So, do you really need travel insurance when you travel abroad even to Thailand or somewhere near the Philippines for only 3 or 4 days? Here’s my guide on choosing the best travel insurance for my fellow Filipinos.

If you can’t afford travel insurance then you should re-consider about going on trips. You can even get it for less than $1.5 or 100 Philippines pesos per day (read below and I’ll show you computation)! You never know what will happen during your trip.

I was on a car accident in Pakistan that required hospital visits, surgery, medicine, wheelchair and last minute flights. After what happened to me, that accident cost more than $15,000 (almost 1 Million sa Pesos) in total (medical and non-medical expenses). Aside from the other expenses of hotels, canceling my upcoming trips and not being able to work.

[box]Other articles you can read:

- Marine Insurance – Why we Should all Insure our Boats and which Marine Insurance to Choose!

- AXA Insurance for Schengen Visa – The Cheapest and Best Travel Insurance for Filipinos

- Best Online Courses You Could Take to Help You Travel the World

- Denied Schengen Visa – Common Reasons for Schengen Visa Rejection [And What You Should Do About It]

- How To Apply for Montenegro Visa for Philippines Passport Holders – Tourist Visa for Filipinos

[/box]

Thankfully, my insurance arranged the “guaranteed of payment” with the hospitals in Thailand and NHS UK so I didn’t have to spend any of our savings – they paid the hospitals directly (ang mahal ng hospital bills ah!!).

I will write another article on how I filed the claim, basically, my husband immediately called them after my accident and they asked for my guide or any local number I have so they can call me to coordinate. I only paid $100 for the hospital in Pakistan since they only did an Xray and temporary cast to help me with the swelling. Imagine, I had to drive for 24 hours after my accident from Hunza Valley to reach Islamabad. There were other hospitals in Gilgit but it means I’ll be stuck there on my own and I don’t think I’d want my surgery in Pakistan. I told the insurance I will pay for it instead and claim later.

I didn’t want to get stuck in Islamabad so I told them the doctor in Pakistan allowed me to take my flight to Thailand (that I pre-arranged months before to meet my family for my birthday) and asked them for the hospital they can recommend so I can get proper treatment.

They recommended BNH Hospital in Bangkok, one of the most expensive hospitals in Thailand (check google!) and they asked me that if a “guarantee of payment” is needed then they can arrange it. So they arranged for the payment directly with the hospital and I did a 3D Xray, a specialist doctor who told me I have a bimalleolar ankle fracture, a physical therapy session to teach me how to use the crutches and medicine. They can’t do my surgery because my ankle was really swollen and I don’t want to do it there because I’ll be on my own later on. Jonathan could fly in (they will pay for the cost) but we can’t be in Thailand for recovery because we have our cats and can’t be left alone for a while.

I told them I want to fly to the UK since my husband is there and I don’t live in the Philippines since 2009 but I am a Filipino citizen. They gave me instruction on how to deal with NHS and foreign national medical bills/payment. NHS / Healthcare in the UK is free for citizens and residents but I’m not a resident so I had to pay for it. The insurance coordinated with their insurance partner in the UK and arrange it with the hospital so my 2 surgeon consultations and my surgery were covered aside from the medicine and follow up appointments.

I will write more later but imagine what I’ve been through and if I had to pay all of these then I think I’d go crazy! I could sue the tour company in Pakistan to cover the cost but you know it’s a small business and it’s an accident, so thankfully, I have travel insurance.

(I don’t know if insurance in the Philippines would pay the hospital directly instead of asking you to pay it first then refund.. pano kung wala kang cash? Mangugutang or gofundme na lang?)

You booked your ticket and hotel already. You even packed your bags weeks before your travel. Akala mo ready ka na.

So ganoon na lang yun? Game ka na to ‘hit the road’ agad – agad?

Wala ka bang nakakalimutan? Feeling ko, there is one important thing that you missed.

Have you purchased your Travel Insurance? If not, better get one from SafetyWing.

[box] Update: I previously thought that the Insurance covers Trip Cancellation but would actually only cover Trip Interruption. They mentioned that they are planning to improve their service next year but thankfully all my medical expenses are covered. [/box]

I will explain it ha. This can be a lengthy post but definitely worth it. Lalo na kung ayaw mo maghirap after traveling.

Most Filipinos love to get the cheapest deals. That’s precisely the reason why airline promos are a big hit to us. Aminin na natin na we are ‘kuripot’. 🙂 I get your point, but after traveling for quite some time, I realized that you would definitely experience a number of mishaps. I’ll give you a list, ok?

-

Nahuli ka sa flight e non-rebookable yung ticket mo!

-

Nagka- dengue ka 2 days before your scheduled flight!

-

You lost your laptop and smartphone, ARAY!

-

Nabalian ka ng buto while doing some adventurous activities

Hindi ako OA, pero these things can happen. Minsan mas malala pa. E di mas mapapagastos ka sa pagbili ng bagong tickets, sa medical expenses and sa pag-purchase ng new gadgets. Mapapamura (pun intended) ka na lang ng hindi oras!

Thing is, you can get yourself protected. Some of you might just resort to simple flight insurance, but are you satisfied with its coverage?

If you are planning to travel and to leave your country without so many worries, I strongly suggest that you get a comprehensive travel insurance – it’s different from Medical Insurance, Life Insurance or the Airline Insurance (don’t get this, you don’t need that!). When you travel around Europe, one of the visa requirements is having your own Travel Insurance and not the other kind of insurance.

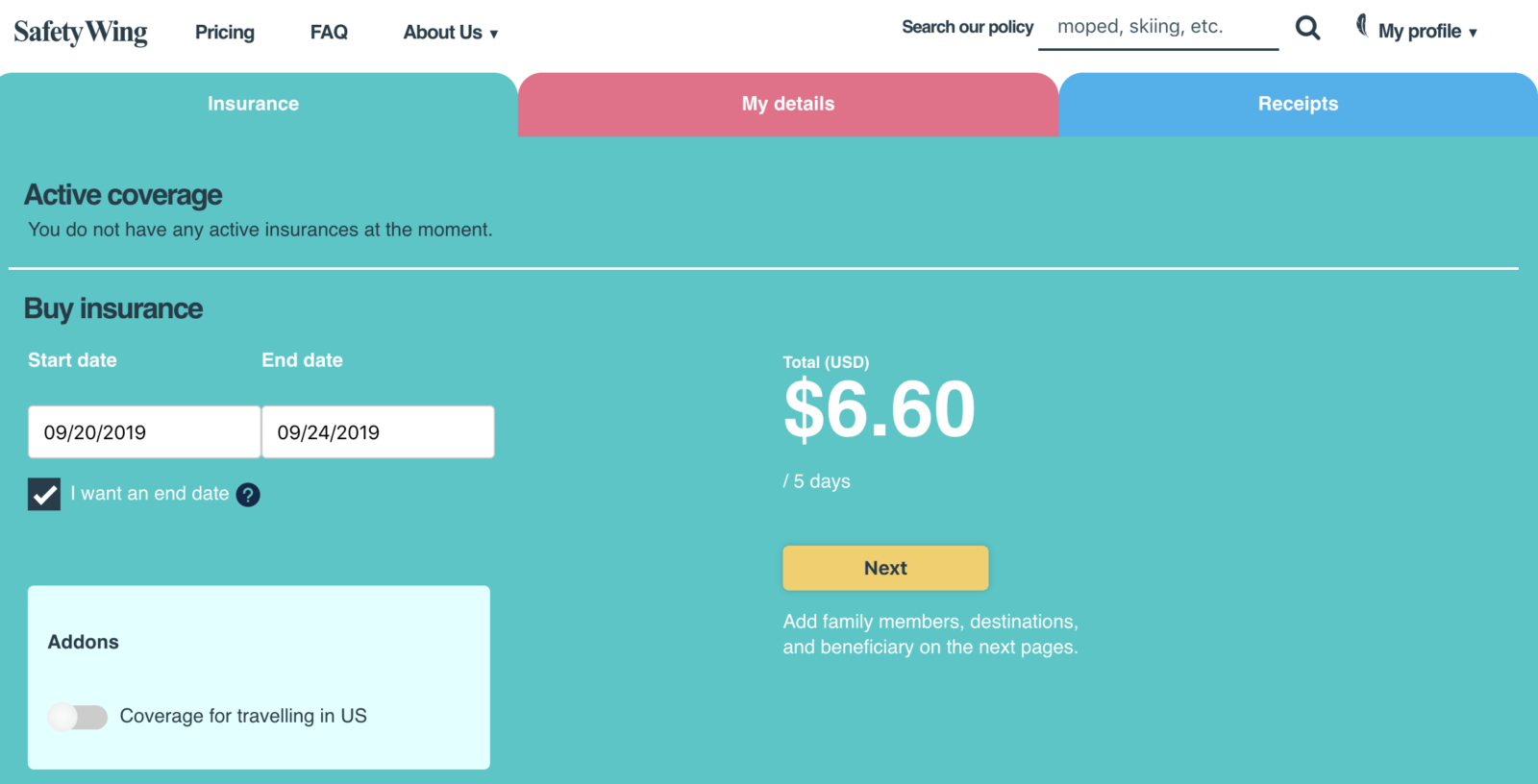

You can check how much your Travel Insurance would cost you pero usually it’s $37 or less than 2,000 more per month pero you only PAY PER DAY.

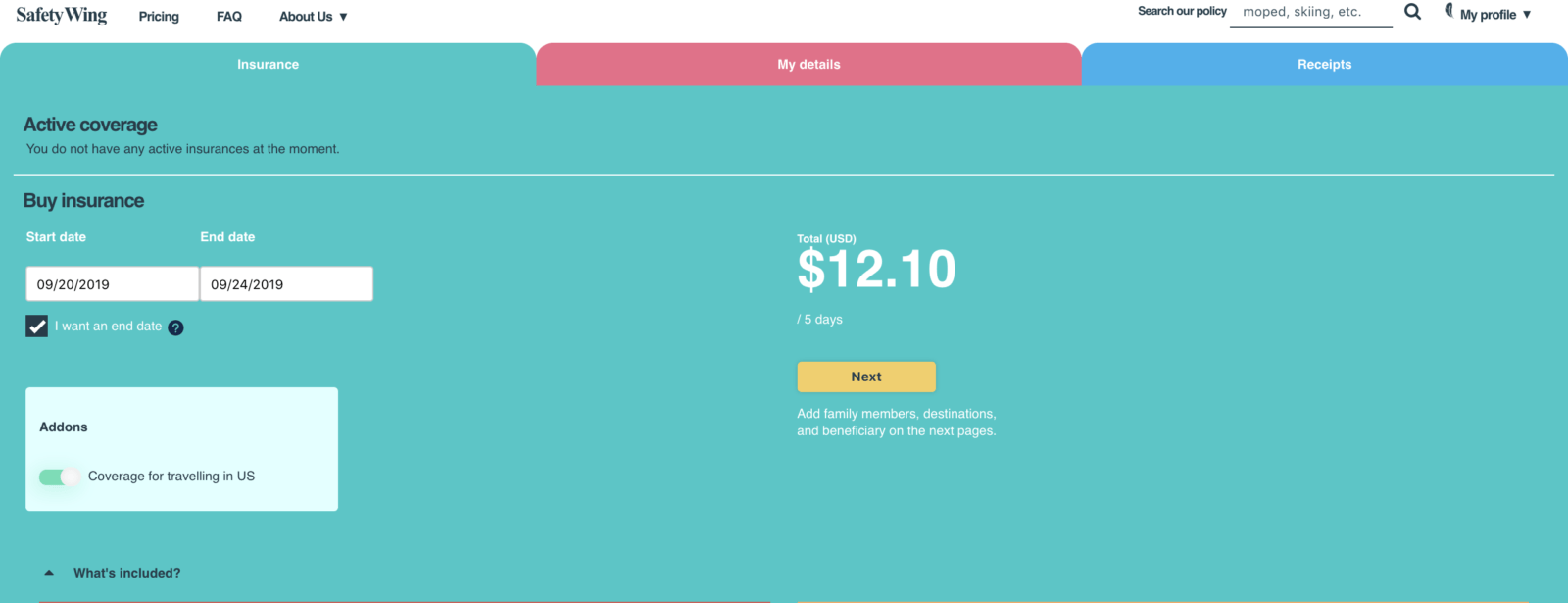

So for example, you’ll go on a 5-day trip then it’s only $6.60 (excluding a trip to USA). You can purchase it ahead of time as long as you put the Start Date and End Date. So how much is $6.60 in Philippines Pesos? Only around 340 Pesos!

… or click here so you can get the price quotation here.

If you decide to travel to the USA then you will be paying more but not much. It’s around $12 (USD) for a 5-day trip or 630 Philippines Pesos! If you will travel to the USA, make sure to always have a travel insurance because it’s REALLY expensive there. I remember after we survived hurricane Irma in Florida and Jonathan had a minor accident on his hand, our old insurance policy won’t cover it because it’s “his fault”, we ended up paying $1,500.

That’s the reason why we switched to a new insurance provider and thankfully when I had my car accident, they didn’t hesitate to help me immediately with my medical situation. I will write more later on how we file insurance claims or what to do when you get into an accident.

[box] Read my other articles:

- 7 Things Filipinos Have To Keep In Mind In Case Of An Accident Abroad

- How to Claim Injury Compensation After an Accident Abroad

- SafetyWing Insurance Review

[/box]

What Makes SafetyWing The Best Option For Backpackers & Long-Term Travellers?

You think that you’ve got yourself covered just because you already have your Life and Medical insurance. Reality check – these are very specific policies and most of the time, hindi mo magagamit when you travel.

Life insurance basically will pay a sum of money either after death or after a number of years. Medical insurance, while important, will not help you pay your medical bills while overseas. So what do you need to ensure that your trip will be a lesser hassle?

Definitely, Travel Insurance.

Travel insurance for us Pinoys, might not be a popular concept but it is a necessity every time you have the urge to leave and travel. In a nutshell, it covers practically everything you need while on vacation. That’s why we strongly encourage to check out SafetyWing because, for us, it is the best option.

1. You can get it even if you are not in your home country.

At least kahit nakaalis ka na, pwede ka pa din mag avail ng travel insurance Safety Wing. Pwede kasing nagbago ka ng travel plans, or ang tagal mo nagdecide kaya hindi ka kaagad nakakuha. Now, you don’t have a reason for not having your travel insurance.

2. Made especially for ‘kaladkarins’ like us – quick getaway, short trip or even long-term travel!

Yes, para talaga sa travelers. Check out why!

a. Medical help

Most likely, your medical insurance will not cover medical expenses incurred overseas. What if wala kang pera sa bank? Or what if walang pera yung relatives mo? E di nganga ka sa hospital nyan? Kanino ka hihiram? Sakit pa sa ulo, di ba?

b. Emergency Medical Evacuation

And what if your condition entails you to evacuate and go home? Mahal yun if you don’t have a travel insurance.

c. Trip Cancellation (Update: NOT COVERED with SafetyWing)

And for some reason kelangan i- cancel yung trip because of something really important or unexpected circumstances? What will happen with all of the paid bookings?

d. Stolen or Damaged Gears (Update: NOT COVERED with SafetyWing)

Sometimes, you are just unlucky. Pero with travel insurance, they’ll reimburse you to buy again yung mga nawalang travel gadgets.

3. Change of Plans

Minsan gusto mo mag- stay sa isang lugar pero hindi na covered ng original travel insurance policy mo? If you get SafetyWing, it is possible to extend and have your stay covered.

4. Resuming your Trip

So nangyari na nga ang dapat hindi mangyari, na-cut ang trip and you have to go home. Don’t worry, you can still resume to your trip. Yes! Some of the policies will allow that.

Check out what it will cover you and this one below is specifically for Filipinos traveling worldwide excluding travel to USA and Philippines. You can start the trip anywhere and not necessarily in the Philippines/ Home Country.

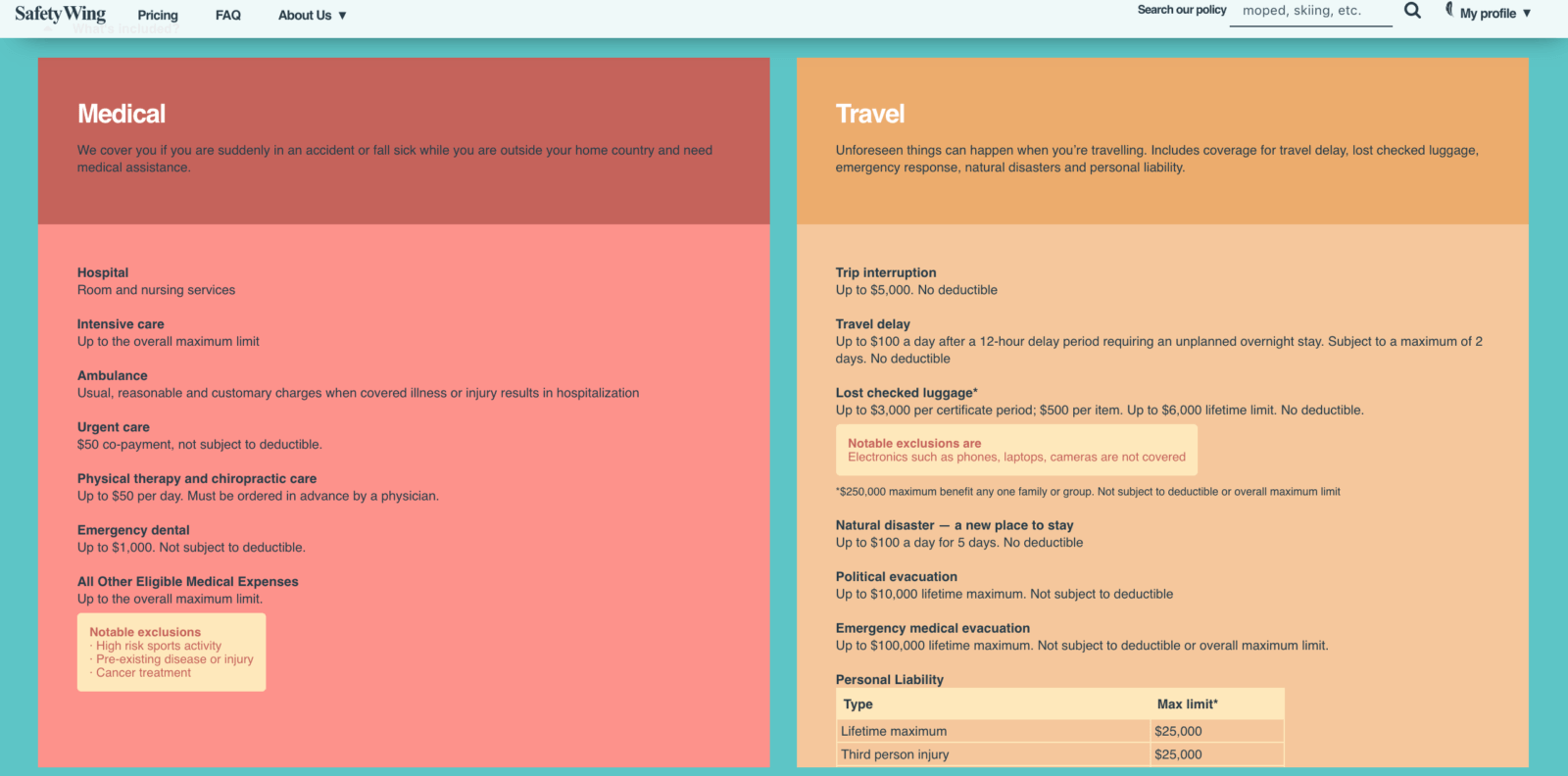

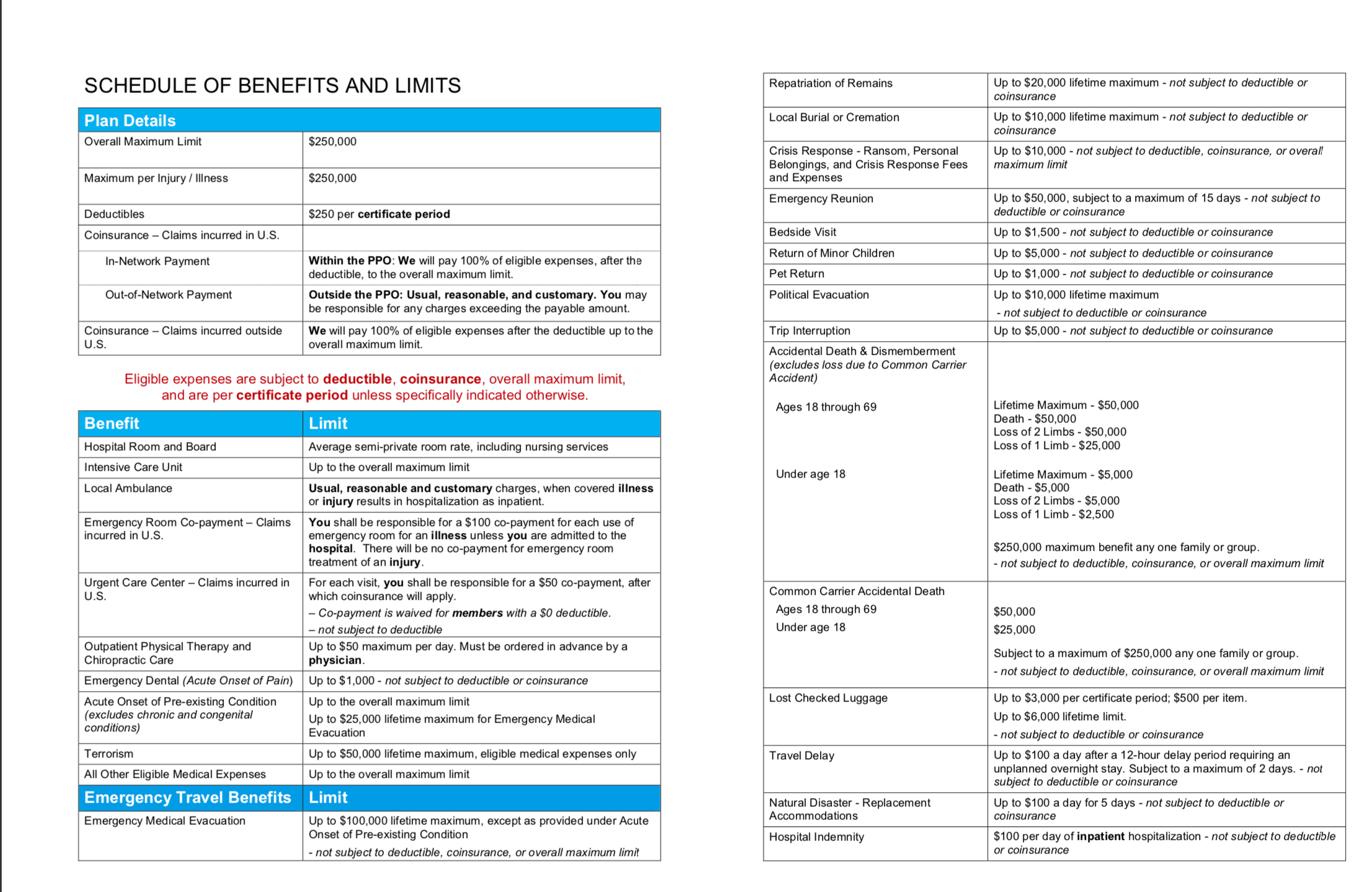

What Does Safetywing Cover on their travel & medical insurance?

For their normal policy they would cover the following on the screenshot above :

-

Travel Delay – when you miss your flights and when the airlines won’t cover you!

-

Baggage & Personal effects – when the airlines lost your luggage and they are not willing to pay for it!

-

Overseas Medical and Dental coverage – yes, even your dental needs

-

Personal and Travel Documents

-

Personal Liability – Physical injury and property damage and much more

Why is it better than the Philippines-based Travel Insurance Companies?

Most of the insurance companies in the Philippines are not used to LONG-TERM Travel or backpacking kind of travel! They don’t know how it entails, you can’t even avail the travel insurance when you’re already abroad and you have to purchase it before you leave the Philippines!

It’s a good thing that SafetyWing is able to understand what travelers really need. Also, I’ve been hearing a lot of stories from Filipino friends and readers that their insurance company didn’t want to pay for the claims or it took ages for them to pay it! Nakaka – bad trip yun, really!

Why Believe me?

I’ve been traveling around the world since 2013 and visited 136 countries. As a traveling entrepreneur, we look for exciting ways to sustain our life of travel. Lahat na siguro ng death-defying adventures nagawa ko na or balak namin gawin.

That said, it is inevitable to have a few accidents or misadventures while on the road like my car accident in Pakistan and glad I have SafetyWing insurance who paid for all my medical expenses.

The only way we can protect ourselves is by having travel insurance. Hindi naman pwede na lahat ng accidents charged sa credit card or tawag sa friends, di ba? That’s why I can truly say that SafetyWing is the perfect solution. Kahit na medyo frugal ako, gagastusan ko talaga ang Travel Insurance. Mahirap na di ba?

Why Filipinos need TRAVEL INSURANCE?

Again, I’ll explain the below items further to enlighten you that travel insurance is a must even if it’s not with SafetyWing or just any random Travel insurance company in the Philippines.

1. You got terribly ill a day before your flight

Your body tells you that you can’t leave the next day, but since you booked the cheapest and most-restricted ticket, you can’t refund nor rebook the flight. Sayang ang pera! And it’s not just about the flight cost. What if you already reserved your hotel? There’s a big chance that they will charge a night for not showing up.

This huge waste of cash can be avoided if you have your travel insurance. You might get a lower amount compared to what you have spent, but that’s better than losing everything for nothing.

2. You lost your expensive smartphone and laptop

I’ve heard a number of horror stories about losing gadgets while on the road. There are actually different reasons. One of my friends left it at a restaurant in Thailand. The other one lost it in a public bus in South America. Ang saklap nito!

While most locals from different countries are hospitable, there are few that will take advantage of tourists. For travel writers like us, losing our laptops and smartphones is literally a big loss to us. Kung sa akin mangyari ito, I will be lost for days.

Our gadgets are considered investment, we try to purchase the best units, which are quite costly. By having a travel insurance that covers lost gears, at least you can replace those without shelling the entire cost from your own pocket.

3. You got hospitalized while traveling

Huwag naman sana, pero it happens.

I remember watching an episode of ‘Monsters Inside Me’ when a couple went on a Safari trip. Unfortunately, parasites went through their skin and that made them sick most of their trip. I immediately thought of their medical bills. Sadly, your local medical insurance will obviously not work overseas. But if you choose comprehensive travel insurance, that would be a lesser burden.

4. You need to go back home – pronto!

In some cases, you need to evacuate instantly. This is applied usually to natural disasters.

5. An accident happened to someone and it was your fault

And for some reason, someone decided to sue you because of an accident, (this rarely happens, but possible). Make sure you got yourself covered. Paying for legal fees can break banks! Make sure you are protected.

Now, if ngayon ka lang kukuha ng Travel Insurance, make sure of the following even if it’s not with SafetyWing:

- Medical Coverage Limit

Your travel insurance policy should have high medical coverage. What if you needed to stay in the hospital for days? How sure are you that your insurance can cover your expenses while in there? If your provider seems to have a low limit for this, I suggest that you get other options.

- Evacuation Coverage

There are really instances that you have to immediately leave the country because of the conditions which you can’t control. By including an evacuation coverage in your policy, you spare yourself from making a handful of calls to different airlines just so you can be accommodated.

- Countries Covered

If you are going to different countries, for example going around South East Asia, you might want to select travel insurance that covers most of your destination. Unless you are a fortune-teller, you can’t say which countries you will need it.

- Gadgets Covered (Update: NOT COVERED with SafetyWing)

Make sure you get the decent limit that can be at par with the cost of your electronics. Again, we all live in a ‘wired’ world and losing gadgets can make you feel disconnected in some ways.

5. Flight, Hotel, and other Transportation Cancellations

When you cancel your trip, it is not only the flight that you are going to lose. You will lose money because of accommodation and sometimes even more if you rented cars or booked a train ride. Your insurance should cover all of these. Otherwise, choose another provider.

6. Round the Clock Support Desk

Most importantly, ensure that your provider has a 24/ 7 desk that can help you anywhere in the world. There are few providers that will only answer your concerns during their office hours, which is of course, based on their location. Mahirap naman ata yun. You need to make a claim as soon as possible so you need to get in touch with a representative right away.

Practical Tips when Getting Travel Insurance

- Always read the fine print and don’t be afraid to ask questions

- Keep a copy of your agreement. Bring it with you and have some copies in your email.

- Ensure that you keep all your travel receipts. This should make claiming easier.

Again, even if you are always looking out for the lowest travel deals, you should never compromise your health and you must prepare for uncontrollable things. The only way to fly without worries is by getting travel insurance that will cover almost everything while you are away from home. Hindi naman sa paranoid ako, pero I want you to enjoy your travel even if something unexpected will happen.

Disclosure: Please note that we are an Affiliate of SafetyWing but I’ve been personally using them since 2017.

[line]

Are you on Pinterest? Pin these!