If you are a digital nomad or have Online Business and earn income in the Philippines, you can pay taxes to the Bureau of Internal Revenue. First, you’ll need to register and have your TIN (Tax Identification Number). Then track your earnings and expenses and pay your taxes. Here’s a guide on how Digital Nomads or Online Sellers can register to BIR and pay Taxes.

We’ll just discuss purely on Self-Employed or a Single Proprietor as well as Income Taxes and Percentage Tax. You can register, file them online, and pay taxes yourself. We will teach you how!

[box]We have also partnered with World Tesol Academy to provide an online TESOL certification course for the lowest price you will find anywhere – $34 USD! We recognised how badly affected many people around the world have been by the Covid / Coronavirus situation. So, we spent a lot of time discussing with this great company how they could come up with an affordable solution to help people afford the opportunities that an online TEFL / TESOL certification can bring.[/box]

How to Register for a TIN and the Business

[box] Other Articles You Can Read:

- Step by Step Guide on How to Pay Your BIR Taxes Online in the Philippines

- How to Apply and Get a Police Clearance Online in the Philippines

- 10 Reasons Why Digital Nomads Should Go on a Bootcamp

- 11 Things You Must Have for Your Home Office – Work From Home Equipment and Essentials

- Popular Home-based Jobs for Filipinos [ Tips on Where To Find Work From Home Opportunities]

[/box]

Documents Needed

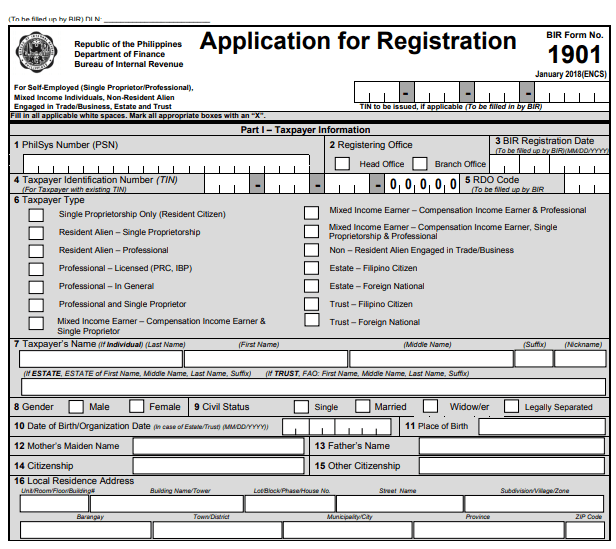

- BIR Form 1901

- Copy of Mayor’s Business Permit (if still in process – received application), Professional/Occupational Tax Receipt (for professionals), or DTI Certificate

- Annual Registration Fee (BIR Form 0605) – PHP 500.00

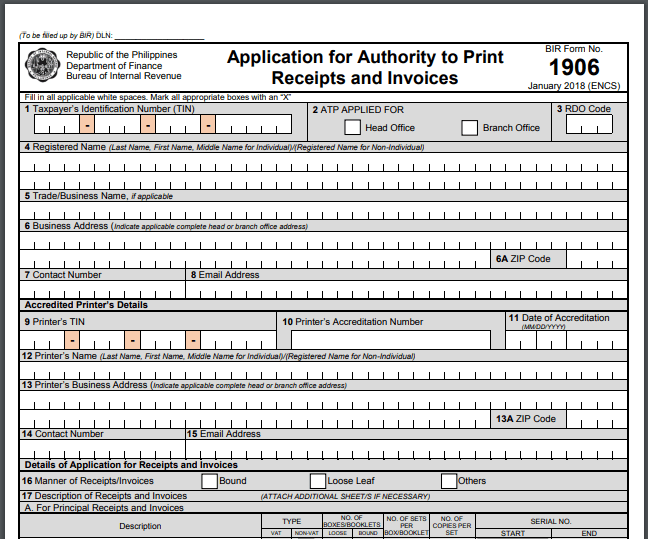

- BIR Form No. 1906

- Final and Clear sample of your receipts or invoices (How your invoices or receipts will look like)

How to Register at BIR

STEP 1: Fill up the BIR Forms.

STEP 2: Go to the BIR Regional District Office, where you are based, and submit the documents to the New Business Registrant Counter.

STEP 3: Pay the Annual Registration Fee (PHP 500.00) and the BIR Printed Receipt or Invoice if you want to use it.

STEP 4: Wait for your BIR FORM 2303 (Certificate of Registration) and also your “Ask for Receipt” Notice, ATP (Authority to Print – for your receipts), and eReceipt of your payment.

STEP 5: Attend a Taxpayer’s Seminar.

How to Pay for your Taxes

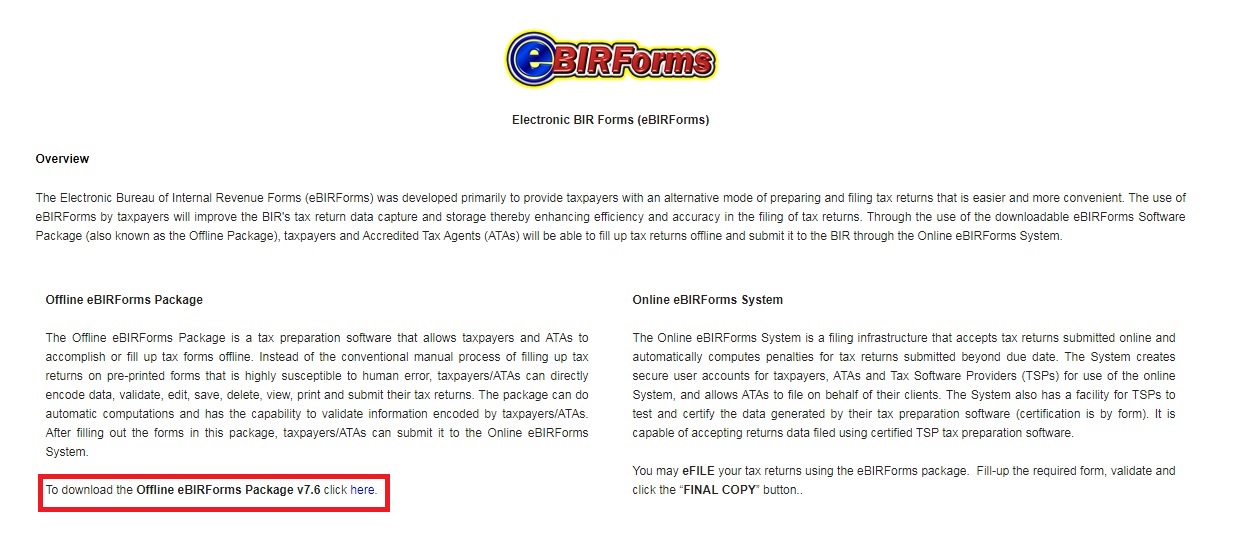

If you are doing this on your own, you might need an eBIRForm Application; you can download the latest version here. Download the Offline eBIRForms Package.

Install by extracting the zip and running Offline eBIRForms Package v??? setup.exe.

How to pay Quarterly Percentage Tax

Quarterly Percentage Tax is 3% of your Total Gross Revenue or Sales for each Quarter. If you opt for 8% IT Flat Rate, no need to pay for this.

Deadline is 25th after each taxable Quarter

- January to March – April 25

- April to June – July 25

- July to September – October 25

- October to December – January 25 of the next year

STEP 1: Compute the total Gross Revenue or Sales for the Quarter. It’s how much you have earned without deducting expenses. Example if you earned January 10,000 + February 15,000 + March 25,000 = Gross for the Quarter is 50,000

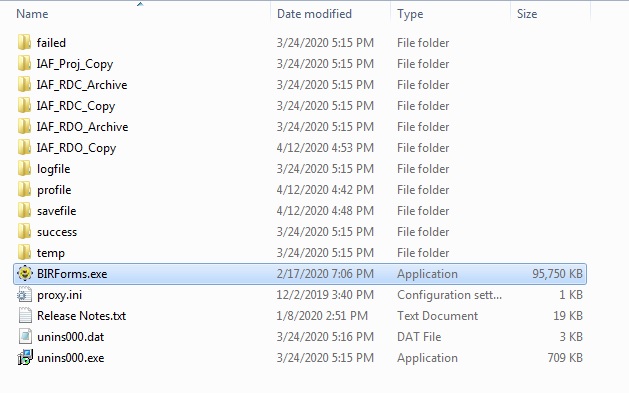

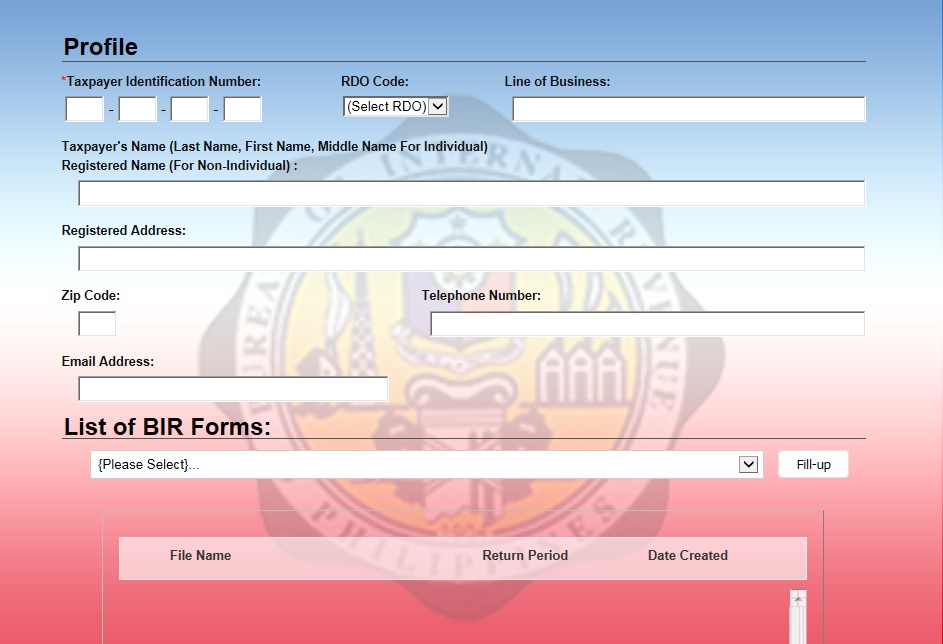

STEP 2: Open the eBIRForms.exe.

STEP 3: Enter your TIN and Profile.

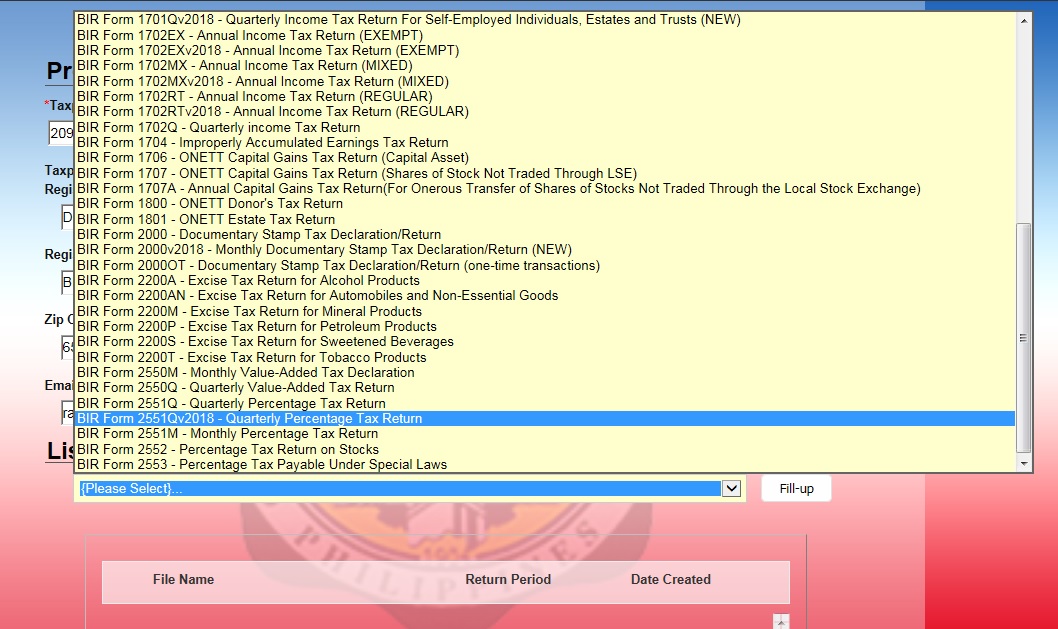

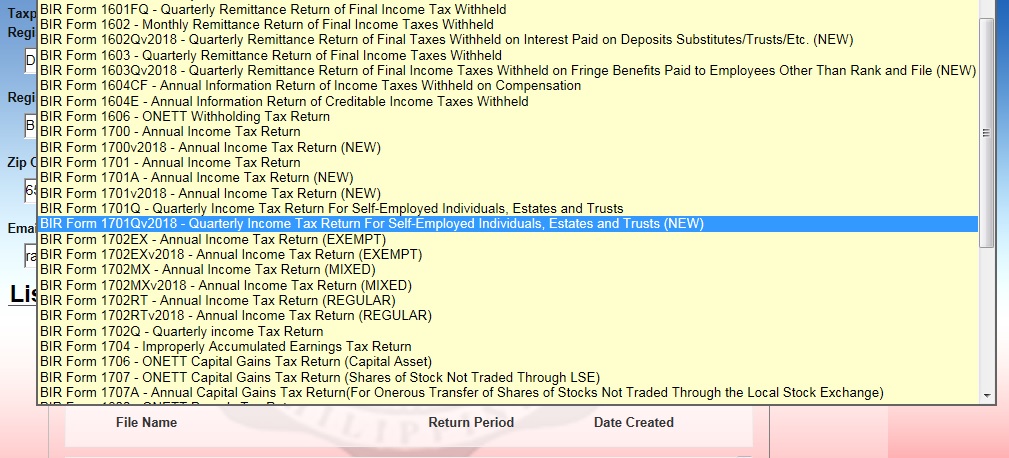

STEP 4: Choose BIR Form 2551Qv2018 – Quarterly Percentage Tax Return. Click Fill-up.

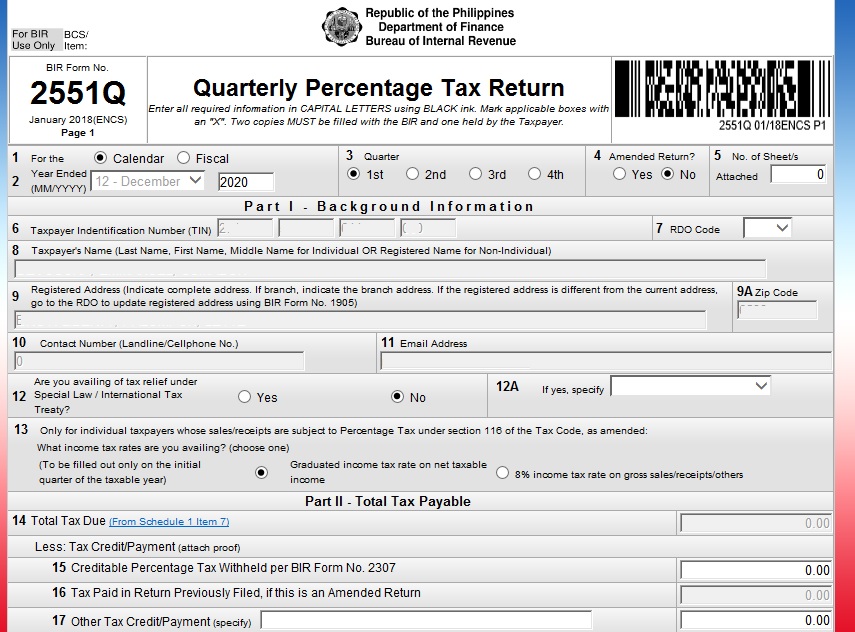

STEP 5: Enter details in your tax return

- Year Ended

- Quarter

- Graduated Income Tax or 8%, many chooses Graduated Income Tax (P.S. You won’t file % tax under 8%)

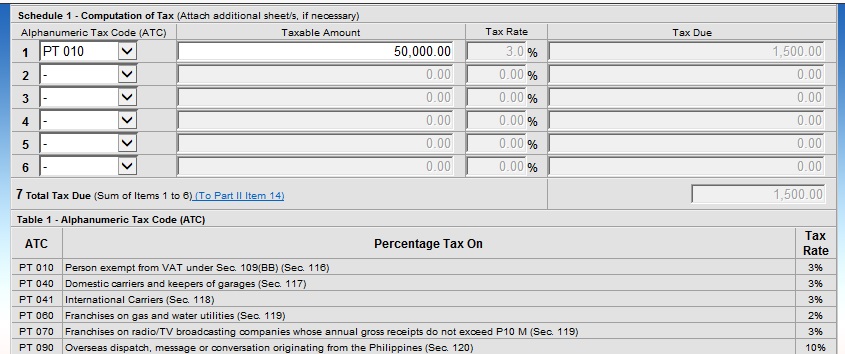

STEP 6: Go to page 2 and type the details asked.

- Under ATC, the usual is PT 010

- Enter the Taxable Amount which is the Total Gross for the Quarter

- Your tax due will automatically be computed

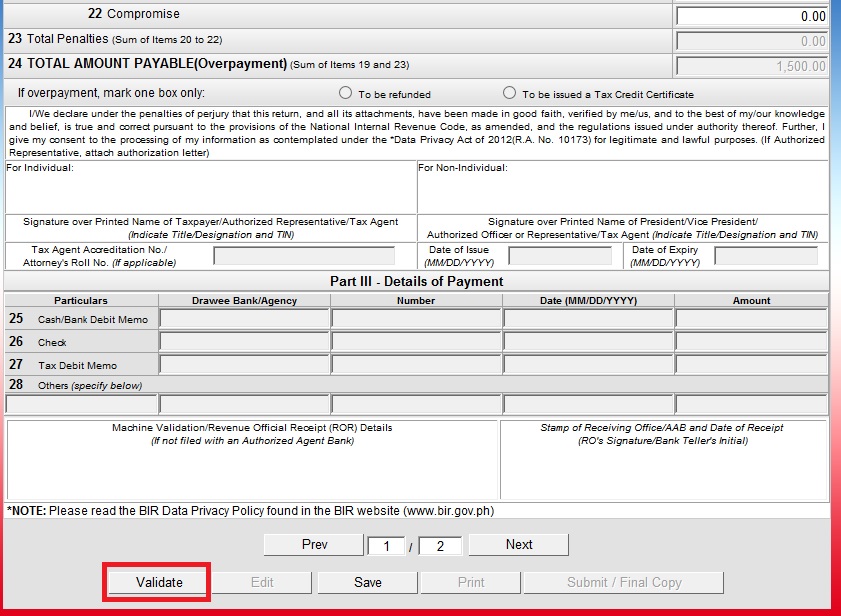

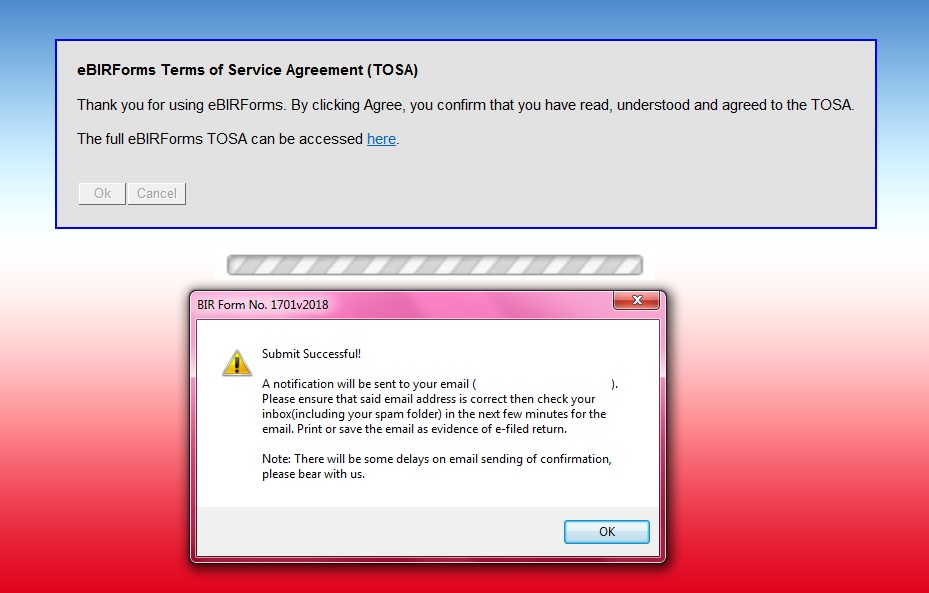

STEP 7: Validate your return to check if there are any mistakes or fields you have not yet filled up. Click Submit / Final Copy.

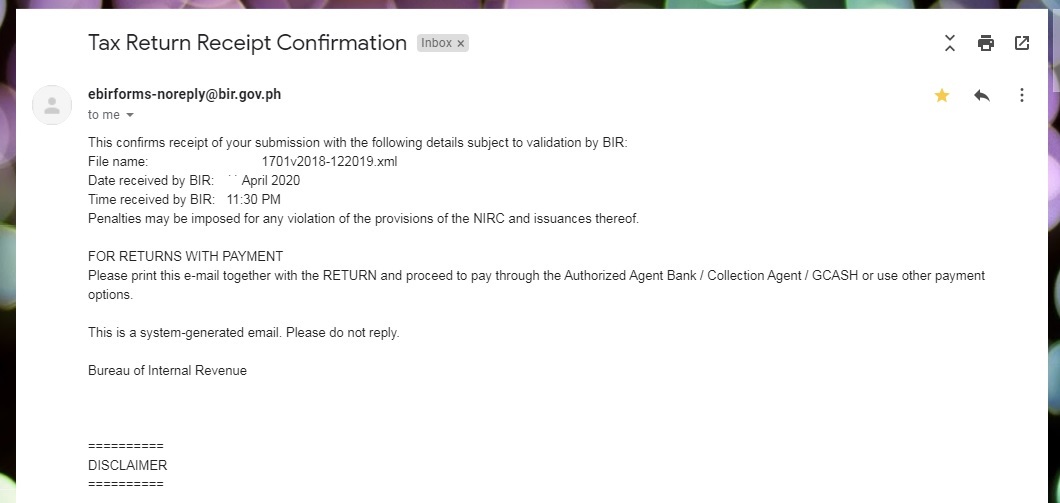

STEP 8: Print 3 copies of your 2551Q, go to your e-mail, and print the BIR Confirmation as well.

STEP 9: Pay your tax at an AAB (Authorized Agent Bank), online, or Revenue Collection Office.

STEP 10: After paying, file your returns at the Regional Collection Office or the RDO.

How to pay Quarterly Income Tax

Quarterly Income Tax is a tax on your net income – For Graduated IT Rates, Gross Revenue or Sales less Expenses (Cost of Sales or Services and Deductions) = Net Income

For 8%, you ‘ll use the Gross. There will be no deductions too. However, if you are a pure income earner (no compensation), you can deduct PHP 250,000.00.

Here are the deadlines:

- 1st Quarter On or before May 15 of the current taxable year

- 2nd Quarter On or before August 15 of the current taxable year

- 3rd Quarter On or before November 15 of the current taxable year

- For the 4th Quarter, you’ll need to use the Annual Income Tax form

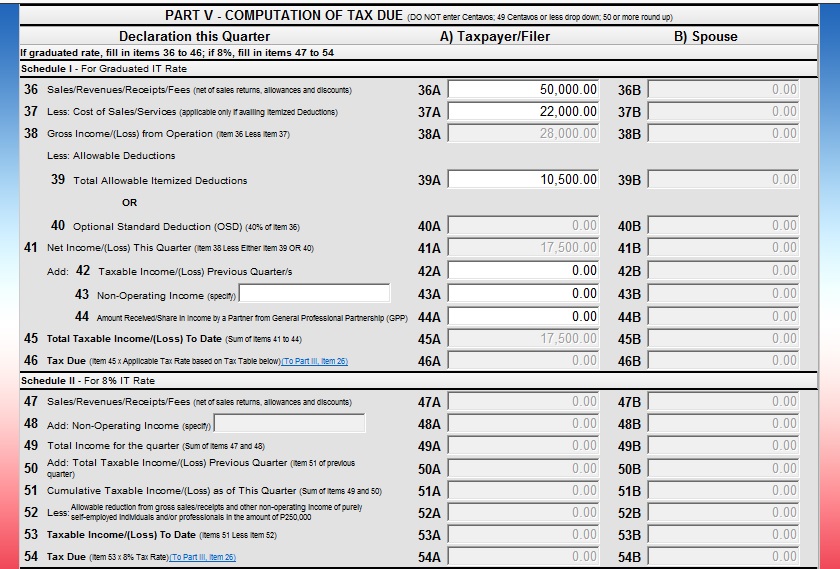

STEP 1: Compute the total Gross Revenue or Sales for the Quarter. It’s how much you have earned without deducting expenses. Example if you earned January 10,000 + February 15,000 + March 25,000 = Gross for the Quarter is 50,000.

Total your Cost of Sales or Services. Usually, this is Inventory Beginning + Purchases – Inventory End. For example, it’s 0 + 30,000 – 8,000 = 22,000. Not available if you are using OSD.

For Allowable deductions, you can choose between OSD (40%) which is 40% of your Gross Sales or Services (e.g. 50,000 x 40% = 20,000.) Or Itemized deductions (you need to check the list) – e.g. Light and Power for the Quarter is 5,000 + Taxes Paid is 1,500 + Supplies 500 + Communication Expense 1,000 + Contributions 2,500 = 10,500

STEP 2: Open the eBIRForms.exe

STEP 3: Enter your TIN, your profile will automatically be shown.

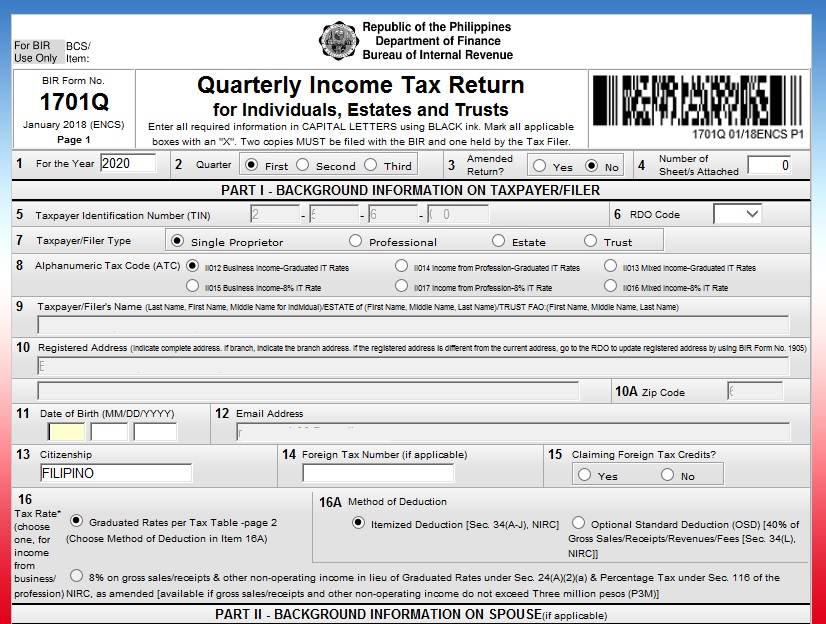

STEP 4: Choose BIR Form 1701Qv2018 – Quarterly Income Tax Return for Self Employed Individuals

STEP 5: Enter details in your tax return

STEP 5: Enter details in your tax return

- Year Ended

- Quarter

- Taxpayer type

- ATC

- Date of Birth

- Citizenship

- Tax Rate

- Method of Deduction

STEP 6: Go to page 2 and type the details asked.

- Sales / Revenues

- Cost of Sales and Allowable Itemized Deductions or OSD

- Taxable Income or Loss for the Previous Quarter (usually if you are on the 2nd or 3rd Q, it’s in #45 of your last return)

- Your tax due will automatically be computed – It’s usually zero if your taxable income is less than 250,000

(For the 2nd quarter, you’ll put PHP 17,500 in #42 to get the taxable income to date. In the 3rd quarter, you’ll put what’s in #45 in the 2nd quarter’s return.)

For 8% IT Rate, you will be placing your gross for at #47 and at #52 PHP 250,000 if you are purely self-employed or professionals.

STEP 7: Validate your return to check if there are any mistakes or fields you have not yet filled up. Click Submit / Final Copy.

STEP 8: Print 3 copies of your 2551Q if you have tax due if zero only if one copy, go to your e-mail, and print the BIR Confirmation as well.

If you don’t have tax payment, no need to do steps 9 and 10.

STEP 9: Pay your tax at an AAB (Authorized Agent Bank), online, or Revenue Collection Office.

STEP 10: After paying, file your returns at the Regional Collection Office or the RDO.

How to pay Annual Income Tax

Annual Income Tax is your total taxable income for the year.

The deadline is usually April 15 of the next year.

STEP 1: Compute the total Sales or Revenues and Expenses for the year.

STEP 2: Open the eBIRForms.exe

STEP 3: Enter your TIN, your profile will automatically be shown.

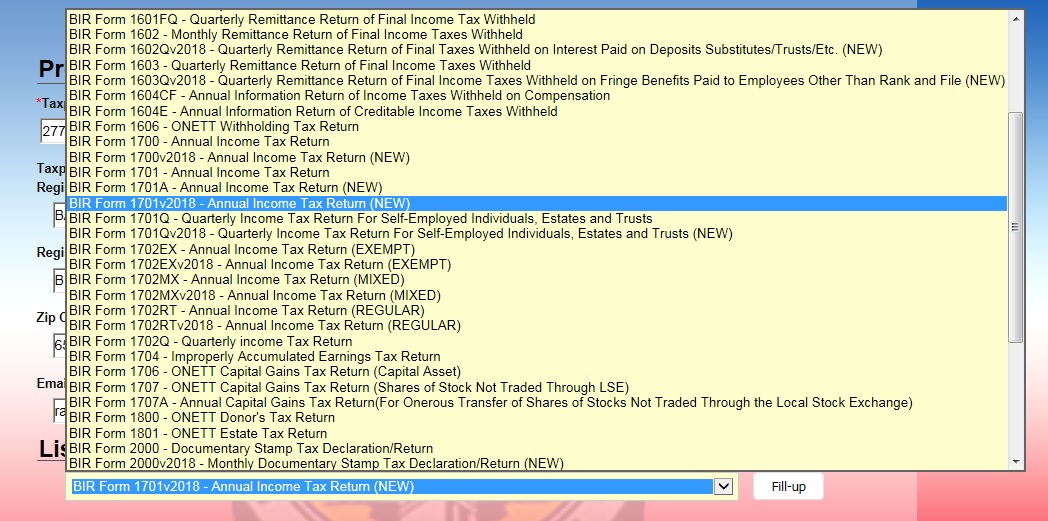

STEP 4: Choose BIR Form 1701v2018 – Annual Income Tax Return (NEW)

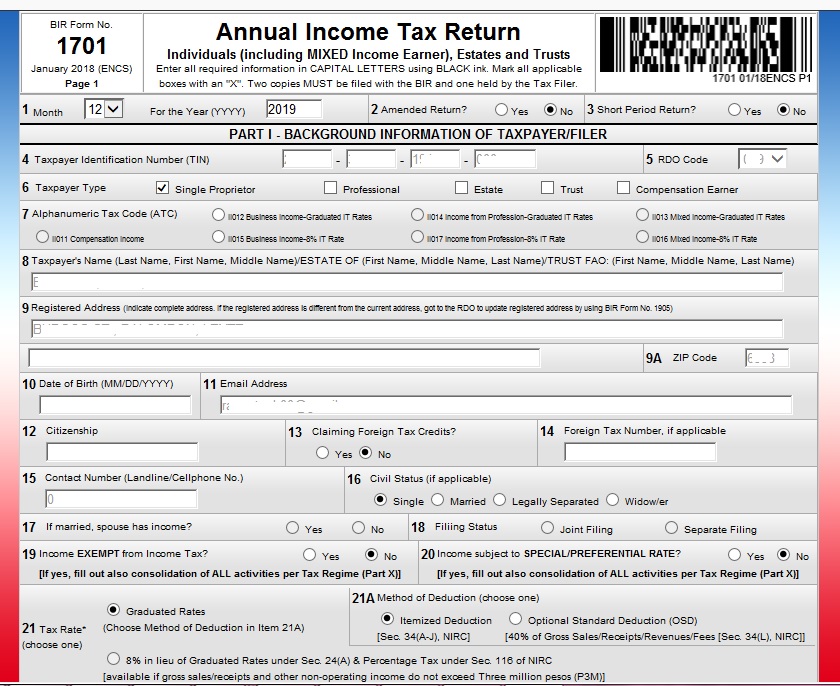

STEP 5: Enter details in your tax return

STEP 5: Enter details in your tax return

- Year Ended

- Taxpayer type

- ATC

- Date of Birth

- Citizenship

- Civil Status

- Tax Rate

- Method of Deduction

(Sample below is using Graduated IT Rate and Itemized Deductions)

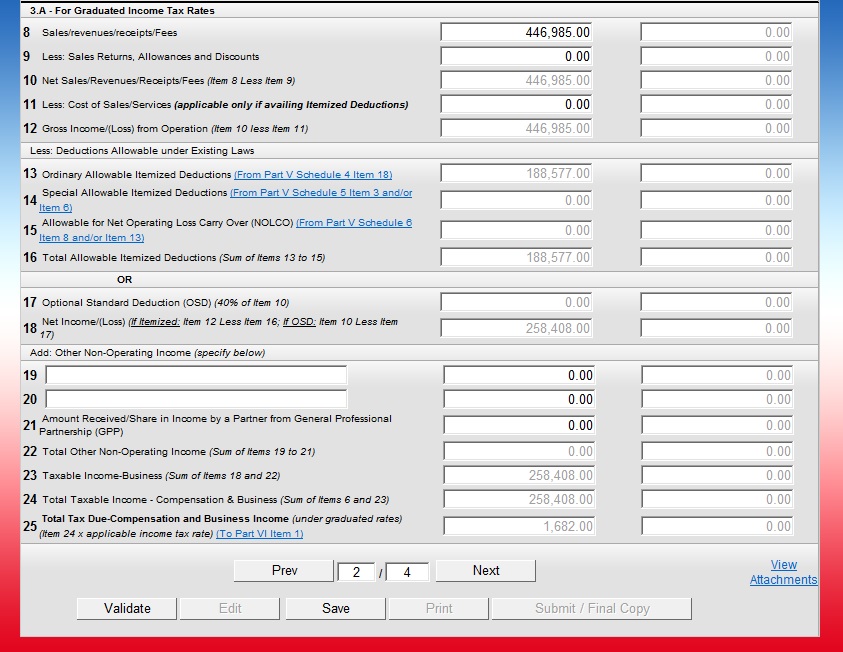

STEP 6: Go to page 2 and type the details asked.

- Sales / Revenues

- Sakes Returns

- Cost of Sales

- If it’s OSD, it will automatically be computed – proceed to STEP 8

- If it’s Itemized Deduction – read next step

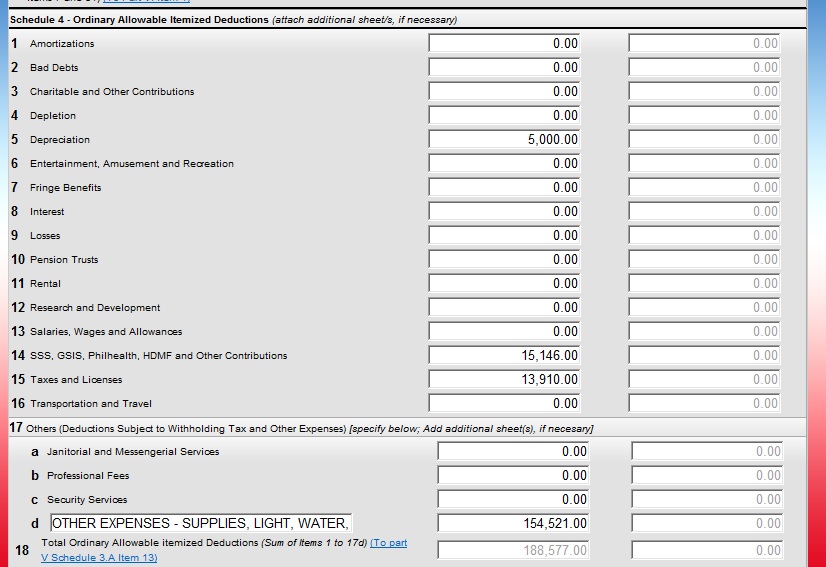

STEP 7: Go to page 3 and enter.

- Enter the deductions on Schedule 4

STEP 8: Go to page 4 and enter your Net Income or Loss

STEP 9: You will see the tax due on page 2. Validate your return to check if there are any mistakes or fields you have not yet filled up.

STEP 10: Click Submit / Final Copy.

STEP 11: You can print 3 copies of your 1701 and the e-mail from the BIR. You will also need to submit your financial statements if you availed of the Allowable Itemized Deductions, no need for this if you used OSD. Print also a Statement of Annual Management Responsibility.

STEP 12: Pay your tax at an AAB (Authorized Agent Bank), online, or Revenue Collection Office.

STEP 13: After paying, file your returns at the Regional Collection Office or the RDO.

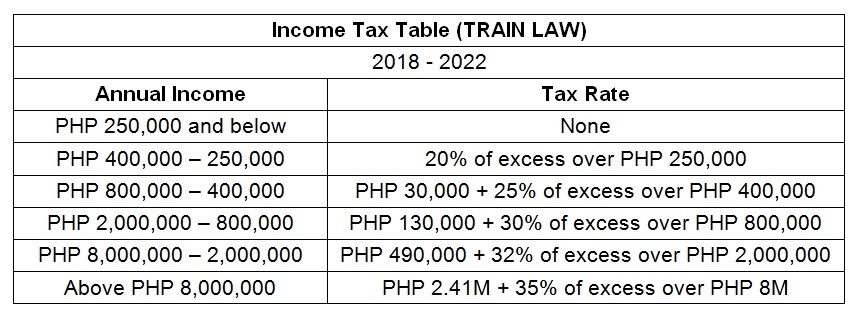

Tax Table

Other Forms you may File or Pay at the BIR

Annual Registration of Tax

- BIR Form 0605

- Php 500

- paid on or before January 30

Inventory List

- RMC No. 57-2015

- If you have inventory ending, you’ll need to submit a list to BIR (e.g., 30 days after the end of the Annual Year (e.g., January 30)

- Here’s the format.

I hope this will help you How to register to BIR and pay Taxes as Digital Nomads or Online Sellers. You can also check our article on How to Pay BIR Taxes Online so you would go directly to the office and not queue on AABs. If you have more questions, please feel free to ask me! I’ll try my best to answer your queries.

[line]

Are you on Pinterest? Pin these!

[line]

About the Writer

Hey, I’m Lyza! I once was a person who just imagined going to places “one day” but decided to pursue my dreams. My first travel abroad was in Japan, solo, last 2018, and fell in love with the journey since. I’m aiming to visit 10 countries before turning 30 and 2 new places in the Philippines every year. Besides traveling, I love organizing trips, photography, reading, and making new friends. Follow my adventures through my Instagram.