Step by Step Guide on How to Pay Your BIR Taxes Online in the Philippines

For those who don’t want to travel far away or queue in long lines to pay taxes, you can do it online. There are many ways to pay BIR Taxes Online in the Philippines. Payment may be made through online banking or online applications. It’s also not exclusive for big taxpayers but also for small ones.

You should compute your payment first before proceeding to pay. You can open accounts to some of the banks or applications here so that it’s more convenient. Please read carefully and follow the steps.

- Working Full time in the Philippines? 6 Ways to Save For Your Travels

- No Bank Account – How To Apply for Tourist Visa Without Bank Statements

- Teaching English Online – How Filipinos Can Get Started Working Online

- How to Apply for Philippines Passport in DFA? Requirements & DFA Appointment Step by Step Guide

- OFW Guide – List of Work Abroad Websites To Help You Find Jobs Overseas

Table of Contents

How to Pay BIR Taxes Online in the Philippines thru Land Bank

STEP 1: Go to this website.

STEP 2: Click “Pay Now.”

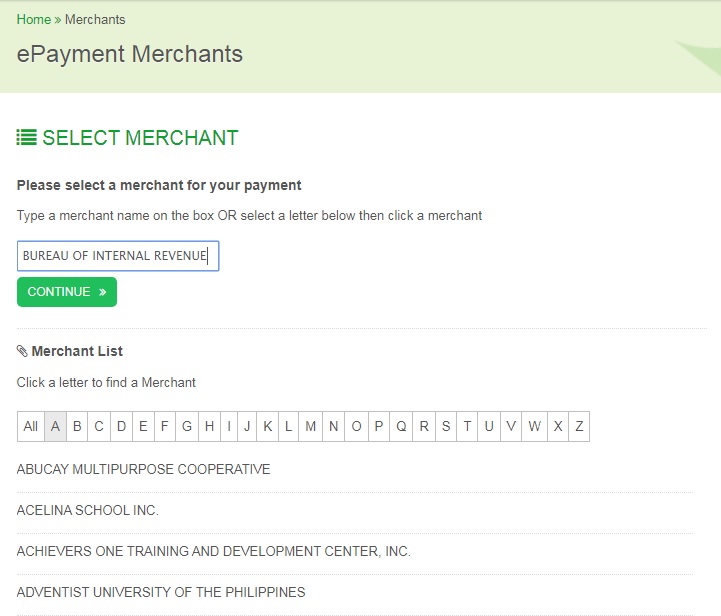

STEP 3: Under the Select Merchant, type “Bureau of Internal Revenue.” Click “Continue.”

STEP 4: There will only be one transaction choice which is “Tax Payment.” Click “Continue.”

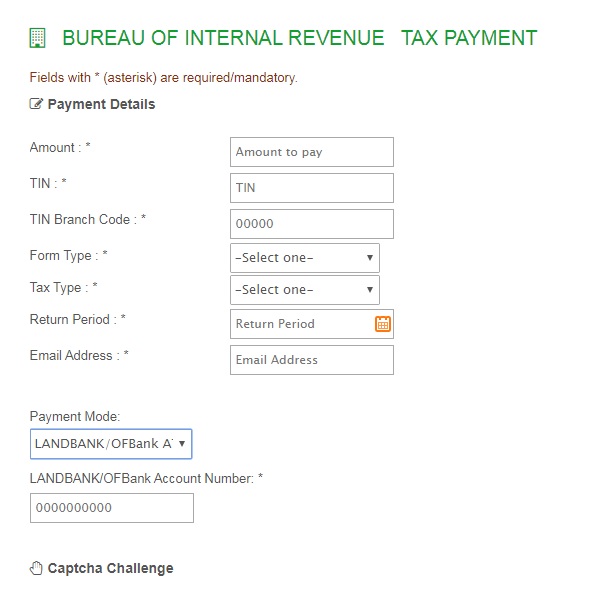

STEP 5: Enter your details.

- TIN is up to 9 characters only

- TIN Brach Code is usually 00000; if you have more than one branch then it may differ like 00001 or 00010

- Select the Form Type (Monthly, Quarterly, and Annual Taxes)

- Tax Type – mostly it will be IT (income tax), VT (Vat) or PT (Percentage Tax)

- Return Period – Month, Quarter, or Annual End Date

- E-mail address – the payment receipt will usually be sent there

- Use which Payment mode you Prefer

- Enter your Bank Account Number

- Review what you have entered before clicking the terms and “Click Continue.”

STEP 6: Enter your One-Time-Pin received in your Mobile Phone or E-mail address. Enter your PIN. Click “Submit” to pay.

STEP 7: You have then successfully paid your taxes. Print the receipt and attach it to your return form.

How to Pay Your BIR Taxes Online in the Philippines thru DBP (Development Bank of the Philippines)

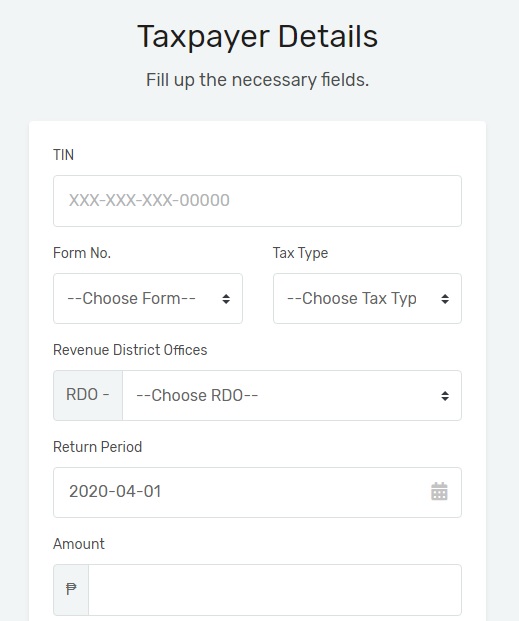

STEP 1: Go to this website.

STEP 2: Enter the details asked and click “Continue.”

- TIN – 9 digit TIN Number + Branch Code

- Form Number

- Tax Type

- Revenue District Office

- Return Period – Month, Quarter, or Annual End Date

- Amount to be paid

STEP 3: Enter your personal details and click “Continue.”

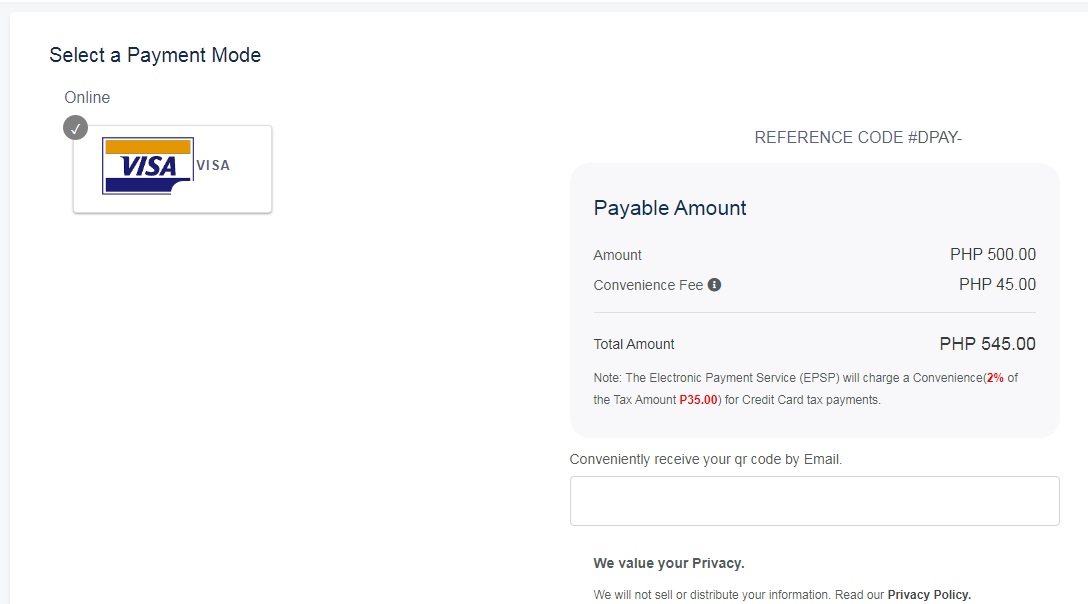

STEP 4: Select the payment method and click “Proceed to Pay.”

STEP 5: Enter the details to be provided.

STEP 6: Verify it and “Submit.”

STEP 7: You will receive an e-mail or text for the confirmation of your payment. Print the receipt and attach it to your return form.

How to

Pay BIR Taxes Online in the Philippines thru GCASH

Please note that you need to have a GCASH Account first, here’s a guide on how to register and use GCash. You can only use GCash for payments that are less than Php 10,000.00.

STEP 1: Open the GCash App on your phone.

STEP 2: Tap “Pay Bills” and select “Government.”

STEP 3: Choose “BIR”

STEP 4: Enter the details asked.

- Choose the Form Series – 0600, 1600, 1700, 1800, 2000, 2200 or 2500

- Form Number – e.g. 2550Q, 1701, 2551M)

- Tax Type (IT for Income Tax, VT for VAT, etc.)

- Return Period – Month, Quarter, or Annual End Date

- TIN – 9 digit number

- Branch Code – maybe 00000 (if you have no branch)

- Amount – less than PHP 10,000

- E-mail address – where your confirmation will be sent

STEP 5: Confirm your payment. Sometimes you’ll need to enter an OTP before the final submission.

STEP 6: Receive a text message for confirmation of your payment or the trace number. You can print this and attach to your return for easier tracing.

How to Pay Your BIR Tax Online in the Philippines thru PayMaya

STEP 1: Log-in to your PayMaya account in your phone.

STEP 2: Tap “Pay Bills” and select “BIR” under the billers.

STEP 3: Enter the details asked and tap “Continue.”

- TIN – 9 Digit TIN Number

- Amount to be paid

- Branch Code – may be 00000 (if you have no branch)

- RDO Code

- Form Series – 06, 16, 17, 18, 20, 22 or 25

- Form Type – e.g. 2550Q, 1701, 2551M

- Tax Type – e.g. IT for Income Tax, VT for VAT, etc.

- Return Period – Month, Quarter, or Annual End Date

- E-mail address – where your confirmation will be sent

STEP 5: Verify the details of your payment and tap “Pay.”

STEP 6: Receive a confirmation in the App, your E-mail, or a text message. You can print this and attach to your return for easier tracing.

It’s now effortless to pay your taxes online without going out or standing in long queues. Though the annual tax payment has been extended from April 15 to May 15, it’s better to do it early. I hope this article will help you in paying your taxes. Opt to pay BIR Taxes Online and be stress-free!

Are you on Pinterest? Pin these!

About the Writer

Hey, I’m Lyza! I once was a person who just imagined going to places “one day” but decided to pursue my dreams. My first travel abroad was in Japan, solo, last 2018, and fell in love with the journey since. I’m aiming to visit 10 countries before turning 30 and 2 new places in the Philippines every year. Besides traveling, I love organizing trips, photography, reading, and making new friends. Follow my adventures through my Instagram.

I have already filled out my form 2551Q, paid the corresponding tax via BPI. I have already printed out the accomplished BIR form, printed the Tax Return Receipt Confirmation email and the tax payment receipt from Landbank. Where should I submit these documents?

Thank you.

Nearest BIR Office. You can check if they have on in your Municipal or City Hall.

Hi. What if I misplaced my receipt of payment what will I do?

Hello, Ms. Lyza! Can you please give an example on what date to put for the Return Period for Form 2551Q. This will be my first time paying online for my taxes and I badly need some information. Looking forward to your reply. Thank you!

pls ask dbp pay tax to update their forms to include form 1601-eq. thanks.

Hi Lyza. I’m an individual tax payer and have no business. I did try to use the DBP tax online payment using my credit card but I didn’t get a confirmation, nor a text or email for the payment. Apparently it has been deducted to my credit card account. What to do?

Try communicating with DBP if they can provide you with a receipt. You can also try to screenshot your credit if the BIR accepts it.

After paying online, how do you file the return form to BIR?

Some BIR offices will need you to present your payment as well as your returns to their office. You can call the BIR office in your town on what’s their procedure.