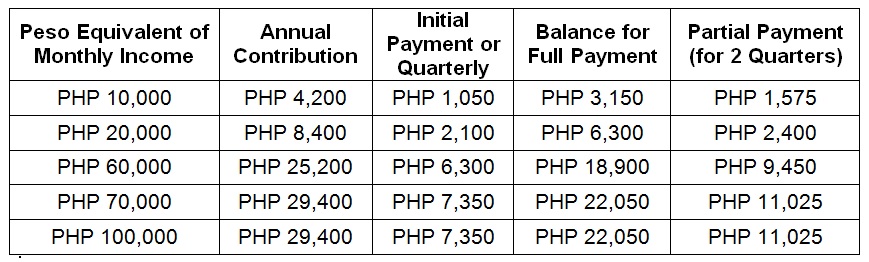

How much is the premium to be paid?

The payment will be based on the Overseas Filipino’s monthly income in the Philippine Peso equivalent. Please check BSP’s bulletin to get the uniform exchange rate. Note that if your income is not in USD, you first must convert your currency to USD before computing to Philippine Peso.

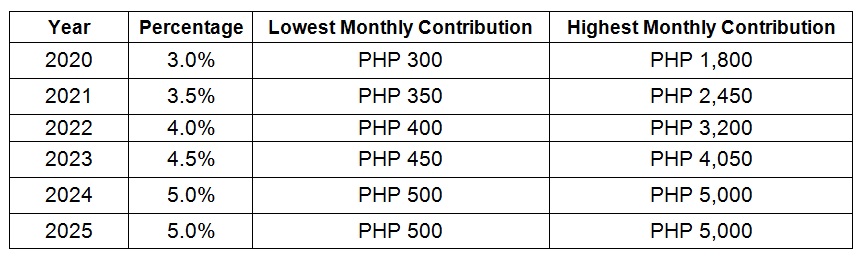

Lowest and Highest Monthly Contribution

Sample Computation 1

Monthly Income is PHP 5,000:

PHP 10,000 X 3% = PHP 300 per month x 12 = PHP 3,600 for 2020

PHP 10,000 X 3.5% = PHP 350 per month x 12 = PHP 4,200 for 2021

Note: Even though your income is not PHP 10,000, 10,000 will be used since it’s the floor income.

Sample Computation 2

Monthly Income is PHP 20,000:

PHP 20,000 X 3% = PHP 600 per month x 12 = PHP 7,200 for 2020

PHP 20,000 X 3.5% = PHP 700 per month x 12 = PHP 8,400 for 2021

Sample Computation 3

Monthly Income is PHP 65,000:

PHP 60,000 X 3% = PHP 1,800 per month x 12 = PHP 21,600 for 2020

PHP 65,000 X 3.5% = PHP 2,275 per month x 12 = PHP 27,300 for 2021

Note: The maximum amount for the 2020 is PHP 60,000, so even though your monthly income is more than that, you’ll use the income ceiling of 60K. As for the next year, since 70,000 is the ceiling, then you will use your initial monthly income.

Sample Computation 4

Monthly Income is PHP 150,000:

PHP 60,000 X 3% = PHP 1,800 per month x 12 = PHP 21,600 for 2020

PHP 70,000 X 3.5% = PHP 2,450 per month x 12 = PHP 29,400 for 2021

Note: You will use the income ceiling every year since your monthly income exceeds it.

Sample Computation 5

Monthly Income is USD 1,000, exchange rate is US 1 = PHP 52 = PHP 52,000

PHP 52,000 X 3% = PHP 1,560 per month x 12 = PHP 18,720 for 2020

PHP 52,000 X 3.5% = PHP 1,820 per month x 12 = PHP 21,840 for 2021

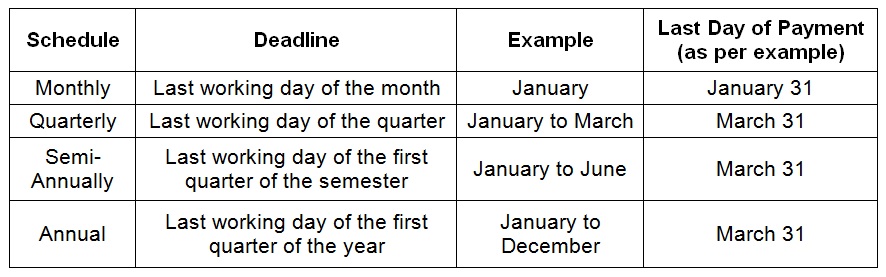

When to Pay the PhilHealth Premium?

According to PhilHealth Circular 2020, sea-based OFWs pay monthly contributions through salary deduction of the Manning Agencies or their Employers. For others, payment shall be made every 3, 6, or 12 months.

For this year 2020, during the transition period, PHP 2,400 shall be the initial payment; balance can be paid full or in quarterly payments. For 2021, the minimum initial amount is a 3-month premium.

Advance payment is allowed based on the length of the valid contract and the current applicable premium and rate.

Should a member fail to pay the premium after the due date, they are required to pay all missed contributions with monthly compounded interest.

The deadline is usually as follows:

Transition Period Sample

For the Year 2020 with premium Rate of 3%

After the Transition Period Sample

For the Year 2021 with a premium rate of 3.5%

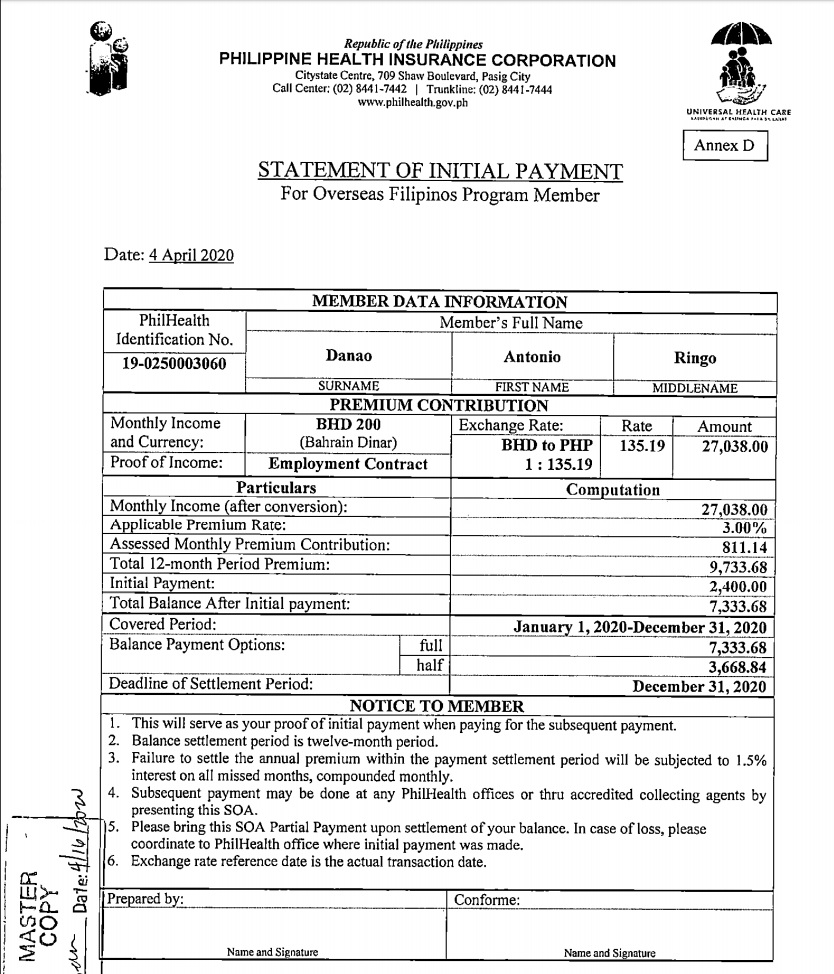

Statements

A Statement of Premium Account (SPA) will be issued to members. It is a system-generated billing statement with contribution and interest. Since it’s not yet available, a Statement of Initial Payment is issued for now.

Response

Due to the outrage of many Overseas Filipinos, President Rodrigo Duterte sent a directive to PHIC not to make the contributions mandatory. The premiums are paid voluntarily, instead. However, as per the response, PHIC states that “PhilHealth has adopted a flexible payment scheme which will allow OFWs to pay their contributions within the year. PhilHealth commits to continue exploring means to soften and alleviate the impact of the premium rate increase, but it cannot change the Law.”

I hope you are enlightened with what is inside PhilHealth Circular 2020-0014. Currently, there are many online petitions concerning this new circular. This might be because the Overseas Filipinos would be paying double especially if they have health insurance abroad. Hopefully, this will only be voluntary, and may the funds be put to good use rather than be pocketed.

[line]

About the Writer

Hey, I’m Lyza! I once was a person who just imagined going to places “one day” but decided to pursue my dreams. My first travel abroad was in Japan, solo, last 2018, and fell in love with the journey since. I’m aiming to visit 10 countries before turning 30 and 2 new places in the Philippines every year. Besides traveling, I love organizing trips, photography, reading, and making new friends. Follow my adventures through my Instagram.

[line]

Are you on Pinterest? Pin these!