How to get a BIR TIN and TIN ID in the Philippines

A person who is going to pay taxes needs to register with BIR. You can be someone who is planning to start a business or you are getting your first job. You need to have a unique BIR TIN (Tax Identification Number) to be properly identified when you pay for your taxes. You can get a TIN ID after too!

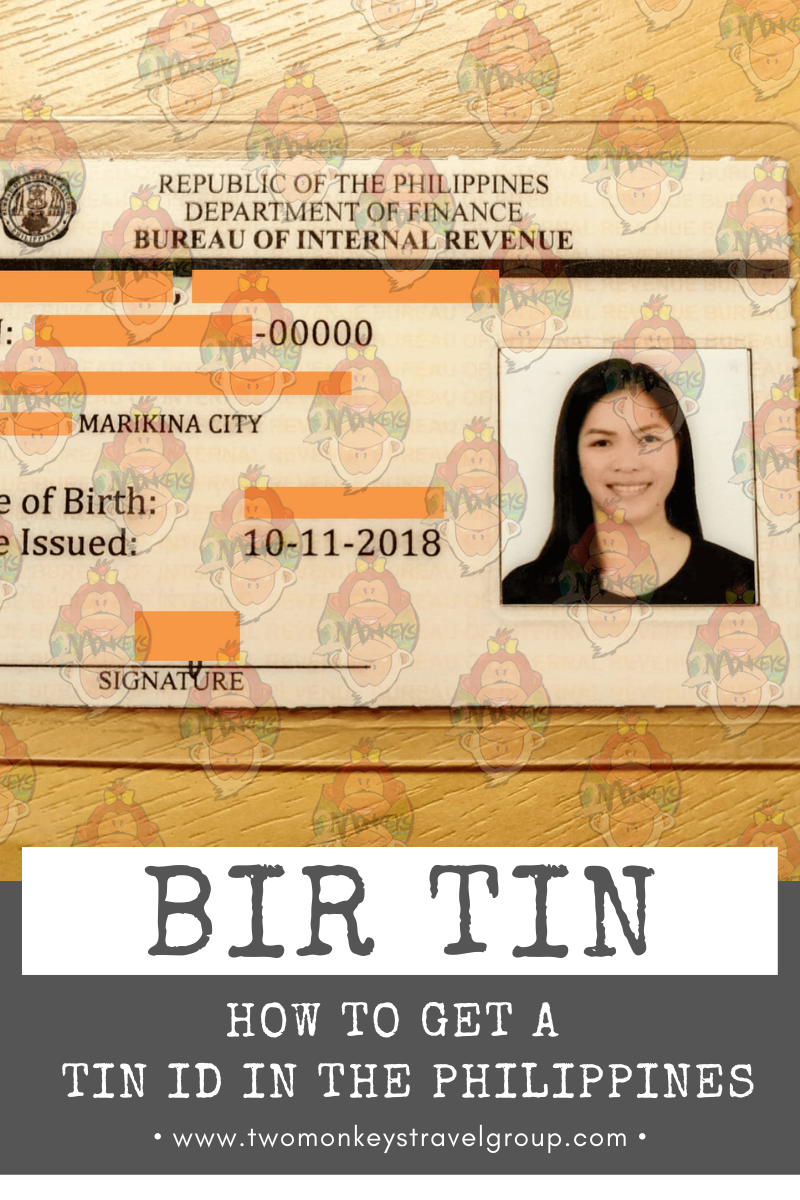

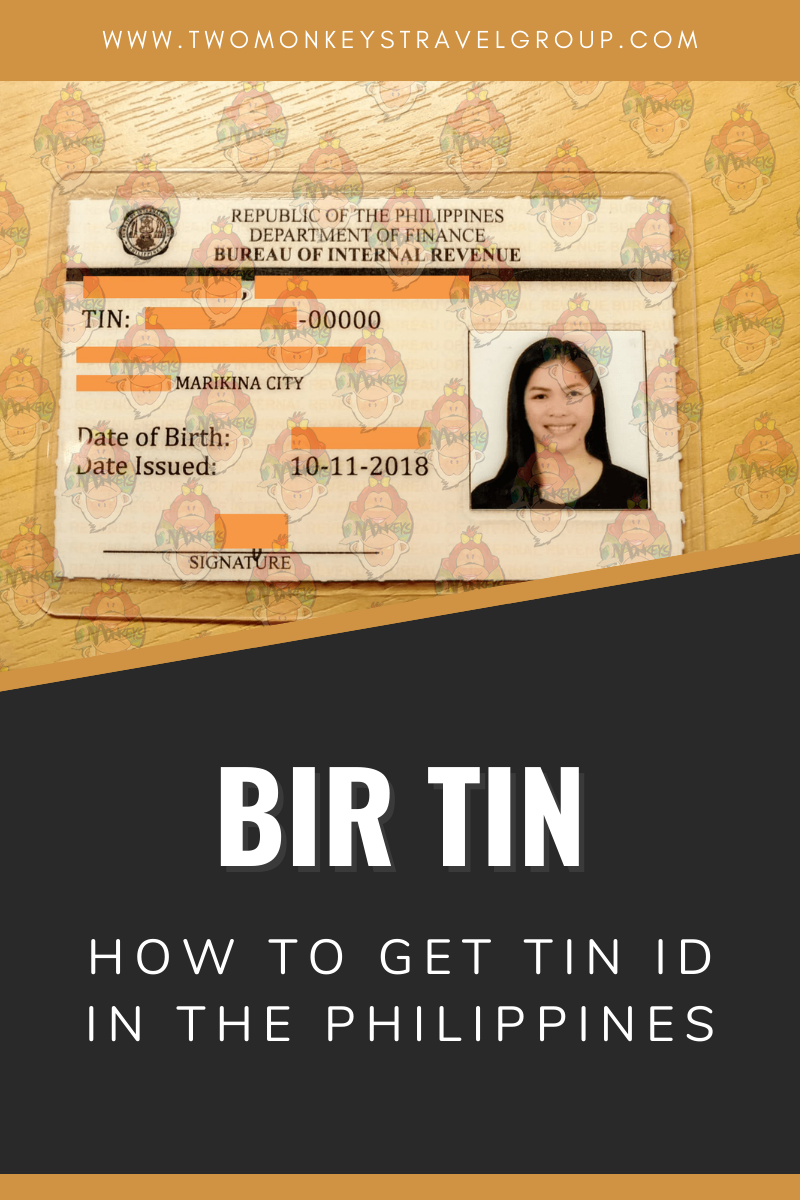

Your TIN ID is sometimes not considered as a valid ID, however, it is a secondary one that needs further verification. Since you are given only a paper card printed with your TIN, Name, Address, Birth Date and Issue date. Pwede yang lagyan ng kahit kaninong picture or signature, so maraming fake TIN ID.

However, be sure to have a BIR TIN as it is important in paying taxes; and it’s not just if you have a business or are employed – like income tax or percentage tax. To name a few, there are Estate tax (when someone has died and estates are given to the heirs), VAT or Value Added Tax, Documentary Stamp Tax, Donor’s Tax, and a few more. So get yourself registered and have a BIR TIN. A TIN ID is also a plus for identification purposes.

Table of Contents

Required to have a BIR TIN

According to the BIR: “Every person subject to any internal revenue tax shall register once with the appropriate Revenue District Officer:

1. Within ten (10) days from the date of employment, or

2. On or before the commencement of business, or

3. Before payment of any tax due, or

4. Upon the filing of a return, statement or declaration as required in the NIRC.

5. Death of individual;

6. Full settlement of the tax liabilities of the estate;

7. Discovery of a taxpayer having multiple TINs; and

8. Dissolution, merger or consolidation of juridical person.”

How to get Registered through RDO

I will only be discussing a few types of registration; most are individuals of #1 and #2 of stated above.

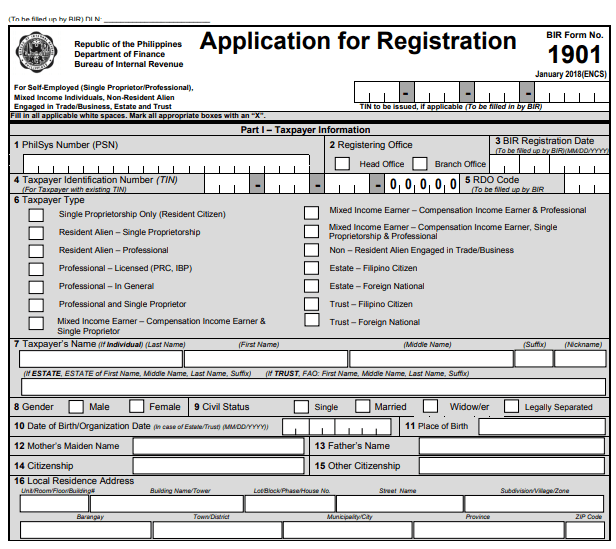

Self-Employed and Mixed Income Earners

If you have your own business or a freelancer then you can do this. Mixed-Income means if you have a job and a business (two types of income) then you can follow the instructions here.

Documents Needed

- Photocopy of Mayor’s Business Permit (if still in process – received the application), Professional/Occupational Tax Receipt (for professionals), or DTI Certificate (Click here for a guide on how to get your DTI Certificate)

- Payment for Annual Registration Fee (Php 500.00)

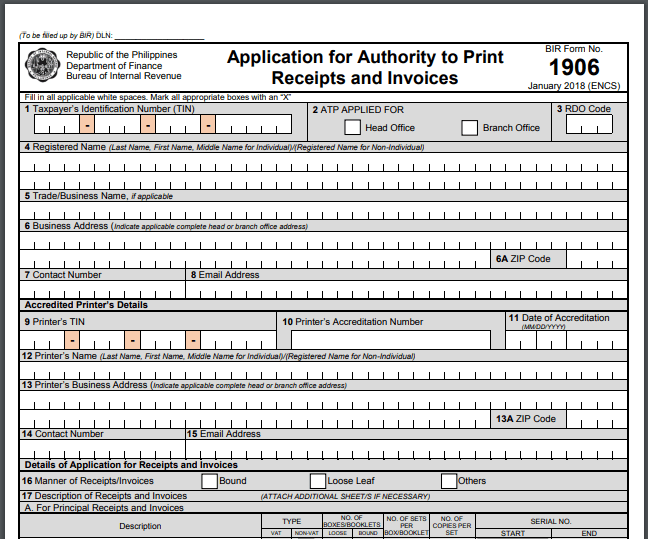

- BIR Form No. 1906

- Final and Clear sample of your receipts or invoices (How your invoices or receipts will look like)

Additional Requirements (if applicable)

- Special Power of Attorney (SPA), an ID of the authorized person (if you have a representative)

- Franchise Documents

- Photocopy of the Trust Agreement (for Trusts)

- Photocopy of the Death Certificate of the deceased (for Estate under judicial settlement)

- Certificate of Authority, if Barangay Micro Business Enterprises (BMBE) registered an entity

- Proof of Registration/Permit to Operate BOI/BOI ARMM, PEZA, BCDA and SBMA

When Do you Need to Register?

You need to register on or before your business starts. It will start on the day of the first sale or within 30 days from the issuance of Mayor’s Permit or Professional Tax Receipt, whichever comes first.

Steps in BIR Registration

1. Fill-up BIR Forms 1901 and 1906.

2. Go the BIR RDO (Regional District Office) where your business is under and submit your documents at the New Business Registrant Counter.

3. Pay the ARF of Php 500.00 and the BIR Printed Receipt/Invoice if they want to use such. (BRPs or BPIs are used in case you don’t have your on yet.)

4. Wait for your Certificate of Registration (Form 2303), your “Ask for Receipt” Notice, Authority to Print and eReceipt for your payment. Also, your BRPs or BPIs if you paid for one.

5. Attend a Taxpayers’ seminar to know your duties and responsibilities.

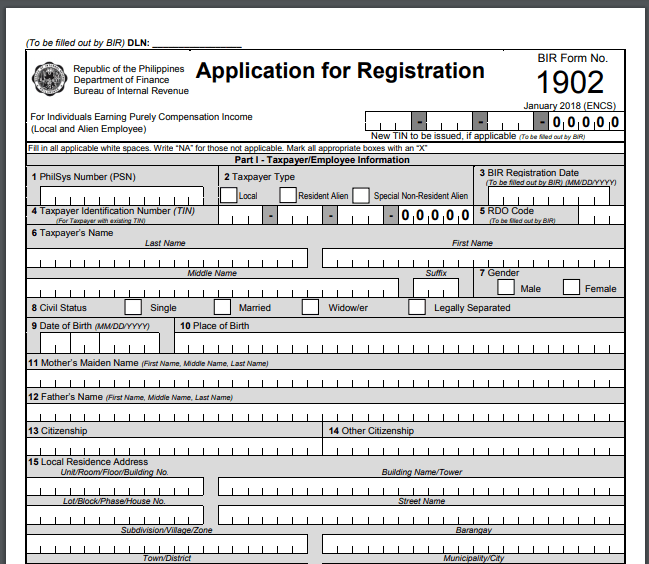

Compensation Income Earners

If you are applying for a job, especially for your first one, then you need to do this. However, if you have a previous TIN, then you don’t need to register again. It’s one TIN per person. One TIN ID per person.

Documents Needed

- Valid ID – showing name, address and birthdate of the applicant (e.g. Birth Certificate, passport, community tax certificate, driver’s license, etc.)

- Marriage Contract (for married women)

- Passport and Work Permit (for Alien Employees)

When you Need to Register

You need to register within 10 days from the employment date.

Steps in BIR Registration

1. Fill-up BIR Form 1902 (except employer’s part – PART IV)

2. Submit your form and documents to your employer or HR department

3. The employer shall fill-up their part (Part IV)

4. Employer will submit the form to the RDO

5. Get your TIN. (Sometimes you will be given back your form or it shows up in the pay slip). You can ask your HR too, to get your TIN ID in your behalf.

Overseas Contract Workers / Seaman with purely foreign-sourced income

Documents Needed

BIR Form 1904 is also used for one-time payers and those who need tin for government transactions

- Valid ID – showing name, address and birthdate of the applicant (e.g. Birth Certificate, passport, community tax certificate, driver’s license, etc.)

- Employment Contract

When you Need to Register

You need to register before filing a return or paying your taxes.

Steps in BIR Registration

1. Fill-up BIR Form 1904

2. Go to the RDO where your residence is assigned

3. Submit all your requirements

4. Wait for your TIN.

Getting your TIN ID

A TIN ID helps you remember your TIN and can also serve as a valid ID in some government agencies.

1. Go to the RDO where you filed your TIN. Ask the officer where you can get your TIN ID Card. However, if it was filed by your employer, you can get it from them.

2. Show a valid ID your application form to get your TIN ID.

3. Check your details. If it is correct, sign it and paste your 1×1 picture.

4. Laminate your TIN ID.

RDO Offices

Here is the list of Regional District Offices in the Philippines. You can get your TIN and TIN ID here. Just make sure they are the same RDOs.

Revenue District Office No. 1 – Laoag City, Ilocos Norte

BIR Building, F.R. Castro Avenue, Laoag City

Revenue District Office No. 2 – Vigan, Ilocos Sur

BIR Building, Quirino Blvd. Zone 5 Bantay, Vigan, Ilocos Sur

Revenue District Office No. 3 – San Fernando, La Union

2F Tan Building, National Highway Sevilla, San Fernando, La Union

Revenue District Office No. 4 – Calasiao, West Pangasinan

Ground Floor BIR Building, MacArthur Highway, San Miguel, Calasiao, Pangasinan

Revenue District Office No. 5 – Alaminos, West Pangasinan

BIR Building, Barangay Palamis St, Alaminos City

Revenue District Office No. 6 – Urdaneta, East Pangasinan

3rd floor, E.F. Square Building Mc Arthur Highway, Nancayasan, Urdaneta, Pangasinan

Revenue District Office No. 7 – Bangued, Abra

Balbin Building, Corner Taft And Economia St. Zone 4, Bangued, Abra

Revenue District Office No. 8 – Baguio City

69 Leonard Wood Road, Baguio City

Revenue District Office No. 9 – La Trinidad, Benguet

2nd Flr, Willy Tan Building, Km. 4, La Trinidad Benguet

Revenue District Office No. 10 – Bontoc, Mt. Province

2/F, Gov. Center, Bontoc, Mt. Province

Revenue District Office No. 11 – Tabuk City, Kalinga

BIR Bldg. Hilltop, Bulanao, Tabuk City

Revenue District Office No. 12- Lagawe, Ifugao

2nd Floor, JDT Building, Inguiling Drive, Lagawe, Ifugao

Revenue District Office No. 13 – Tuguegarao, Cagayan

BIR Regional Office Building, No. 11 Pagayaya Road, Govt. Center Carig Sur, Tuguegarao City

Revenue District Office No. 14 – Bayombong, Nueva Vizcaya

BIR Building, Capitol Compound, Bayombong, Nueva Viscaya

Revenue District Office No. 15 – Naguilan, Isabela

BIR Building, Barangay Magsaysay, Naguilian, Isabela

Revenue District Office No. 16 – Cabarroguis, Quirino

BIR Building, Brgy. Marcos, Cabarroguis, Quirino

Revenue District Office No. 17A – Tarlac, Tarlac City

BIR Building, Macabulos Drive, San Roque, Tarlac City

Revenue District Office No. 17B – Paniqui, Tarlac

3rd Floor Avila Building, Zamora Street, Paniqui, Tarlac

Revenue District Office No. 18 – Olongapo City

1F &2F Lincoln Masonic Temple, #4215 West Bajac=Bajac, Olongapo City

Revenue District Office No. 19 – Subic Bay Freeport Zone

BIR Bldg., Burgos St cor. Samson Rd, Subic Bay Freeport Zone

Revenue District Office No. 20 – Balanga, Bataan

Leonida Bldg., Capitol Drive, San Jose, Balanga City

Revenue District Office No. 21A – North Pampanga

RDO 21A Building, BIR Complex, Mc Arthur Highway Sindalan City of San Fernado, Pampanga

Revenue District Office No. 21B – South Pampanga

Ground Floor, BIR Building, BIR Complex, Mc Arthur Highway Sindalan City San Fernando, Pampanga

Revenue District Office No. 21C – Clark Freeport Zone

Revenue District Office No. 22 – Baler, Aurora

Burgos Ext., Barangay Suklayin, Baler Aurrora

Revenue District Office No. 23A – North Nueva Ecija

Maestrang Kikay, Talavera Population, Nueva Ecija

Revenue District Office No. 23B – South Nueva Ecija

Liwag Blvd., Burgos Ave., Cabanatuan City

Revenue District Office No. 24 – Valenzuela City

2nd/3rd floor JRC Building, McArthur Highway, Malinta, Valenzuela City

Revenue District Office No. 25A – Plaridel, Bulacan

Rocka Commercial Complex, Cagayan Valley Road, Tabang, Plaridel, Bulacan

Revenue District Office No. 25B – Sta. Maria, Bulacan

312 Gov. F. Halili Avenue, Barangay Bagbaguin, Sta. Maria, Bulacan

Revenue District Office No. 26 – Malabon-Navotas

5th Floor Fishermall, C4 Road Barangay Longos, Malabon City

Revenue District Office No. 27 – Caloocan City

BIR Regional Office No. 140 Barrio Kalaanan, Edsa, Caloocan

Revenue District Office No. 28 – Novaliches

1st and 2nd Floor, 122 West Venue Building, West Avenue, Quezon City

Revenue District Office No. 29 – Tondo – San Nicolas

3/F BIR Regional Office Building, 1 Tuazon Building, Solana cor Beaterio sts. Intramuros, Manila

Revenue District Office No. 30 – Binondo

3/f, Benlife Building,Solano cor. Beaterio Sts., Intramuros, Manila

Revenue District Office No. 31- Sta. Cruz

5th BIR Regional Office Building 2 Benlife Building, Solano cor. Beaterio Sts., Intramuros, Manila

Revenue District Office No. 32 – Quiapo-Sampaloc-Sta. Mesa- San Miguel

6th Floor BIR Regional Office Building 2 Benlife Building, Solana cor. Beaterio Sts. Intramuros, Manila

Revenue District Office No. 33 – Intramuros-Ermita-Malate

2/f BIR Regional Office Building 2 Benlife Building, Solano cor. Beaterio Sts., Intramuros, Manila

Revenue District Office No. 34 – Paco-Pandacan-Sta. Ana-San Andres

BIR Regional Office Building 2 Benlife Building Solana cor Beaterio Street Intramuros, Manila

Revenue District Office No. 35 – Romblon

2 / f, Fernandez Building, Brgy. Sea Coast , Odiongan, Romblon (Island District)

Revenue District Office No. 36 – Puerto Princesa

BLC Green Building 320 Rizal Avenue Brgy. Puerto Puerto Princesa City, Palawan

Revenue District Office No. 37 – San Jose, Occidental Mindoro

DBP Building, Quirino St. San Jose, Occidental Mindoro (Island District)

Revenue District Office No. 38 – North, Quezon City

3rd & 4th Floor West Venue Building, 112 West Avenue, Quezon City (opposite of ST. Vincent School)

Revenue District Office No. 39-South Quezon City

4th to 7th Floor, 1424 Coher Center Bldg., Quezon Avenue, Q.C.

Revenue District Office No. 40 – Cubao

5th Floor (roof deck) FISHER MALL, Quezon Avenue cor. Roosevelt Junction, Quezon City

Revenue District Office No. 41 – Mandaluyong City

YSK Bldg., 743 Boni Avenue, Brgy. Malamig Beside Metrobank and infront of Caltex Station and Rizal Technical University (RTU)

Revenue District Office No. 42 – San Juan

Juana Carpio Bldg., F. Blumentritt cor. Tuano St , San Juan City

Revenue District Office No. 43 – Pasig

2nd and 3rd Floor Rudgen Building, Shaw Blvd. Brgy. San Antonio, Pasig City beside the office of SSS and infront of Pag-Ibig Fund

Revenue District Office No. 44 – Taguig-Pateros

3/F, Bonifacio Tech. Center, 31st St., cor. 2nd Ave., Crescent West Park, Bonifacio Global City, Taguig City

Revenue District Office No. 45 – Marikina

Antonio Luz Arcade, Cirma St. corner Toyota Avenue, Sto. Niño, Marikina City

Revenue District Office No. 46 – Cainta/Taytay

2nd flr. Manila East Arcade 2, Don Hilario Cruz Avenue, Brgy. San Juan, Taytay Rizal

Revenue District Office No. 47- East Makati

4th Floor, BIR Regional Office, 313 Sen. Gil Puyat Ave., Makati City

Revenue District Office No. 48 – West Makati

5th Floor, BIR Regional Office, 313 Sen. Gil Puyat Ave., Makati City

Revenue District Office No. 49 – North Makati

6th Floor, BIR Regional Office, 313 Sen. Gil Puyat Ave., Makati City

Revenue District Office No. 50 – South Makati

5/f, Atrium Building, Makati Ave., Makati City

Revenue District Office No. 51 – Pasay City

BIR R.O NO. 139 Sen. Gil J. Puyat Avenue

Revenue District Office No. 52 – Parañaque

GRAM Centre Building, Dr. A. Santos Ave. cor. Schilling St. Brgy. San Dionisio, Parañaque City (beside Puregold Jr./ Opposite Liana’s Supermarket)

Revenue District Office No. 53A – Las Piñas City

OHZ Building Lot 1, E-F, L. Hernandez Ave., Brgy Almanza Uno, Las Pinas City

Revenue District Office No. 53B – Muntinlupa City

Lower Ground Floor, Ayala Malls South Park National Road, Alabang, Muntinlupa

Revenue District Office No. 54A – Trece Martirez City, East Cavite

Indang Road, Barangay Luciano, Trece Martirez, Cavite City

Revenue District Office No. 54B – Kawit, West Cavite

Ground Floor, Local Mall, Centennial Road, Magdalo Potol, Kawit, Cavite

Revenue District Office No. 55 – San Pablo City

BIR Regional Office Building Barangay San Nicolas Maharlika Hi-way, San Pablo City

Revenue District Office No. 56 – Calamba, Laguna

2nd Floor, Puregold Jr., Supermarket Barangay Parian, Calamba City, Laguna

Revenue District Office No. 57- Biñan, Laguna

2nd Floor Umbria Commercial Center, National Road, Tulay Bato, Brgy. San Antonio, Binan City

Revenue District Office No. 58 – Batangas City

BIR Building, Brgy.Hilltop , Batangas City

Revenue District Office No. 59 – Lipa City

BIR Building, Barangay Marawoy, Lipa City

Revenue District Office No. 60 – Lucena City

LGCTI, Ilayang Dupay, Lucena City

Revenue District Office No. 61 – Gumaca, Quezon

2/F, Tanada Building, P. Tanada St., cor. Burgos St.,Brgy. Pipisik, Gumaca, Quezon

Revenue District Office No. 62 – Boac, Marinduque

Elmer Tan Building, Nepomuceno St., Boac, Marinduque

Revenue District Office No. 63 – Calapan, Oriental Mindoro

Dolce Casa Tawiran Calapan City

Revenue District Office 64- Talisay, Camarines Norte

BIR Building, Maharlika Highway, Talisay Camarines Norte

Revenue District Office No. 65 – Naga City

BIR Building J. Miranda Ave., cor. Pricenceso St., Monterey Village, Naga City

Revenue District Office No. 66 – Iriga City

BIR Building National Highway San Nicolas Iriga City

Revenue District Office No. 67 – Legazpi City, Albay

BIR Building, Camia St., Imperial Court Subd., Legaspi City

Revenue District Office No. 68 – Sorsogon, Sorsogon

BIR Building, City Compound, Capid-an, Sorsogon City

Revenue District Office No. 69 – Virac, Catanduanes

BIR Building San Isidro Village Virac, Catanduanes

Revenue District Office No. 70 – Masbate, Masbate

Sitio Cagba, Brgy. Tugbo, Masbate City

Revenue District Office No. 71 – Kalibo, Aklan

Arch. Reyes cor. Acebedo St., Kalibo, Aklan

Revenue District Office No. 72 – Roxas City

McKinley St., Roxas City

Revenue District Office No. 73 – San Jose, Antique

Corner Zardiver and Salazar St., San Jose, Antique

Revenue District Office No. 74 – Iloilo City

Ground Floor, BIR Regional Office Building M.H Del Pilar Street, Molo, Iloilo City

Revenue District Office No. 75 – Zarraga, Iloilo City

Poblacion, Zarraga, Iloilo City

Revenue District Office No. 76 – Victorias City, Negros Occidental

BIR Building, Brgy. V. Osmeña Avenue, Victorias City, Negros Occidental

Revenue District Office No. 77 – Bacolod City

BIR Building, Jocson- P. Henares Street Extension, Brgy. Taculing, Bacolod City

Revenue District Office No. 78 – Binalbagan, Negros Occidental

BIR Building, Poblacion, Binalbagan, Negros Occidental

Revenue District Office No. 79 – Dumaguete City

BIR Building, Agapito Valencia Drive, Brgy. Taclobo, Dumaguete City

Revenue District Office No. 80 – Mandaue City

3/F FRC Building, Subangdaku, Highway, Mandaue City

Revenue District Office No. 81 – Cebu City North

BIR Regional Office Building, Arch. Reyes Ave., Cebu City

Revenue District Office No. 82 – Cebu City South

Philwood Building, N. Bacalso Avenue, Cebu City

Revenue District Office No. 83 – Talisay, Cebu

G/F Rosalie Building, Tabunok, Talisay, Cebu City

Revenue District Office No. 84 – Tagbilaran City

2/F Judge Oppus Uy Building, M. Torralba St., Tagbilaran City

Revenue District Office No. 85 – Catarman, Northern Samar

Purok 1, Brgy. Dalakit, Catarman, Northern Samar

Revenue District Office No. 86 – Borongan, Eastern Samar

2/F JRC Building, Real St., Brgy. Songco, Borongan, Eastern Samar

Revenue District Office No. 87 – Calbayog City, Samar

Barangay Bagacay, Calbayog City, Samar

Revenue District Office No. 88 – Tacloban City

BIR Building, Govt. Center Candahug, Palo, Leyte

Revenue District Office No. 89 – Ormoc City

National Highway, Brgy. Bantigue, Ormoc City

Revenue District Office No. 90 – Maasin, Southern Leyte

Barangay Combado, Maasin City, Southern Leyte

Revenue District Office No. 91 – Dipolog City

Upper Sicayab, Dipolog City

Revenue District Office No. 92 – Pagadian City, Zamboanga del Sur

3rd Floor, ACC Building, Rizal Avenue, Pagadian City

Revenue District Office No. 93A – Zamboanga City, Zamboanga del Sur

BIR Building, Petit Barracks, Zamboanga City

Revenue District Office No. 93B – Zamboanga Sibugay

Demegilio Bldg. Purok Airways National Highway, Santol, Ipil, Zamboanga, Sibugay

Revenue District Office No. 94 – Isabela, Basilan

Aniceto G. Mon Bldg. N, Valderosa St., Isabela City, Basilan

Revenue District Office No. 95 – Jolo, Sulu

2/f Hadji Sabtirul Building, Travisi St., Jolo, Sulu

Revenue District Office No. 96 – Bongao, Tawi-Tawi

AMT Tamburani Bldg. Pag-asa St., Tawi-Tawi

Revenue District Office No. 97 – Gingoog City

Gugenueo St., Gingoog City

Revenue District Office No. 98 – Cagayan de Oro City

G/F Regional Office Building, Westbound Terminal, Bulua, Cagayan de Oro City

Revenue District Office No. 99 – Malaybalay, Bukidnon

BIR Building, Casisang, Malaybalay City, Bukidnon

Revenue District Office 100 – Ozamis City

BIR Building, City Hall Drive, Ozamis City

Revenue District Office No. 101 -Iligan City

Quezon Avenue Extension, Palao, Iligan City

Revenue District Office No. 102 – Marawi City

Alic Usman Building, Quezon Ave., Marawi City

Revenue District Office No. 103 – Butuan City

BIR Building, J. Rosales Ave., Butuan City

Revenue District Office No. 104 – Bayugan, Agusan del Sur

Molave Cor. Magkono Sts., Poblacion, Bayugan

Revenue District Office 105 – Surigao City

BIR Building, Km4 Brgy. Luna 8400, Surigao City

Revenue District Office No. 106 – Tandag, Surigao del Sur

2/F Eduhome Building, Osmeña St., Tandag City, Surigao del Sur

Revenue District Office 107 – Cotabato City

BIR, Building SK Pendatun St., Cotabato City

Revenue District Office 108 – Kidapawan, North Cotabato

BIR District Office Building, Quezon Blvd., cor. Padilla St. Kidapawan City, North Cotabato

Revenue District Office No. 109 – Tacurong, Sultan Kudarat

Linfel Building, Magsaysay Ave., Tacurong City

Revenue District Office No. 110 – General Santos City

BIR District Office Building, Pendatun Avenue corner Laurel & M. Roxas Streets, General Santos City

Revenue District Office No. 111 – Koronadal, South Cotabato

Arellano Street Brgy. Zone II Koronadal City, South Cotabato

Revenue District Office No. 112 – Tagum, Davao del Norte

Provincial Capitol Compound, Mankilam, Tagum City, Davao del Norte

Revenue District Office No. 113A – West Davao City

Bolton Ext., Davao City (at the back of the Regional Office Building–right wing)

Revenue District Office No. 113B – East Davao City

Bolton Ext., Davao City (at the back of the BIR Regional Office Building-left wing)

Revenue District Office No. 114 – Mati, Davao Oriental

BIR RDO 114., Gomez St., Mati, Davao Oriental

Revenue District Office No. 115 – Digos, Davao del Sur

BIR RD-115, BIR Building, Aurora 3rd St. Digos City

Click here to see the complete list of Revenue District Offices

There was online registration before, however, it has been stopped this May 2019. Also, take note that you can’t have more than one TIN; it is criminally punishable.

I hope you learned a lot in this article on getting a Tax Identification Number at the Bureau of Internal Revenue. It’s quite easy to get one. If you want to have a business check our article on How to get a DTI Certificate, as well as our other How-to guides!

Are you on Pinterest? Pin these!

Hi, Can you please tell me how to get a TIN No. for a religious group like Church. What are the requirements?

My compang applied for me a Tin no. and i have copy of the form what i need is i want to have tin card which i can apply to where i get but it far from my place it in provinve are which im already here in manila .Is it possible to apply here in manila since the copy send me a copy of my tin form that they already applied

How to get BIR TIN ?

TANZA CAVITE PART

Hello, I am a Filipino naturalized US citizen. I needed to get a TIN to transfer a property that was left to us by our mother who passed away in 2019. Due to Covid,19 we were not able to do anything until now. How do I apply for one? I know I needed to get a Power of Attorney to have someone apply for me. I also have another sister who is a naturalized US citizen. Can this be applied to a Philippine Embassy in the U.S. Looking forward to your response? Salamat po.

Where can I get my TIN ID number?

Balanga Bataan area po

check your nearest RDO po! there’s one in Balanga

How to get tin I’d number

go to BIR po

Hello po.

Can i ask something regarding sa TIN ID. i have already have one but it has erasure in my signature. is it okay? if not how to solve that. salamat po.

You can ask the BIR, personally, I think it’s okay since it’s not really considered a “VALID ID” compared to UMID, Philpost etc.

I’m just asking how can I get the ten ID I will use to apply for a job

A BIR TIN is only needed, please register at the nearest BIR office. Di required yung card.

Yung tanung ko po wla pang reply

Hello po, please contact the nearest RDO office since wala kaming database

Ask ko lng po pwede ko pa po bang makuha yung TIN ID ko kahit 2019 ko pa po pinagawa???

Meron na po akong TIN pero wala pang TIN Card. Employer ba ang kukuha or pupunta ako sa RDO kung saan ako naka register? Pwede din po bang kumuha sa pinaka malapit na RDO kung kung saan ang home address ko. Nasa Laguna ako. Employer ko ay QUEZON CITY. Looking forward of your reply. Thank you

Hello, as per my experience, our company got it for us.

nung last year 2020 kamo di nag rerelease ng TIN ID si BIR, ngayon bang 2021 nag rerelease na sila o hindi?

Meron na po akong TIN number at RDO ko ay nasa ILOCOS NORTE, pero nasa NCR ako ngayun. Pwede ba ako kumuha ng TIN ID dito sa NCR?

Hi! Pwede po ba ang employee mismo ang kukuha ng TIN number sa BIR branch?

Ano po mga kailangang documents, pag kumuha po si employer ng mga TIN Cards para po sa mga employees., Meron npo TIN Numbers ang mga employees.

Ma’am ano po requirments Ng tin I.d

hello po, I have a question I applied for a TIN number 17 years ago, I used my ex husbands lastname, pero never ko nagamit dahil i did not work, now Im an OFW and is using my maiden last name since yun yung nakalagay sa lahat ng credentials and passports ko along with my PRC license.

1. Can I still use my TIN ID with my ex husbands last name? kahit na sa lahat ng identification cards ko, im using my maiden lastname?

2. Can I request for a new copy of ID and ask for it to be changed or updated to match with all my documents

Hi, panu kumuha ng tin id card with existing tin#? Di kc ako na issuehan ng tin id during my local employment wayback from 2004 to 2006.

Maraming salamat sa sagot

1.May bayad po ba pag kumuha ng TIN ID?

2.Pwede po bang sa ibang branch ng BIR kunin ang TIN ID?

Maraming salamat po sa sagot. God bless

It’s free. You can only get it at the correct branch.

nung last year 2020 di nag rerelease ng TIN ID si BIR, ngayon bang 2021 nag rerelease na sila o hindi?

Paano.po nandito akao sa aibang bansa d ko na maaĺala ang tin number ko need ko pa namn gamitin sa online application.

you can e-mail BIR

Hello po, may alam po ba kayo kung kailan ang transaction schedule ng pagpapagawa ng Tin Id card? ty.

Malayo po ang RDO ko, sa Las Piñas pa, HR kasi namin kumuha, totoo ba na hindi nagbibigay ng ID ang pinakamalapit na BIR Offices? kailangan ko pa bang Lumipad to Luzon galing Mindanao?

hello, ive recently tried getting my tin ID, i applied for 1904 via EO.98 but they dont entertain it. they said i should get 1902 then my employer will process it but im not employed thats why im applying for 1904 EO.98. why does bir make it so hard. frustrating.

Hello. Pano po if first time lang kukuha ng id but i got my tin no. in my first employee 2yrs ago but now, I’m working in a new employee. Where will I get my tin id? thanks.

try getting it from the BIR office where your previous employer is under.

nung last year 2020 kamo di nag rerelease ng TIN ID si BIR, ngayon bang 2021 nag rerelease na sila o hindi?

How much do we pay for the TIN card if issued for the first time?

there’s no payment po, it’s free.

Hi, is SPA allowed if the person is not available to get his TIN No. And Tin Card?

Great post.

Awesome post.

Wohh precisely what I was looking for, thanks for posting.

Good eve apply for tin id

You can go to the nearest BIR RDO for your TIN ID.

Hello po Paano makuha ng tin id Wala po akong trabaho house wife po ako gusto ko po sana kumuha pang valid id lang po

Good pm po. Applay of Tin ID from: lipa batanggas