Recovering TIN – How to Know Your Lost Tax Identification Number in the Philippines

Don’t know your TIN? Well, here are ways to know your Lost Tax Identification Number as well as verifying if it’s yours. Each one of us has a Tax Identification number to file our taxes. When we work, sometimes the employer processes our TIN for us, but we have to fill up a form.

When we are doing business, we need to register at the RDO, and they provide us with TIN. It’s important so we should remember or keep a file of it.

In case we forget our TIN or lost it, we can’t get a new one. Having multiple TIN is punishable by law, as it will feel that you are avoiding taxes by doing so. In case you lost your Tax Identification Number, check out this article on how to find it and verify it.

- How to get a BIR TIN and TIN ID in the Philippines

- All You Need To Know About the BIR Memo for Online Sellers and Freelancers

- How Filipino Digital Nomads or Online Sellers Can Register to BIR and Pay Taxes

- Step by Step Guide on How to Pay Your BIR Taxes Online in the Philippines

- 3 Ways on How to get a PSA Birth Certificate – Walk In and Online for Pinoys Abroad

Table of Contents

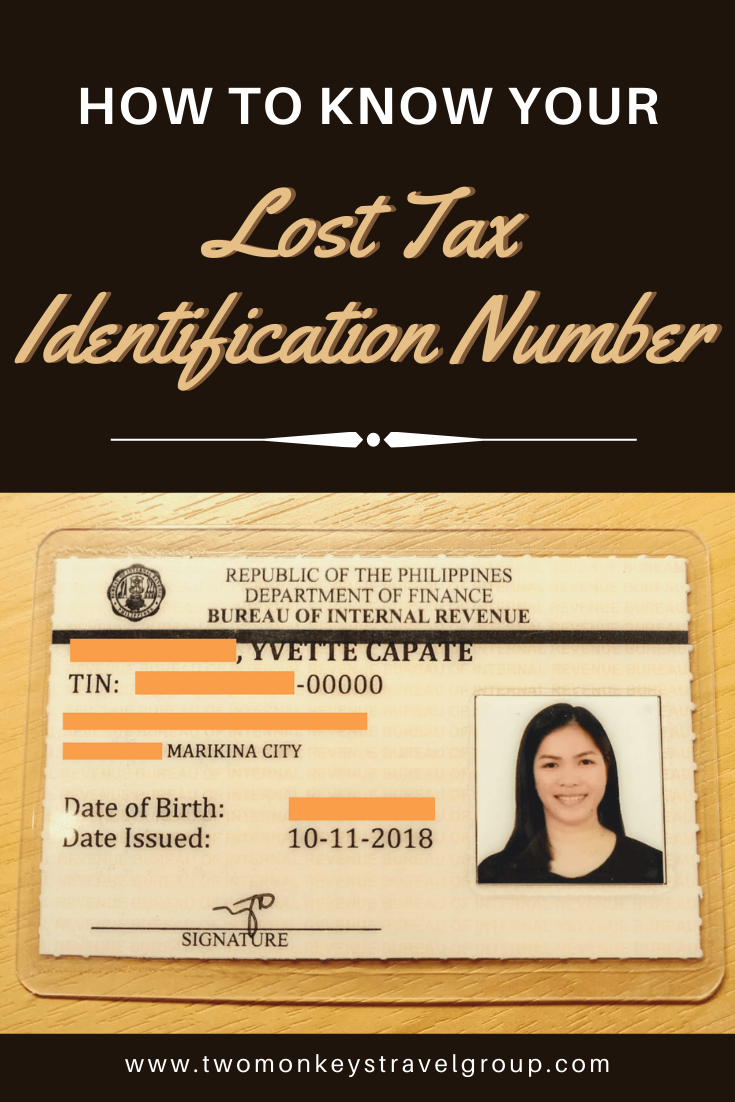

1. Check your Documents or IDs

The best place to find your TIN is through your TIN ID if you have one. If not and you were previously working, try finding your old pay slips or Form 2316, which is from your old company. For those who had a business, check your 1701 or 2551 forms or a copy of your certificate of Registration (2303); your TIN is found there.

2. Call your Employer

You can contact your employer as they surely know your TIN – it’s on their record as they file taxes on your behalf. Usually, the HR, Payroll, or Accounting department has your TIN.

If you have resigned already, you can also contact your previous employer as they may retain your details in their system. If not, you can also check through the BIR.

3. Contact BIR

Prepare your details and contact BIR so that you can get your TIN. Customer Assistant Division can be contacted using the following lines:

- 8981-7030

- 8981-7003

- 8981-7040

- 8981-7020

- 8981-7046

- 8981-7419

- 8981-7452

- 8981-7478

- 8981-7479

In case you find it hard to contact them, you can also e-mail your query at [email protected].

You can e-mail like this

Dear Sir/Madam,

Good day.

I am (complete name) from (town/city). I would like assistance from your good office as I have forgotten my Tax Identification Number and need it for (purpose.) The following are my details:

(For Self-Employed)

Complete Name:

Birthdate:

Gender:

Residence Address: (include Zip Code)

Past Business Registered with BIR:

(For Employed or Previously Employed)

Complete Name:

Birthdate:

Birthplace:

Gender:

Mother’s Maiden Name:

Father’s Name:

Residence Address: (include Zip Code)

I am hoping for your response.

Sincerely,

Your Name

4. Visit an RDO

You may go to the nearest Regional District Office where you are. You can ask the counter where you can queue to have your TIN found or verified. Make sure you bring valid ID or documents to prove that you are the owner of the number.

5. Online

Under “other E-Services” of BIR, there is eReg TIN Query. However, this is only restricted to authorized parties. It will contain your basic information, like name, birthdate, and TIN. If you know someone who is authorized, then you can also ask them. However, going to the BIR or contacting them is a much better option.

That’s how you find TIN! Know you have located your Lost Tax Identification Number, make sure to have an ID or keep your documents so that the next time you need it, it’s easier to retrieve. Good day!

Are you on Pinterest? Pin these!

About the Writer

Hey, I’m Lyza! I once was a person who just imagined going to places “one day” but decided to pursue my dreams. My first travel abroad was in Japan, solo, last 2018, and fell in love with the journey since. I’m aiming to visit 10 countries before turning 30 and 2 new places in the Philippines every year. Besides traveling, I love organizing trips, photography, reading, and making new friends. Follow my adventures through my Instagram.

I lost my BIR number how to get

Again the BIR number

I lost my tin card id pls update me. Tnk u

I forgot my tin# pls help me

My tin number na po ako kaso na Wala gsto ko sana po Makita tin number ko salamat.

I forgot my TIN number. How can I get my retrieve my TIN. Please help. Thank you.

I need to know my tin

I need to know my tin

Good day po!

Pahelp po i forgot my tin#

Nalimutan ko po ang Tin number ko. Paano ko po yon marecover.

I forgot my tin number pls help me to recovered it.

Can I ask my TIN number again coz it was lost my ID.

PLEASE HELP ME PO I LOST MY TIN ID LAST JANUARY 27 1998,HELP NAMAN PO TO RECOVER MY TIN NUMBER AND TO GET ID AGAIN,SALAMAT PO MARAMI ,GOOD DAY. myra manuel marcelo ,march 14 1974,

How to recover my tin id

How to know the tin number

I am Ruel Hernandez Palileo from General Trias Cavite. I would like assistance from your good office as i have forgotten my Tax Identification Number and need it for Self employed.

*Ruel Hernandez Palileo

*January 9,1974

*Muntinlupa City

*Male

*Lydia Regodon Hernandez

*Reynaldo Caisido Palileo

*B1 L126 GL2 Lancaster New City Pasong Camachile 1 General Trias Cavite

*4107

I am hoping for your response.

Sincerely Yours

Ruel Hernandez Palileo

I Forgot My Tin Number. Please Help Update Me. Tnx

Sir/madam

I lost my TINcard po and i dont know my number. Can i get or know my number. Thank you

i forgot my tin number please help me update me please

I lost my TIN card po and I forgot my TINumber, pwede ko po ba malaman ulit ang number ko po? Tnx

good day gusto ko po malaman kung anung tin ID number ko, salamat

I forgot my tin no. Pls allow me to ask in your office

Rowena gozo pulumbarit

Feb 28, 1970

Father’s name

Filicisimo mapalad gozo

Mother’s name

Teresita villamiel gozo

My last employer

Vasar Services and General Contractor

I forgot my tin no. Pls allow me to ask in your office

Rowena gozo pulumbarit

Feb 28, 1970

Father’s name

Filicisimo mapalad gozi

Mother’s name

Teresita villamiel gozo

My last employer

Vasar Services and General Ckbtractor

I lost my TIN number? Can I know ??? Please 🙏 badly needed 🙏

Good day Sir/ madam,

My concern is I’ve lost my TIN id and I forgot the number so please can help me to get my tin number..thank you and God bless!!

Hello , I also want to know my tin number coz I lost my i.d please… Thank you in advance

I lost my tin no. AAnd I forgot can I have it

I forgot my tin #,can i have it? Thank you

I forgot my tin number.

I lost may tin ID and I don’t know my tin number. Can you send me through email please 🙏

Can I know my tin #.thank you so much

Nawala yung card ng tin ko paano ko po ma recover yun?

I applied yesterday for a tin number, BIR office issued me a number but when i filled up my number using that was issued yesterday , it appeared that my new number is invalid, any suggestions or advise pls.

Pwede po ba malaman tin number ko po Na kalimutan ko po kse..

Greeting!

I forgot my TIN number, please help!

Thank you

I Forgot My Tin Number. Please Help… tnx

I lost my TIN number how can i know my TIN number

nakalimutan ko po yung tin # pwde po pa pahanap. Thank you

I lost my tin ID card .. anu po pwede gawin ???

Nawala Po ung TINcard ko,pero Indi ko kabisado ung TIN number ko..patulong nmn po na Malaman ko uli ito…pls .

I forgot my Tin Number pls help me

i really need my TIN ID # im not in phil. now so please help me … thank you

please help me to recover my TIN identification … i lost my I.D

Patulong po kung ano po yung tin number ko nawawala po kasi yung form ko maraming salamat po

At yung imformation mg tax ko

Please help me to get my tin card ive lost it last year..

please help me to recover my tin # I really really need it thank you

I am 88 of age, retired and “tax free” for about 30 years. Need now to know my Tax Number for money transfer reasons. Anyone who can help?

Nawala tin number ko? Paano marecover 2004 po nung ngaply ako.thanks

I want to get my tin no. Issued by my employer

I want to know my tin number,because my tin I’d is lost

I forgot my TIN number help mi

I forgot my TIN number

Pls kindly send to my email addess my TIN number

Please contact BIR and not us.

I forget my tin jimber please help me to recover my tax identification number.

Thank you

Nawala Po ung TINcard ko,pero Indi ko kabisado ung TIN number ko..patulong nmn po na Malaman ko uli ito…pls . Pede Po pa send nlang SA email ko.

I forgot my TIñ number. Pls kindly send to my email address

What is my tin number

i forgot my tin number help me

I lost my TIN but i dont onow the # can you help me recover it

kindly go to the nearest BIR Office or follow the steps

i forgot my TIN number pls help me

Hey,gil im planning to work as self imployed i want to secure my lost tin

My father has forgotten his tin number due to the long years passes.

May I ask favor to search of the above mentioned.

Thank you so much.

Please contact the BIR where your father resides.

I have already visit to the BIR here in my City and they advised me to the download bir tin verifier app but it has no agent to response my concern.

Try doing it on office hours.

How to find my Tin # I forget

Good day paano po malaman TIN number ko kasi meron daw kapareha yung number ko tnx po sa sagot

ask bit po.

Hi..tanong ko lng Po kung anong pwedeng gawin ko Kasi Po mawala Po ung tin id ko tapos Ang ginawa ko Po kumuha Po ako Ng bago sa nakilala ko online .Hindi Po ako Ng file Ng affidavit of lost.paano Po Kya Yun.salamat po

Go to the nearest BIR office and Ipa-cancel mong isang TIN mo, it can lead to a fine or imprisonment.

Good po. Paano po ma tace ung TIN number ko. Pls reply.

You can ask your former employer here in the Philippines po or visit the RDO where you get your tin. 🙂

For the ones living abroad panu po kaya? The app are not available sa.amin.

Good afternoon po tanong kolang po kong anu ang akin TIN number po hanggang ngayon po kasi hindi pako nakaka kuha ng TIN ID SLAMAT PO?

please follow at least one of the steps above as we don’t have a database of TIN.

Hello po Maam/Sir Ask ko lang po kung pano ko malalaman online ung Tin No. ko nawala po kasi at hindi ko na matandaan. Dito po kasi ako sa Taiwan. Thank you in advance po ☺️

You can ask your former employer here in the Philippines po or visit the RDO where you get your tin. 🙂

Pano po mag request ng tin#nawala po kasi at di ko tanda number salamat po

Panu po kung nakalimutoan ko tin number ko , nawala po yung form ko

Lost tin.number

Good am…

Maam/ sir,panu po mtrace un tin number ko

Hello po.

So eto po situation ko. Nagresign ako sa previous employer ko. tas nakahanap ng bagong trabaho. At nung gusto ko sana I verify Ang TIN number ko sa BIR office, it says daw no data found. No TIN daw. Nagulat ako. Bat ganun? At after that pinuntahan ko Ang previous employment ko tas nagask Kung bakit Wala daw ako TIN. Ang response ng HR ay pending pa daw Yung processing. Worst pa is resigned na ako dun. Ano po ba Ang gagawin ko?

Madali lang po kumuha ng TIN sa BIR, baka super tagal lng nung company mo or nakatambak yung files nila. Buti ipa cancel mo doon sa previous mo at doon nlng sa present.

Okay thanks.

Hello, paano ko po malaman yung TIN number ko? Nawala kasi yung card po. Tapos deto po ako sa Thailand now. salamat po sa sagot.

Pano ko po makikita sa online yung TIN number ko po

Ma’am verified ko Lang tin no. Ko..

maam hello po , sana po matulungan niyo ako ive been hired by a company matagal na pero wala pa po kami TIN no. ,yes po di lang ako 3 po kami,makakakuha pa po ba kami nang tin number pa? ano pong form ang kailangan namin ? di po ba maapektuhan yung company na kinabibilangan namin?

thanks sa pag sagot and Godbless po sa Blog po ninyo

How can I retrieve my tin number

Would like to ask my tin number for bank requirements. I can’t go to the main office of bir because of pandemic & I’m pregnant. Thank you so much!

please contact your local RDO

Hi lyza

Just want to say you are doing a great keep it up,

Stay safe

Ma’am/sir

Puwede ko bang makuha Yung tin number ko

How to Recovering TIN I forget my TIN 30 years ago hindi ako maka punta ng BIR kasi po ditto ako ouside the country OFW po ako I need TIN no. for some purpose needed

Ma’am/sir

Ask kulang po…pano kuba malama yung TIN number ko? Nawla ko. Mga 7years na po… gagamitin ko po kc…para sa pag-aapply para abroad po…

Sir/Ma’am

Good day how can I get may TIN I forget my TIN no. and please give the active email add the person who help us thank you

I would like to know my TIN number. I have been an OFW for 13 years and I will be working home from this week. Appreciate a revert please.

hello im from davao, and nag punta ako d2 bir .. na ipa transfer ko from 1905 to 1902 .. pero dapat ipa fax pa yung number ko.. pero habang nagpa fax ako walang sumasagot.

Paanu ko malalaman na mu tin number ako?

Tanong kulng po pano poba malalaman ulit yung tin # ko nakalimutan kopo kasi

Good eve po sir/mdam.i lost my tin number please help.thank you..

Paano po pag sinabi sa pinuntahan ko na RDO na wala pa daw po akong tin number, ibig sabihin po ba kahit saang RDO wala po akong tin number o possible po na sa ibang rdo? Sana masagot nyo po pls.

What if I forgot my tin # Ang my ID is lost..how can I know my tin id number

Good am maam/sir i lost my tin number pls check my record.

Hi mam I would like to ask if ,bibili ba nang property need din pa yung tin no.at paano pag May open case matitrace ba yung nG bir?

Hoping for you’re answer mam.thank you

ma’am/ sir

nawala ko po ung tin number at diko po maalala. ptulong nman po kc kylangan ko po ung tin number ko.

Sir/mam im lose my id pls check may tin number

May i know my previous tin number??

Good day ma’am/sir

I lost my id and other documents to look out my tin number and i want to know it for ma’am pls. Help me. Thank you

Good day sir/madam

Meron po akong tin id since 2011

Then ngayon nag aaply ako through online Banking need tin I’d nilalagay ko yong tin id ko ayaw mag activate.

Ano po kailangan o gawin ko sa tin Id ko po.

Thank you

I do already have my TIN number, I believed it was being processed way back 2017 by my previous company. For the past three (3) years now I’m still having a hard time on how to Identify my TIN number in any possible convenient way, I cannot afford to visit their site due to very complicated shift schedule.. I already contacted them several times but there was no resolution provided.. we always end up to a one (1) resolution with the exact information on how to visit them on site.

Best regards to whom might have concern.

Hi Mam i lost my tun id and cannot remember my number,pls.help naman po thank you

good day po mam/sir nawala ko po kasi tin number ko and id need ko po malamam ung tin number ko patulong naman po diko narin po kasi ma contact dati kung employer wait for your kindly reply salamat

pano po kaya matetrace yung nawala kong TIN number.. pa help naman po salamat sa makakapansin

Maam, patulog naman po. My father forgot his TIN no. At ang layo po ng BIR office sa amin.

try po calling BIR or e-mail them.

I would like to check my tin number if not fake

Ma’am panu qu ba ma update tin # since 2013 pa po un..ndi po mareleased ATM qu pagwala po updated na tin#

what do you mean po na update? isa lang po kasi tin per person. Or yung RDO po iuupdate?

SIR/MAM PATULONG PO NG AKING TIN NUMBER HINDI KO LANG PO ALAM ANG TIN NUMBER KO SALAMAT PO

Hi Mam/Sir,

Please help me.. i forgot my tin number at gusto ko rin n palitan ung civil status..Asap…thank you…

Good pm ser paano po mka kuha ng tin id meron npo akoa kaso lng na wla

Hi Sir/Mam

Please Help me I forgot and Lost card Tin # please help me for necessary purposed.

Thank sir/mam in Advance

What if the TIN number of may Mother is lost? Do I need to have an Authorization in retreiving it? Thank you

Nawala po tin id ko panu po aq makakakuha ulit

Good day. Please may i know my tin number because i can not remember?Can I change the status by online…ASAP.

Good day po .. Nawala po ang wallet ko kasama ang tin id ko d ko po tanda ang id number pwd ko po bang malaman ito salamat po

Please contact BIR po

Hi gooday can you please help me To get may tin number because I lost it.

I forgot my tin no. Can you help me?

Good day. Please may i know my tin number because i can not remember? Thank you. ASAP

please contact BIR as we don’t have a database.

i dont know my tax id my wallet missing in coastal area

i forgot my tin no. can you help me?

Hello good day hindi pa po ako nag kakaron TIN ID but meron na ako TIN NUMBER through my work last time sa STARBUCKS and hindi ko kabisado yung TIN number ko ask ko lang if pwede ko ma retrieved yung TIN NUMBER ko salamtttt

Good day,, paano ko po ma retrieved ung TIN number ko,, burado na kasi sa old id ko since 2004 pa po ung id…salamt

Hello po, pano ko po b mareCover ang aking TIN ID NUMBER

hi meron po ako tin numbr before nung nagbarko po ako. now nawawala napo yung copy ko and yung sa agency ko po. paano po ba malalaman tin number ko ulit thanks po

try po sa SSS RDO na under yung agency mo

Paano po makakuha Ng tin #? Samantalng nakapagtrabaho po ako sa Jollibee Ng 6 months…at Ng iverify ko sa BIR Wala daw po akong tin #…

How to get a BIR TIN and TIN ID in the Philippines

Papanu malalaman tin number k kasi naka register na p ako salamat po nawala p kasi

Questions po:

1) Have you already applied for this before? Kasi once kalang mag-aaply for TIN

2) How po? Thru an employer or have you been to BIR yourself – Self-Employed

3) Mga what year kayo nag-register or first nag-work? Saan pong lugar?

You can follow po instructions above.

Recovering my tax identification number

How can I recover my lost tin number

How can i know my tin number? I forgot po. Salamat

Paano KO ba malalaman ulit ang aking tin# nkalimutan KO po kc June xxxxx

June x xxxx

please contact po your nearest RDO

Dear BIR,

Greetings !

Have a pleasant day can I ask a favor from your good office to send through my e-mail with regard on my TIN number because it was lost by then since the flood hit our home last 2016 in CDO sadly most of my Documents were missing. Hoping for your kind consideration on this regard. Thank you !

Hello po, hindi po ito BIR. Please send it to the e-mail to the nearest RDO po.

Please stop saying TIN number!

I can’t remember my TIN number. Can u help me?

I cant remember my tin number. Can you help me?

I forgot my tin number my employed not told me just I want to know if I register it thank you

Please help me I’ll forget my tin number my previous company did not told me

how can i retrieve my tin number

I lost my Tin number pls help

Can i get my tin number because i lost it .

I forgot my tin number can you help.

What is my TIN?

I would like to recover my forgotten tin number please

Hi! While searching how to retrieve TIN on Google I found your article. You said one of the ways is to email the bit. Is this really possible? Because I’ve heard before in 2011 that they don’t give the TIN thru email. I’m really desperate to retrieve my tin bcoz I really need it badly, I’m here abroad, when I called bir numbers I can’t go through I’m always directed to answering machine.

There’s no harm in trying 🙂 Right now, government agencies are responsive. If not, you can complain thru 8888.

How to recover my tin number

please read the article po.

I would like to know mywhat TIN Number

follow the instructions above po 🙂

I forgot my TIN NUMBER

follow the instructions above po 🙂

Ask Lang Po Nag Palakad Akong Tin Ma’am Peru wala Pong verification slip ano Gagawin Ko po ?

Thank You

You can confirm it with the BIR, but usually ibibigay lng yung form mo.

Thank you for this, Lyza!

good am po.. di ko po kasi alam ang tin number ko

Na wala po yung tin id ko at hndi ko po kabisado ang tin number ko .paano ko malaman kung ano ang tin number ko..

Sir/ma’am

Nka limutan ko po tin number ko gusto k po malaman tin number ko…

Salamat po

Good day pwede ko po ba ma veryfy yung tin number ko kse nakalimutan ko.po salamat.

You can contact BIR po, please follow the instructions above.

How to know my TIN number

You can follow the instructions above.

I’m forgotten my tin

How to know my TIN

follow the instructions above po 🙂

MAY POSIBILIDAD PO BA NA MADOBLE ANG TIN NUMBER NG ISANG PANGALAN?

If you got it twice po, then it’s doubled. Better cancel the other one as you’ll be penalized. My ex-coworker once have two TINs under his name.

Good day po. Pano po if confirmation Lang po Kung meron nang TIN number? Thank you

Pwede po ba kumuha ng TIN even if unemployed?

depende po if anong purposes mo, usually TIN can be given sa merong business or babayaran na tax like Estate, etc.

Ano po ang requirements sa pag kuha ng TIN id?

How to get a BIR TIN and TIN ID in the Philippines

how to verify my tin number i forget it …

You can follow the steps above.

How to verify again my

Tin# .because i forget already?

Good day! I am requesting my TIN number because i forgot it and i need it to fill up application on having savings account here in Taiwan. It is required in their post office. Thanks.

Please contact SSS as provided on the article.

Paano po kumuha TIN # sa online sir/mam

Kaelangan ko kase ng TIN#

Kailangan mong pumunta at magregister sa BIR Sir.